Markets start to think about inflation again

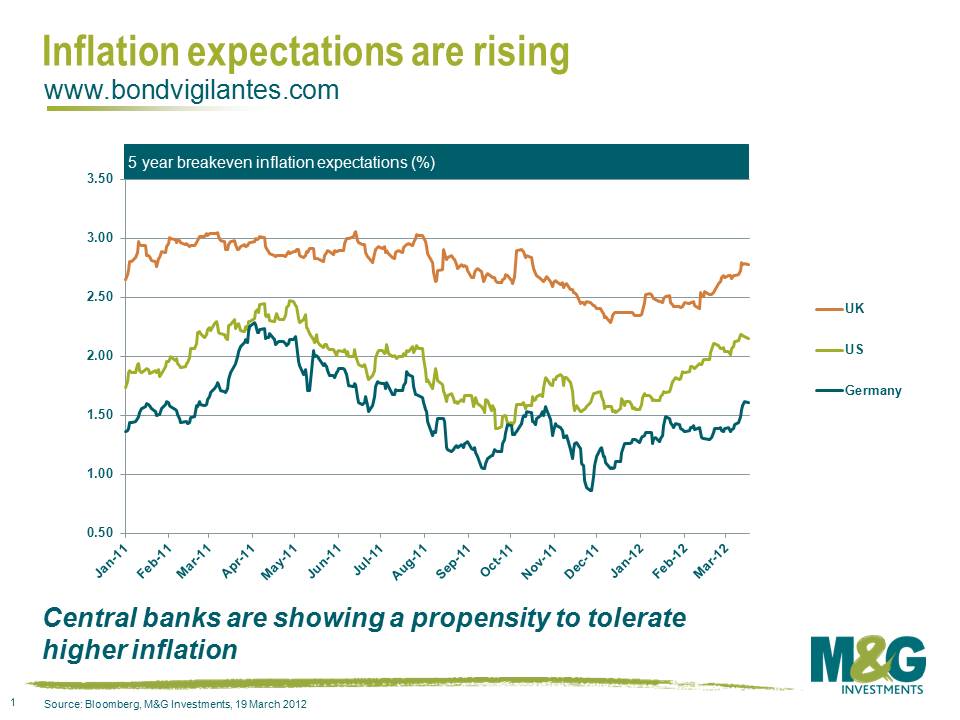

Over the last few weeks we have witnessed a meaningful bounce in inflation breakevens in the UK, Europe and the US. When breakevens are rising, it is a signal that the fixed income market is anticipating higher inflation than has been priced in. It also means that index linked bonds are outperforming conventional bonds. In the UK, the linker gilt of 2016 has outperformed the conventional gilt by 45 to 50 basis points in yield terms since the start of this year.

Why have the bond markets started to price in higher levels of inflation?

Perhaps there is an element of geo-political risk affecting the oil price, which feeds into the inflation baskets in a plethora of forms? Yes, but I don’t think oil is the major culprit here, although in the US, where oil is taxed far less than in the UK or Europe, inflation is far more sensitive to changes in the oil price. See Jim’s blog here.

Perhaps rising breakevens owe to fears around money creation? In Europe, at the end of 2011 the interbank market was completely disfunctional, and we were entering a deflationary spiral. But the long term repurchase operations (LTRO) have added somewhere in the region of €1 trillion euros to banks over the last few months, the interbank market has been showing signs of being slightly less disfunctional, and the risks of deflation feel for the moment substantially reduced. In the UK, the mechanism of quantitative easing boosted the prices of conventional gilts more than index linked gilts, as the Bank of England did not purchase linkers directly. This artificially suppressed the relationship between the conventional gilt and the linker (the breakeven), at exactly the moment when money creation ought, in my opinion, to have seen higher inflation risk premia priced in. The strong performance of index linked gilts in the UK either owes to a fear that improved economic data means we are closer to the end of QE than the beginning, so the artificial source of demand for gilts is not going to be in the market for much longer (a relative call), or owes to the market’s deciding that we are not going into a disinflationary or deflationary economy, and are more likely to see on target inflation or higher.

It is worth thinking about the levels of 5 year breakevens in the chart, a relative valuation measure. In the UK the bond market is expecting inflation to average 2.8% a year for the next five years. Remember though that this is RPI inflation, which historically has averaged 0.8% more than CPI. If we assume this historical relationship holds, then this 5 year breakeven implies CPI will be bang on the Bank’s target of 2%. So on this basis the breakeven does not make inflation protection look expensive at all. Considering the 5 year breakeven in Europe, which is currently 1.6%, this is still pricing in inflation being below the 1.8% (ish) target on average for the next 5 years. With aggressive money creation (at last!), surely the risks are skewed to the upside? In fact, only the US market is pricing in inflation to be above target for the next 5 years. I think that this is the correct side of the inflation target for linkers to be valued at, and I believe there is a good chance the UK and European markets start to move towards this US dynamic.

Why? Firstly because of the ultra low interest rates and ultra accommodative monetary stance at the ECB, BoE and Fed. And also because of the large scale money creation we have seen in all three markets and have discussed briefly above. But most importantly to me is the fact that at this moment in time, the three central banks in question all have a clear and visible inflationary bias. They would rather have inflation than deflation (rightly). But now they are showing a propensity to favour above-target inflation over below-target inflation. This is tantamount to a (temporary or permanent, we do not yet know) change in the inflation targets. And this must, in my opinion, see higher inflation risk premia. How do we show this clear inflationary bias? Inflation is significantly above target in all three economies, and yet policy is not only not being tightened, the taps are still very much on!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox