This lady is for turning – why the Bank of England should lead the tightening cycle.

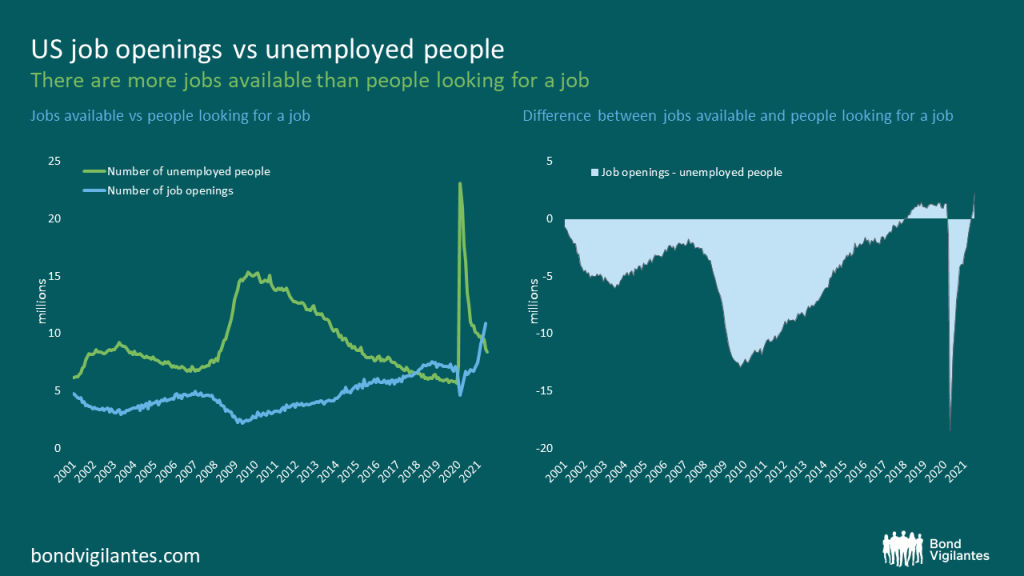

As bond investors we constantly focus on economic growth, inflation, and interest rates. In order to understand the potential moves in the above we focus at the crux of the problem which is the labour market. One way we have looked at this over the years is looking at the supply and demand for labour. The most common way we have done this is the chart below.

Source: M&G, Bloomberg, 31 August 2021 (latest data available)

This data is one of the reasons we are concerned re US central bank positioning; job vacancies at record levels, more job offers than unemployed, yet fiscal and monetary policy in the US remain exceptionally easy. In this blog we are going to focus more on the UK labour market.

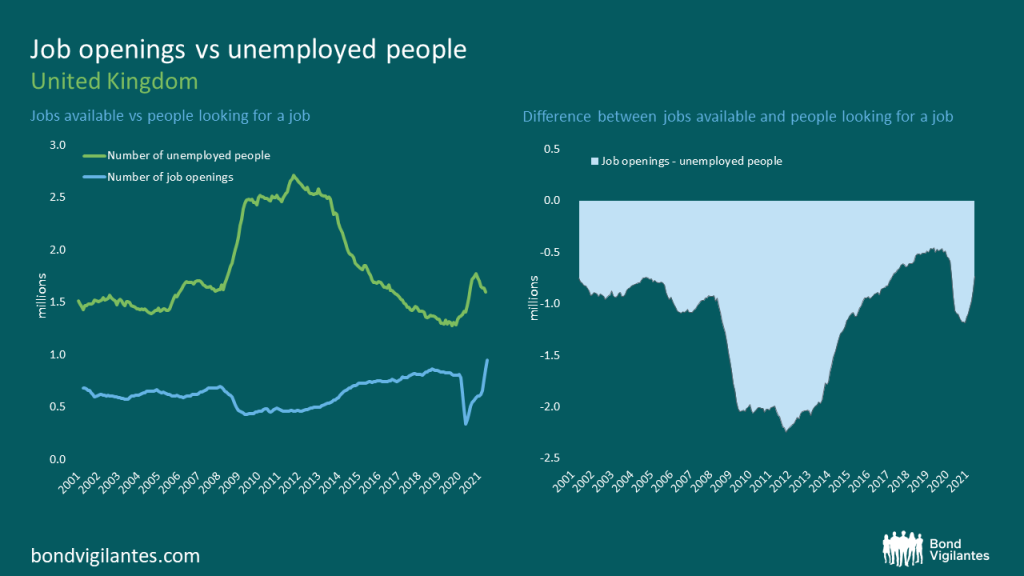

Like the US economy we, in the UK, are coming out of the public health policy slowdown and have an economy being supported by monetary and fiscal policy. We can also see a similar trend in job vacancies vs the unemployment total as illustrated below.

Source: M&G, Bloomberg, 31 July 2021 (latest data available)

At first glance we are heading in the same direction as the USA, the UK labour market is looking to be going back to normal. However, we think the MPC in their next policy meeting this week should look through that number as we believe it is underestimating labour tightness due to a structural change that has been masked by the COVID slowdown.

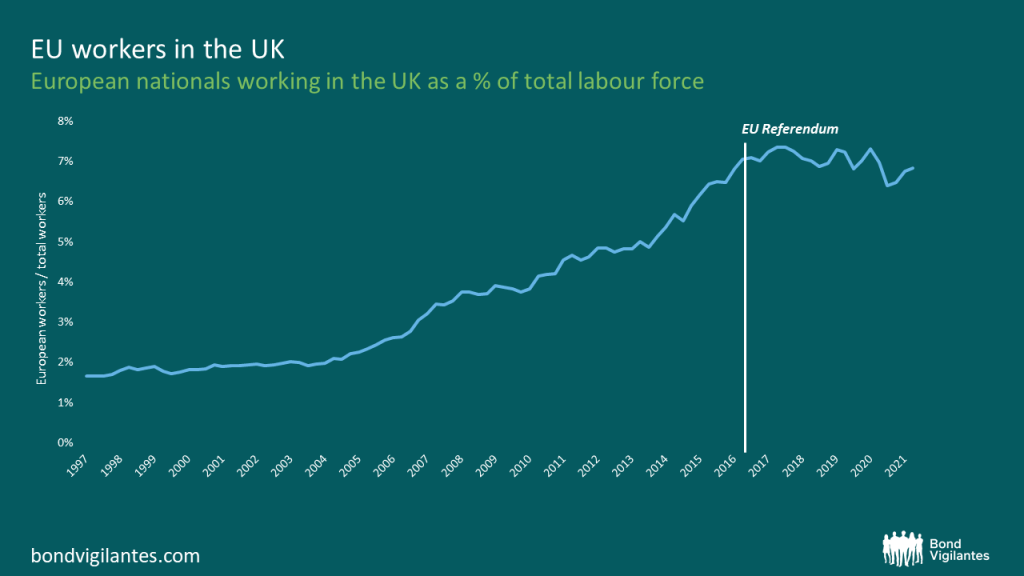

The much awaited Brexit finally arrived from a labour point of view in the summer of 2020. When you look at the labour market in the UK, the historic supply has been supplemented by the wider European pool of labour. That option has been legally curtailed post Brexit. Whilst in the past this pool of foreign labour had been taking pressure off wage inflation. We can see the flattening of this trend post the Brexit vote below. Anecdotally we are seeing this in the current recovery with comments re staff shortages in discretionary sectors like the restaurant industry, and essential sectors such as truck drivers, both of which would have historically been attractive sources of employment for European citizens. In order to understand the importance of this historic labour participation from abroad we have constructed the chart below, the UK’s labour market was previously supplemented by European labour, this will no longer be the case.

Source: M&G, ONS, 30 June 2021

Hopefully public health restrictions on economic activity will continue to reduce, and the UK economy will be vibrant once again. The Bank of England, like the Fed, has to be aware of the inflation implications of the historic monetary and fiscal interventions that were needed through the Covid years. One unique challenge for the UK central bank is trying to understand the tightness of the UK labour market and its inflationary implications post Brexit.

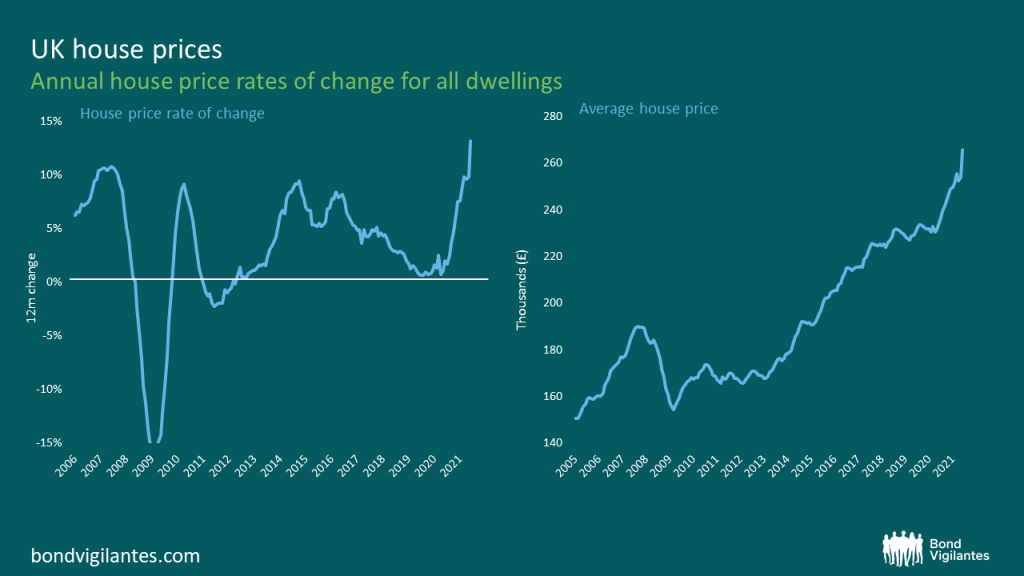

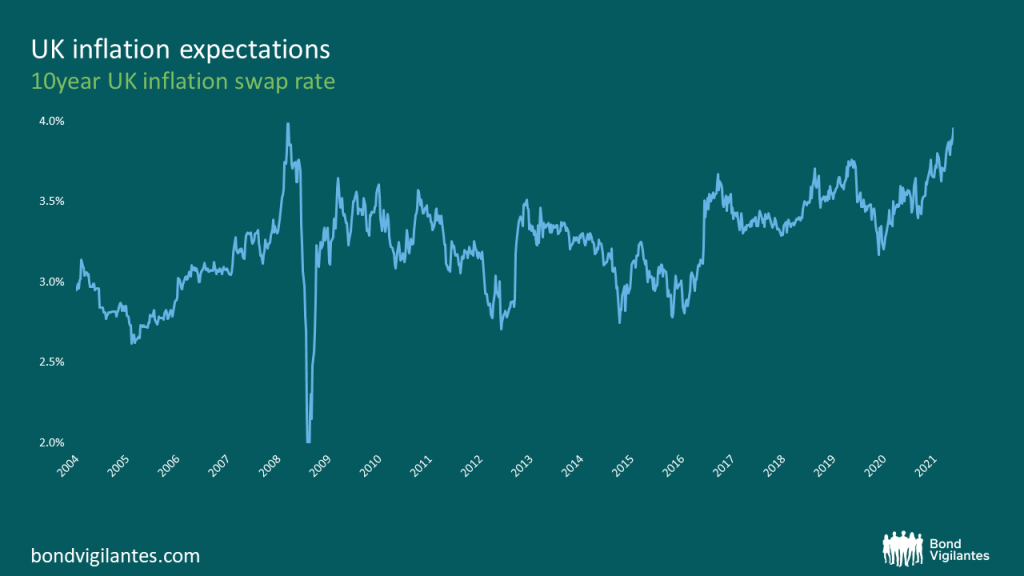

When you take a look at the broad data the Bank of England will have at the September meeting, they will see not only the tightening labour market data we illustrated above, but a booming housing market, whilst the market implied outlook for future 10 year inflation is towards/at its longer term highs.

Source: HM Land Registry, Registers of Scotland, Land and Property Services Northern Ireland, and Office for National Statistics, 30 June 2021

Source: M&G, Bloomberg, 13 September 2021

Unlike the Fed, the Bank of England does not do talking about talking about talking about, however in a select committee meeting recently the governor simply stated that the committee is evenly split regarding the time to change policy direction. This, and the above data, indicates that the tightening of UK monetary policy is firmly on the agenda. The old lady that is the Bank of England is likely for turning.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox