If China’s economy rebalances and growth slows, as it surely must, then who’s screwed?

OK so that wasn’t the exact title of the IMF’s paper from the end of last year – it was Investment-Led Growth in China: Global Spillovers – but you get the gist.

First a little preamble. Many people who were China bears last year have become less bearish or even outright bullish, no doubt on the back of an improvement in Chinese economic data and a corresponding rally in China’s equity markets. But I don’t think the better data (if you believe the data) should inspire confidence, and you could actually argue the opposite; the growth rebound in China is likely due to yet more government-encouraged unproductive and unprofitable lending. The quality of China’s growth has become increasingly poor, and the rate of growth is utterly unsustainable. The bigger the bubble, the bigger the eventual bust.

Morgan Stanley’s Ruchir Sharma wrote a piece in the Wall Street Journal this week about how China’s total and private debt has exploded to over 200% of GDP, and how the Bank of International Settlements has previously found that ‘if private debt as a share of GDP accelerates to a level 6% higher than its trend over the previous decade, the acceleration is an early warning of serious financial distress. In China, private debt as a share of GDP is now 12% above its previous trend, and above the peak levels seen before credit crises hit Japan in 1989, Korea in 1997, the US in 2007 and Spain in 2008’.

The IMF has long been warning of the threat posed to global financial stability by the great Chinese credit bubble, and their study on global spillovers referenced above makes interesting reading. They estimate that for each percentage point deceleration in China’s investment growth, 0.5-0.9% is subtracted from GDP growth in regional supply chain economies such as Taiwan, Korea and Malaysia. Commodity producers such as Chile and Saudi Arabia are also likely to suffer substantial growth declines while countries such as Canada and Brazil would experience ‘somewhat significant output loss and slowdown’. There would be ‘a substantial impact on capital goods manufacturing economies such as Germany and Japan’, and one year after the shock, commodity prices, especially metal prices, could fall by 0.8-2.2% from the baseline levels for every 1% drop in China’s investment rate.

So what kind of correction in China’s investment growth rate is likely? China’s growth in fixed investment from 2002-2011 was 13.5% per year, a rate that greatly exceeded China’s GDP growth rate and meant that fixed investment is now running at about 50% of China’s GDP. No major countries have sustained such a high investment rate as a percentage of GDP – since 1960, the only countries to have managed a ratio of more than 50% for at least two consecutive years are Republic of Congo 1960-61, Botswana 1971-73, Gabon 1974-77, Mongolia 1981-87, Kiribati 1982-83 and 1985-90, St Kitts & Nevis 1988-90, Lesotho 1989-97, Equatorial Guinea 1994-98 and 2000-01, Bhutan 2001-04, Azerbaijan 2003-04, Chad 2002-03, and Turkmenistan 2009-10.

Judging by other countries at China’s stage of development, a more reasonable investment/GDP ratio is maybe 30-35%. Achieving this ratio will require a sharp drop in China’s investment growth rate to perhaps mid single digits, and if China’s slowdown proves to be hard rather than soft, then the investment rate will likely fall even further (taking two other post bubble economies in the region,Japanese investment growth has been negligible since the early 1990s, while Korean investment growth has averaged low single digits since the mid 1990s). According to the IMF’s model then, a drop in Chinese investment growth from 13.5% to 4.5% implies a 4%-7.2% hit to the GDP of countries such as Taiwan, Korea and Malaysia. Some commodity prices would fall almost 20%. Ouch. And if you want to get extra gloomy, you can also consider that such a large economic shock would also be accompanied by a reversal of the huge decade-long EM equity and bond inflows to the region, which is something else that the IMF has repeatedly warned about (eg see page 70 and Fig 2.51 of this report). It’s quite easy to see how a Chinese rebalancing and slowdown can develop into an Asian/EM financial crisis.

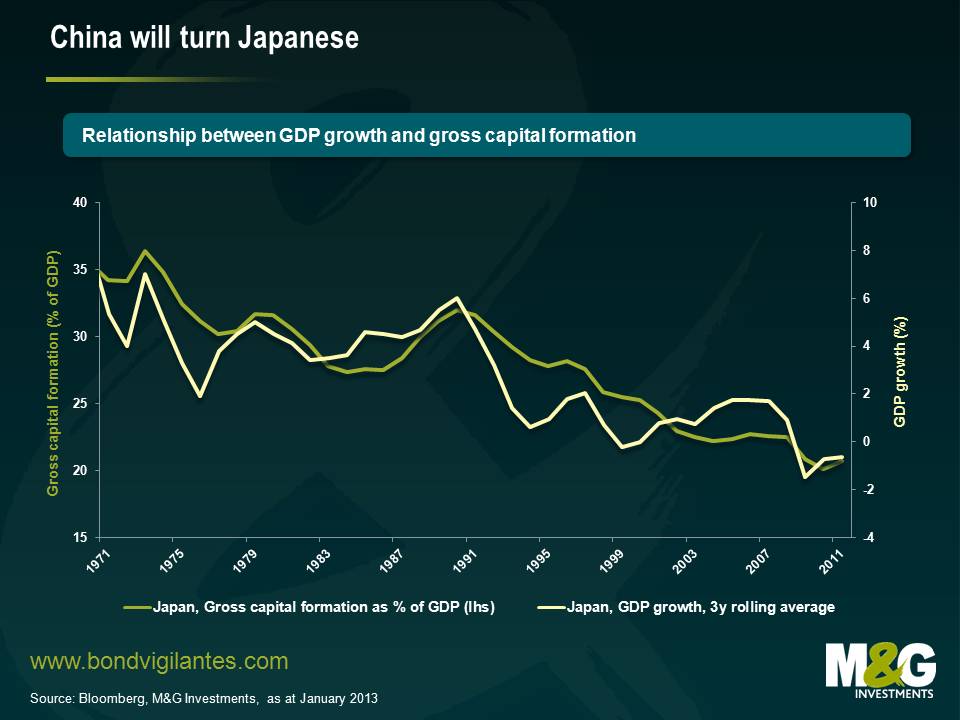

Finally it’s worth reproducing a chart I used in a note from last year demonstrating what happened to Japan’s GDP growth rate as it rebalanced away from an investment-led model and towards more of a consumption based model in the 1970s-80s (countries such as Thailand and Korea followed a very similar path 20 years later). When investment as a percentage of GDP falls, then the GDP growth rate falls too. Everyone accepts that China must reduce investment and increase consumption, but few people acknowledge that this means that China’s GDP growth rate will slow considerably.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox