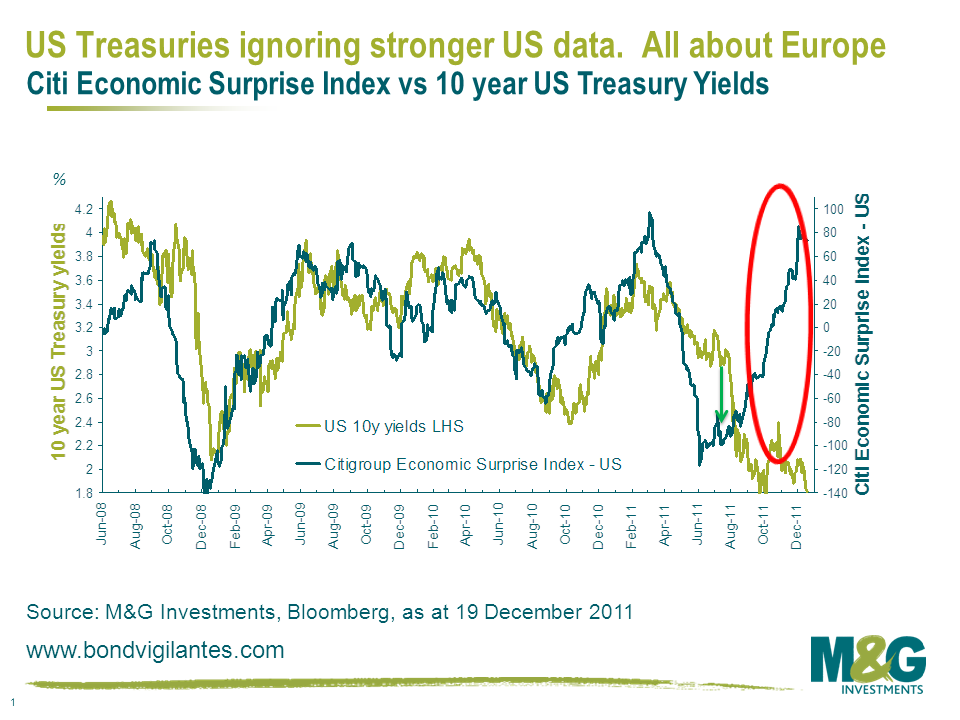

A chart that may make you nervous if you’re long of government bonds

Government bond investing used to be about analysing and assessing economic data. Judging by the last few months, not any more.

At the beginning of June, I argued here that US economic data was a horror show and was falling off a cliff, and bond investors (and risk assets generally) seemed not to have noticed. The chart I posted back in June stoked quite a bit of reaction, with the main points of contention being that (1) government bonds would surely sell off as inflation rose; (2) government bonds would surely sell off as sovereign debt levels rose; (3) the weaker economic data was due to the Tsunami on March 11th and would prove temporary; (4) there was a risk of a US downgrade as S&P had put the US credit rating on negative outlook in April; (5) it’s not accurate to compare a surprise index to an absolute yield level (fair point, although the close historical correlation suggested that Treasuries should have rallied at least a bit given how bad the data had been); and (6) US economic surprise indices have never stayed negative for long, so given the index was already so low, Treasuries were about to sell off lots as the data improved.

Anti-bond sentiment reached a peak in early July, when JP Morgan’s weekly US Treasury client survey revealed that zero clients were positioned long duration (i.e. positioned for a Treasury rally), which was the first time this had been the case since February 2005 and only the third time in the survey’s 20 year history. Anyway, what with Spanish and Italian government bonds coming under renewed pressure in June and all the European stuff we’ve talked about over the past few years, it felt like AAA rated sovereign bonds were ripe for a rally so I moved long duration (a position I’ve run ever since although the reasons have slightly changed).

Curious things have been going on since August. US Treasury yields finally did enjoy a big rally from early August once the market realised that S&P’s decision to downgrade the US wasn’t going to prompt a wave of forced sellers. But from early August, the US economic surprise line started edging upwards (so those who said economic surprise indices don’t stay very negative for very long were eventually correct). Initially I suspect this improvement was simply due to the index being a 3 month moving average, and a lot of the bad data from May was dropping out, although there’s no question that US data has been genuinely stronger since the beginning of October. The improving trend has been maintained, and a couple of weeks ago the 8 year old index hit a level that had only been exceeded for a few days in November/December 2003 and in the week immediately prior to the tsunami in March this year.

Eurozone data has been improving versus expectations lately too, although it is worth emphasising that Eurozone economic data is far from great, it’s just that the markets are now fully pricing in a mild recession so are no longer being ‘surprised’. Just as with Treasuries, 10 year German government bond yields are not far off recent record lows.

Eurozone data has been improving versus expectations lately too, although it is worth emphasising that Eurozone economic data is far from great, it’s just that the markets are now fully pricing in a mild recession so are no longer being ‘surprised’. Just as with Treasuries, 10 year German government bond yields are not far off recent record lows.

The reason for sustained ultra low government bond yields, rather obviously, is the ongoing mess in Europe. Government bond yields are more about the market trying to price the tail risk that the market may not exist in a recognisable form in a few months. Perhaps related to this, low Treasury yields are also reflecting the risk (likelihood) that most of the European rated sovereigns and various supranationals that are currently rated AAA will very soon cease to be rated AAA. The end to European AAA ratings would surely accelerate the ongoing credit/collateral crunch as investors scramble for the few remaining safe haven assets.

If you’re still long of government bonds and expect them to rally (like me), then you have to be expecting the situation in Europe to deteriorate further. If the situation improves, then the recent flow of economic data leaves government bonds looking very vulnerable.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox