Not all change is bad: coming reforms to credit default swaps

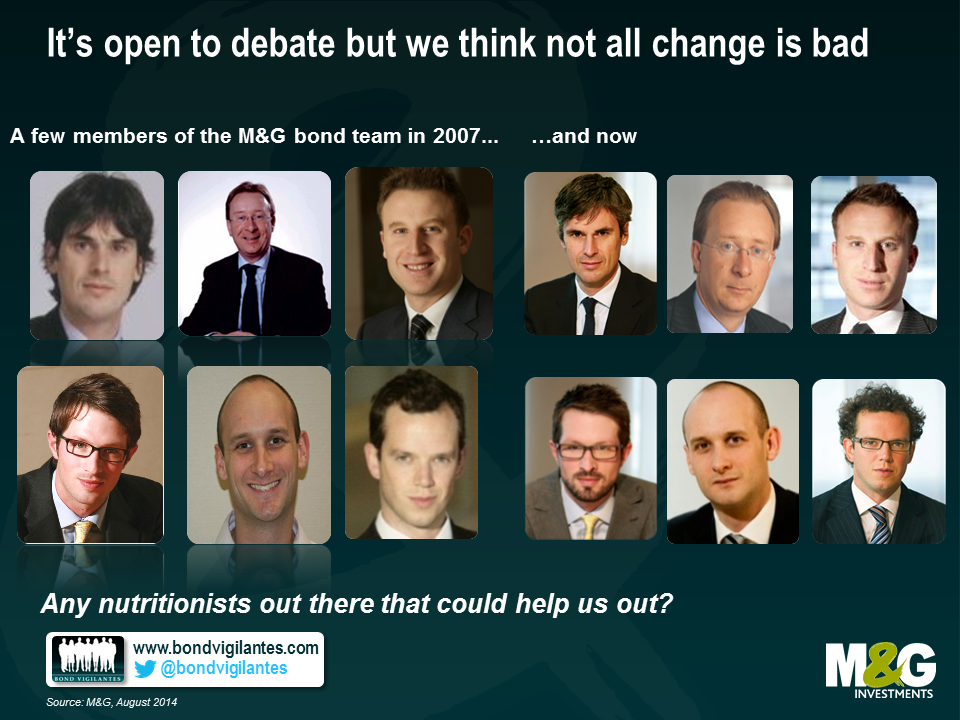

There is a lot of analysis and conjecture about how much impact the financial crisis has had on the global economy and financial markets. There has been considerably less analysis around the impact of the crisis on bond fund managers. In a small attempt to quantify these impacts, we have dug out a few old photos of members of the M&G bond team pre and post-crisis. The photos show clearly where change has been bad.

There is, though, good change. In September there are changes taking place to bank CDS contracts that represent clearly positive progression.

The CDS rules and definitions of 2003 state that there are 3 different credit events that will trigger corporate and financial CDS contracts: 1. failure to pay 2. bankruptcy, and 3. restructuring (this means that a company can’t modify the conditions of debt obligations detrimentally as far as investors are concerned). If any of these are determined to have occurred, then buyers of protection receive par from sellers of protection (and sellers of protection pay out par minus the recovery value of the defaulted bonds, so are in the same situation as if they owned the defaulted bond). In the event of one of these events being triggered, buyers of protection are ‘insured’ against the losses incurred on the bonds.

However, whilst the above works well in most cases of corporate defaults, we have seen several examples in the last few years in terms of banks in which the outcomes have left buyers of protection in effectively defaulted bonds none the better off. For purposes of succinctness and relevance, I would like to mention two of the more recent such cases so as to bring out the flaws of the existing financial CDS contracts, and to highlight the improvements we will soon see.

In early 2013, the Dutch government expropriated the subordinated debt of SNS Bank, which had got into serious difficulties. Bondholders would therefore no longer receive coupons or principal, and so the determinations committee ruled, quite simply, that a restructuring event had occurred. However, the buyers of protection had to deliver defaulted bonds to the sellers, and there being no subordinated bonds left, had to deliver senior bonds, whose value was around 85p in the pound. This meant that they ‘owned’ bonds worth zero, and were being paid out 15p as a result of the protection they had bought!

The most recent example of subordinated CDS not working is still on-going, being the case of Banco Espirito Santo. This bank has seen all the good assets, deposits and senior debt transferred to a new, good, bank, and all the bad assets, subordinated debt and equity stay with the old, bad, bank. So subordinated debt will very likely get a very low recovery (the sub bonds are today trading at around 15 cents). Subordinated bank debt is now, in practical terms, able to take losses and be written down in European banks. Senior bank debt will also become write-down-able at the start of 2016, but as yet legislators and regulators are showing the continued desire to make senior good. In BES’ case, though, with all the deposits and senior debt moving to the good bank (and with a very thin layer of subordinated debt), more than 75% of the liabilities will go to the new entity. In CDS terms, this means that the contracts move to the new entity. So, again, buyers of subordinated protection in BES are left with significant losses on their bonds, but will have to deliver senior bonds which are trading close to and in some cases above par. Not the outcome that the owners of protection wanted or expected. And, frankly, not the right outcome.

So the existing rules around financial CDS are unfit for purpose. Starting in September, new rules will come into place that will vastly improve the economics of these contracts, and in simple terms will make them behave far more like senior and subordinated bonds, which after all is what they are meant to do. The major differences can be summarised into two: a new, fourth, credit event trigger called Government Intervention will be added; and the removal of the cross default provision. The Government Intervention trigger will mean that in instances such as SNS, when governmental authorities impair debt, CDS contracts will be triggered, and in the same case, owners of subordinated protection would have delivered a claim on the Dutch government that was worth zero, through the expropriation, and would have received par from sellers of protection. In terms of the second major reform to financial CDS contracts, current contracts mean that a credit event on subordinated CDS also results in a credit event on senior. This clause will be removed, meaning that in the Banco Espirito Santo on-going case, subordinated CDS contracts would travel with the subordinated bonds, and senior with senior. Unlike the changing faces of the Bond Vigilantes, the changes soon coming in CDS are ones we think are positive.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox