Who owns sovereign credit default swaps and why it matters

Guest contributor – Tamara Burnell (Head of Financial Institutions/Sovereign Research, M&G Credit Analysis team)

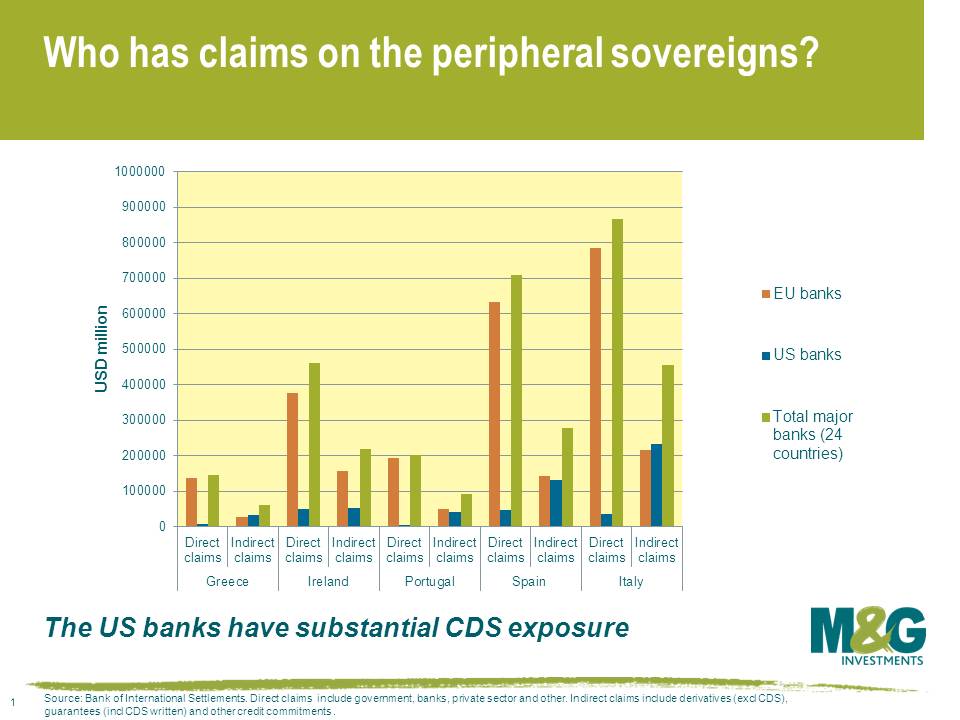

The Bank for International Settlements (BIS) recently released some fascinating data on the country risk exposure of global banks. For the first time we got some insight into not only which banks own Greek and other peripheral European sovereign, bank and corporate debt, but also who is likely to have written credit default swap (CDS) protection on entities in those countries. We also got some information on the UK banks, including the fact that they currently have USD 1.15 trillion in counterparty exposure on non-credit derivatives, valued at positive replacement value, a whopping one third of the global total, but that’s a story for another day.

There are some uncertainties in the data. For example, CDS written on an obligor is included in the BIS data as a “guarantee extended” to that party, since the ultimate risk is that obligor defaults, but there could also be other types of guarantees such as trade finance letters of credit included within the total figures. And the data only includes CDS protection written by banks, so excludes all the CDS written by insurers, hedge funds and other counterparties.

But it does highlight a few interesting points. Firstly, European banks hold the bulk of direct (cash) exposure to peripheral European borrowers, whereas US banks have little direct exposure. But US banks appear to have written the majority of CDS contracts on peripheral European borrowers, up to three quarters of the total in most cases. The data doesn’t tell us who has bought CDS protection on peripheral European borrowers, but it would be reasonable to assume that EU banks have tried to hedge their direct exposures by buying CDS protection from US banks. Therefore if we get to the point where a peripheral European borrower restructures its debt you would assume that Europe in general would have an incentive to try and trigger CDS protection payouts, whereas the US would typically want to avoid an event of restructuring because its banks would then potentially have to make big payouts. On this issue, the general counsel of derivative industry body International Swaps and Derivatives Association (ISDA) David Geen said that a debt exchange that pushed out maturities would not typically trigger payment of CDS contracts.

This highlights how political any decisions over triggering events of default, in either the underlying bonds or the CDS contracts, will be in practice. No wonder there have been press reports that the US has put pressure on EU politicians to deal with Greece in a way that avoids triggering CDS at all costs.

But surely the triggering of sovereign CDS should be a “market issue” rather than a political one? Well, unfortunately, CDS contracts have proven impossible to draft in a watertight way, as it’s impossible to predict how events of default will happen in practice – and you can’t legislate for a change in legislation. Over the years we’ve seen numerous changes to ISDA CDS protocols, as individual restructuring events have shown up flaws in CDS contracts. And sovereigns, of course, are the ultimate writers of legislation, so it’s in their own hands whether they change their own laws in such a way as to trigger an event of default on either the CDS or the underlying debt. For example, if Greece changed its domestic laws in a way that it altered the maturity date of all its debt, would that be enforceable and would that trigger a CDS event of restructuring? How about if it gave extra security to new lenders, while leaving the old bonds unchanged? Or imposed a special tax on principal or interest payments on sovereign debt? The functioning of bank CDS has already been called into question by the way the Irish government has changed the terms of the underlying debt, extending the maturity date so that there are no longer any relevant bonds outstanding in the reference maturity buckets used in CDS contracts.

Unfortunately, not only did plenty of market participants think that sovereign CDS was a good idea, either as a way to take risk, or as a hedge against existing risks, but regulators also endorsed the idea that CDS could offer some sort of risk hedge, and therefore allow banks to reduce the amount of capital they held against their counterparty risk exposures. If we get any precedent cases that show CDS protection not to work in practice and provide the hedge it was expected to, potentially the solvency of the banking system comes under question all over again.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox