Playing Russian roulette

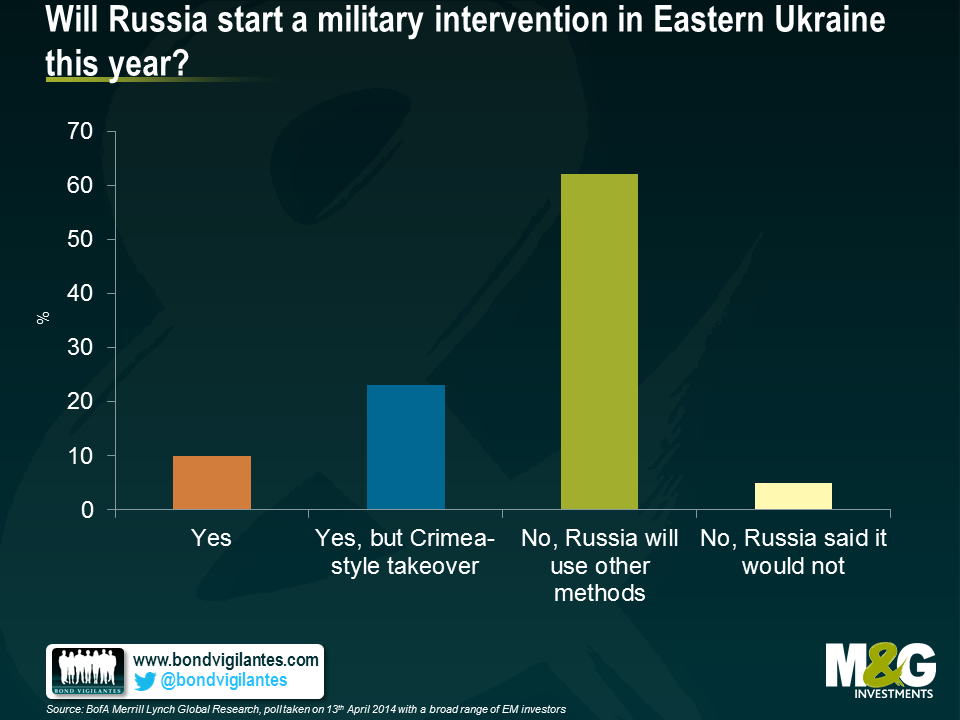

The Russia and Ukraine geopolitical tensions have driven their asset prices since February. As the below research courtesy of BofA Merrill Lynch shows, investors’ base case scenario is that a major escalation of the conflict, in the form of a direct Russian invasion of parts of Eastern Ukraine, is unlikely. The possibility of an invasion seems analogous to Russian roulette, a low probability but high impact game.

I just returned from a trip to Moscow. You would not know there is the possibility of a war going on next door by walking around the city, if you didn’t turn to the news. Its picture perfect spring blue skies were in stark contrast to the dark clouds looming over the economy.

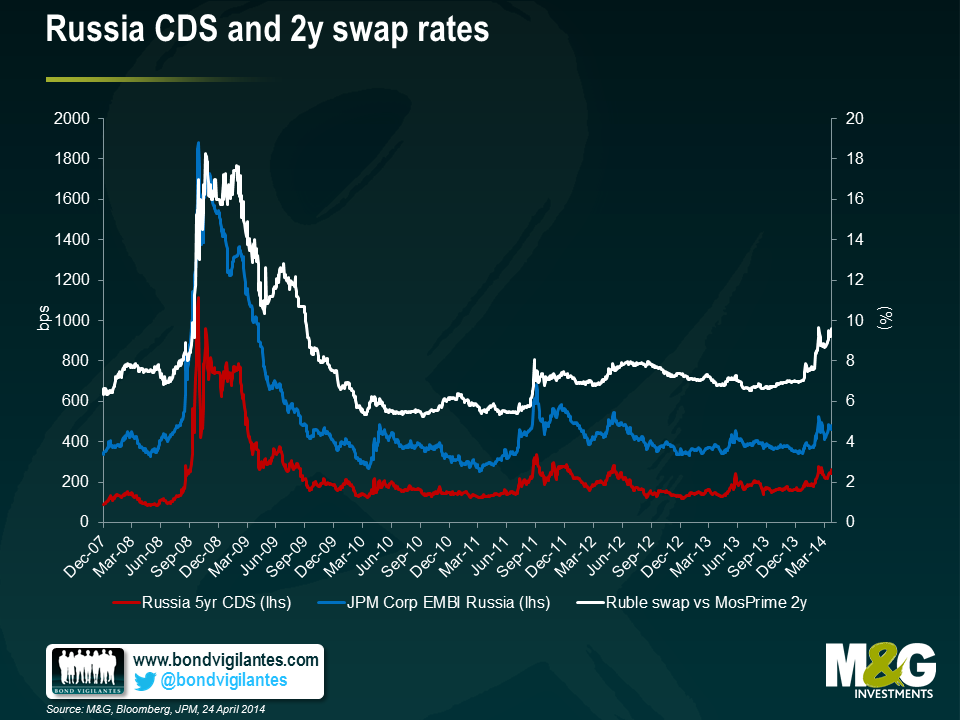

The transmission mechanism of the political impact into the economy is fairly predictable:

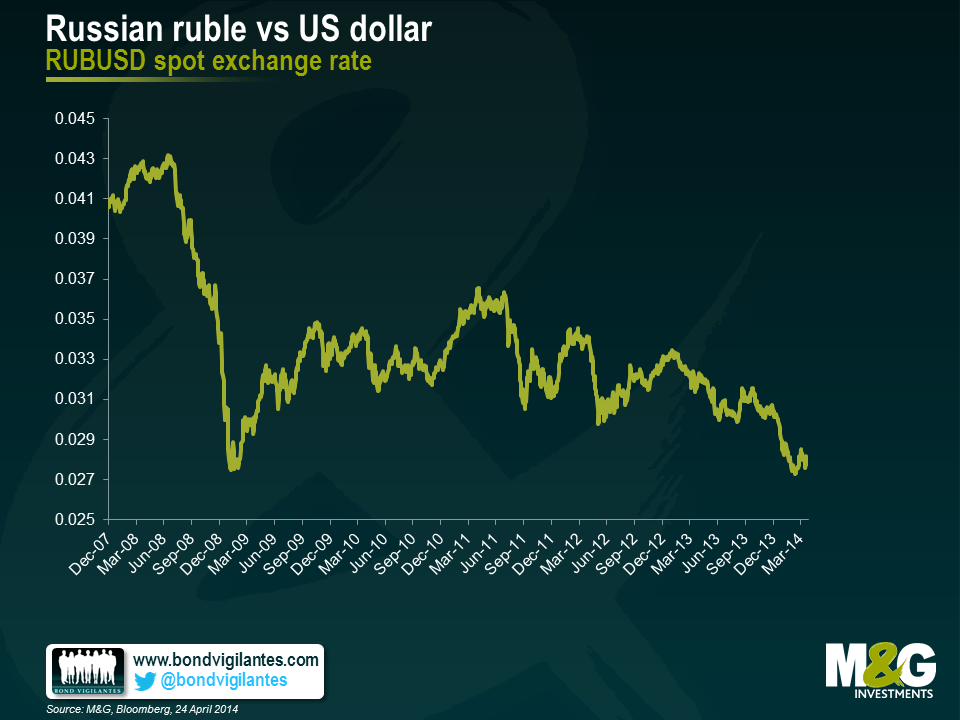

- Political-related risk premia and volatility remaining elevated, translating into weakening pressure on the ruble;

- Pressure for higher rates as the ruble weakens (the CBR has already hiked rates by 200 bps, including the unexpected 50bps hike last week, but more will be needed if demand for hard currency remains at the Q1 2014 level and pressure on the currency increases further);

- Downside pressure on growth as investment declines and through the impact of sanctions or expectation of additional sanctions (through higher cost of capital);

- Downward pressures on international reserves as the capital account deteriorates and CBR smoothens the currency move;

- Decline of the oil reserve fund should it be used for counter-cyclical fiscal purposes or refinancing of maturing debt (the $90 billion fund could theoretically cover one year of amortizations, but in that case, capital flight and dollarization would escalate further as the risk perception deteriorates).

All these elements are credit negative and it is not a surprise that S&P downgraded Russia’s rating to BBB-, while keeping it on a negative outlook. What is less predictable, however, is the magnitude of the deterioration of each of these elements, which will be determined by political events and the extent of economic sanctions.

My impression was that the locals’ perception of the geopolitical risks was not materially different from the foreigners’ perception shown above – i.e. that a major escalation in the confrontation remains a tail risk. The truth is, there is a high degree of subjectivity in these numbers and an over-reaction from either side (Russia, Ukraine, the West) can escalate this fluid situation fairly quickly. The locals are taking precautionary measures, including channelling savings into hard currency (either onshore or offshore), some pre-emptive stocking of non-perishable consumer goods, considering alternative solutions should financial sanctions escalate – including creating an alternative payment system and evaluating redirecting trade into other currencies, to the extent it can. Locals believe that capital flight peaked in Q1, assuming that the geopolitical situation stabilizes. Additional escalations could occur around 1st and 9th of May (Victory Day), as well as around the Ukrainian elections on 25th of May.

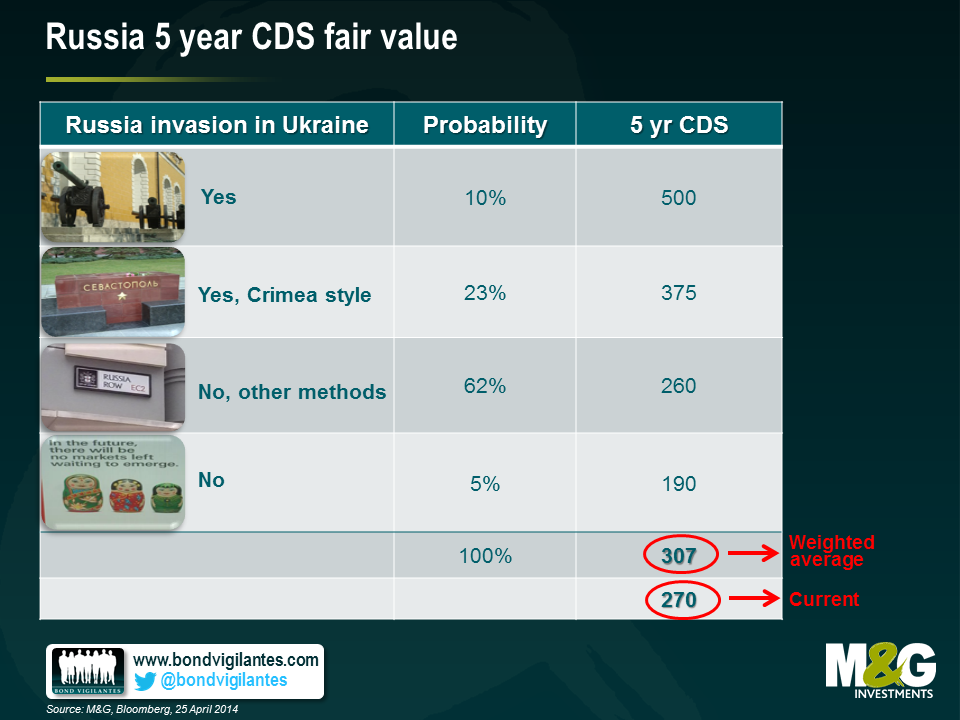

The table below assigns various CDS spread levels for each of the scenarios, with the probabilities given per the earlier survey. The weighted probability average is still wider than current levels, though we have corrected by a fair amount last week. I used CDS only as it is the best proxy hedge for the quasi-sovereign and corporate risk. Also, the ruble would be heavily controlled by the CBR should risk premia increase further, and may not work as an optimal hedge for a while, while liquidity on local bonds and swaps would suffer should the sanctions directly target key Russian banks.

The risk-reward trade-off appears skewed to the downside in the near term.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox