The case for global corporate bond investing – Wolfgang Bauer

US companies issued a record amount of more than €27 billion of euro-denominated bonds (known as ‘reverse Yankees’) in the first quarter of 2015, taking advantage of the relatively low financing costs on offer in Europe compared to their home market. This is just one example of how corporate issuers routinely capitalise on local corporate bond market supply and demand dynamics in search of cheaper finance. Such opportunities are not only available to issuers. Those investors with a sufficiently flexible investment strategy can also exploit relative value opportunities across global corporate bond markets and, in so doing, potentially earn a significant pick-up over more constrained strategies. They can also benefit from the many other advantages that flexible global investing offers, such as diversification.

US dollar credit spreads have widened significantly in relative terms

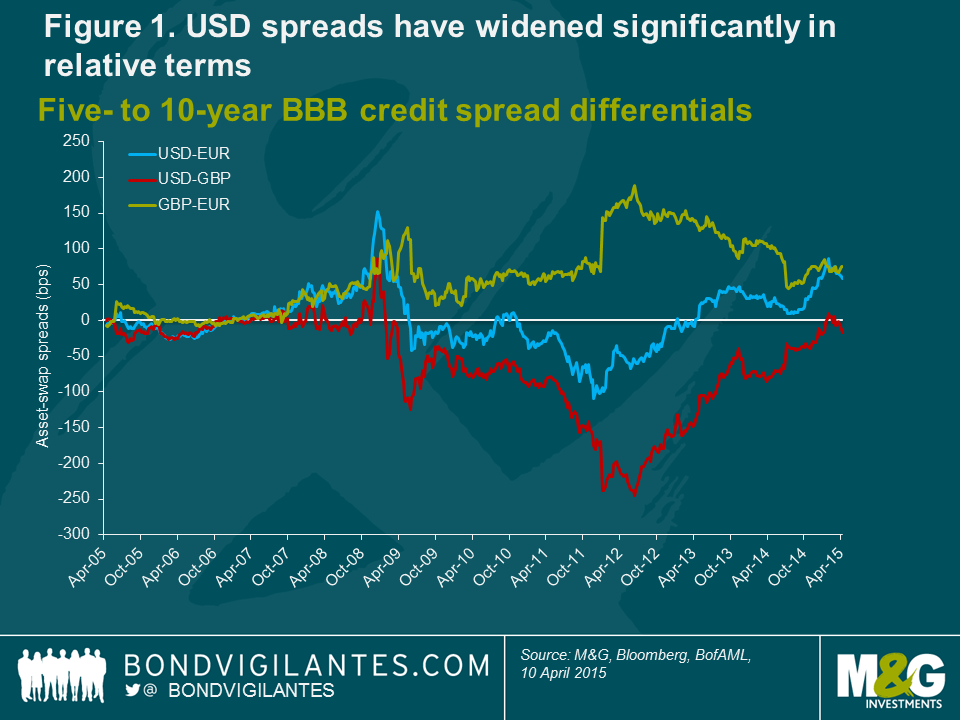

Figure 1 shows changes in credit spread differentials (the differences between credit yields) between USD, EUR and GBP corporate bond markets over the last 10 years, highlighting that USD spreads have widened significantly, in relative terms, more recently. The USD–EUR spread differential has risen by nearly 170 basis points (bps) to +58 bps from -109 bps in November 2011. GBP spreads are currently slightly wider than USD spreads, but the USD–GBP spread has come a long way from its lows of -238 bps at the beginning of 2012 to only -17 bps today. This trend is not confined to USD spreads: relative to EUR spreads, GBP spreads have also outperformed over the past three years, with the GBP–EUR difference trending downwards by around 115 bps since June 2012.

The magnitude of the relative spread movements between USD, EUR and GBP corporate bonds over the past 10 years is also striking. Although we are looking at bonds from the same credit rating band (BBB) and maturity range (5-10 years), the spread differential ranges are substantial. This volatility in spread differentials across corporate bond markets is a powerful argument in favour of global bond investing. At M&G, we look to exploit these cross-market discrepancies through the flexible nature of our fixed income mandates.

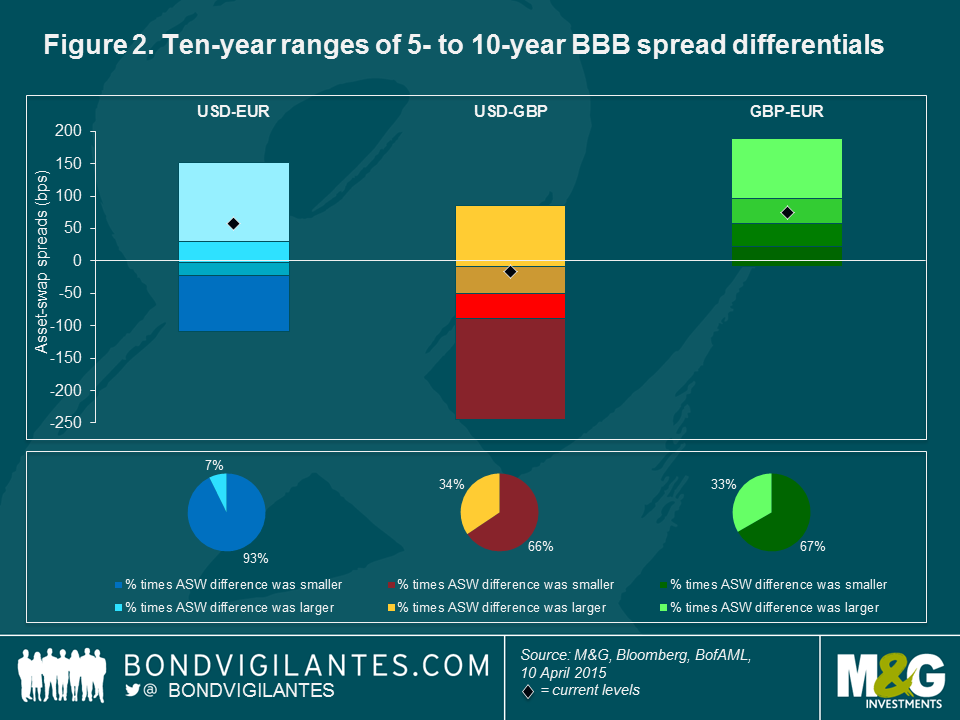

The percentile analysis shown in figure 2 illustrates the spread differential ranges in global corporate bond markets over the past 10 years. The current USD–EUR spread level ranks within the top quartile. Apart from a brief moment at the height of the global financial crisis, USD spreads have never been wider, relative to EUR spreads, in the past 10 years than in the first quarter of 2015. In fact, for about 93% of the time, the differential was smaller (or even negative).

The current values for the other two currency pairs are high relative to their 10-year ranges, too. For roughly two-thirds of the time, the USD–GBP and GBP–EUR differentials have been lower than now, although their position is less extreme than that of the USD–EUR pairing.

On this measure, USD BBB spreads look attractive at the moment, particularly compared to EUR spreads. If we assume that mean reversion (which says that prices and returns eventually move back towards their average over time) will apply, then there is a good chance that USD corporate bonds will outperform EUR bonds on a credit spread basis going forward. But are things really that simple? Unfortunately, they are not.

There are a number of reasons for this. It can be misleading to compare pure credit spread levels between different corporate bond markets without taking the cross-currency basis into account. This is a measure of the premium that borrowers pay to obtain funding in a currency other than their own (see box for more detail). In the case above, this approximate adjustment reduces the attractiveness of USD credit spreads relative to EUR spreads by around 35 bps at the five-year point. Nevertheless, according to our analysis, this leaves an average spread pick-up of approximately 25 bps for switching from EUR into USD BBB credit.

The EUR–USD cross-currency basis

It is surprisingly tricky to compare credit spreads in different currencies on a like-for-like basis. The easiest way to do so is perhaps to think it through from a bond issuer’s perspective. Imagine a US company (A) wants to take advantage of low interest rates in Europe and thus plans to raise debt capital by issuing a EUR-denominated ‘reverse Yankee’ bond. Without any hedges in place, the success (or failure) of this strategy will depend mainly on the future course of interest rates in both markets and the EUR–USD exchange rate. If the company does not have a view on these factors, it will probably decide to hedge away the risks by entering into a cross-currency swap with a counterparty.

The swap works as follows: Company A raises a certain principal amount of EUR debt capital in the European corporate bond market and then passes it on to the counterparty in exchange for the corresponding principal amount in USD, based on the spot EUR–USD exchange rate. During the life of the swap, Company A will pay USD interest on the USD principal to the counterparty, for example, at 3-month USD Libor. In exchange, Company A will receive EUR interest on the EUR principal, for instance at 3-month Euribor plus a certain margin, which can be positive or negative and is called the cross-currency basis. Company A can use these intermediate EUR cashflows to pay the coupons to its EUR bondholders. At the maturity of the swap contract, the USD and EUR principals are again exchanged between Company A and the counterparty. Company A can then use the terminal EUR cashflow to redeem the outstanding EUR bond.

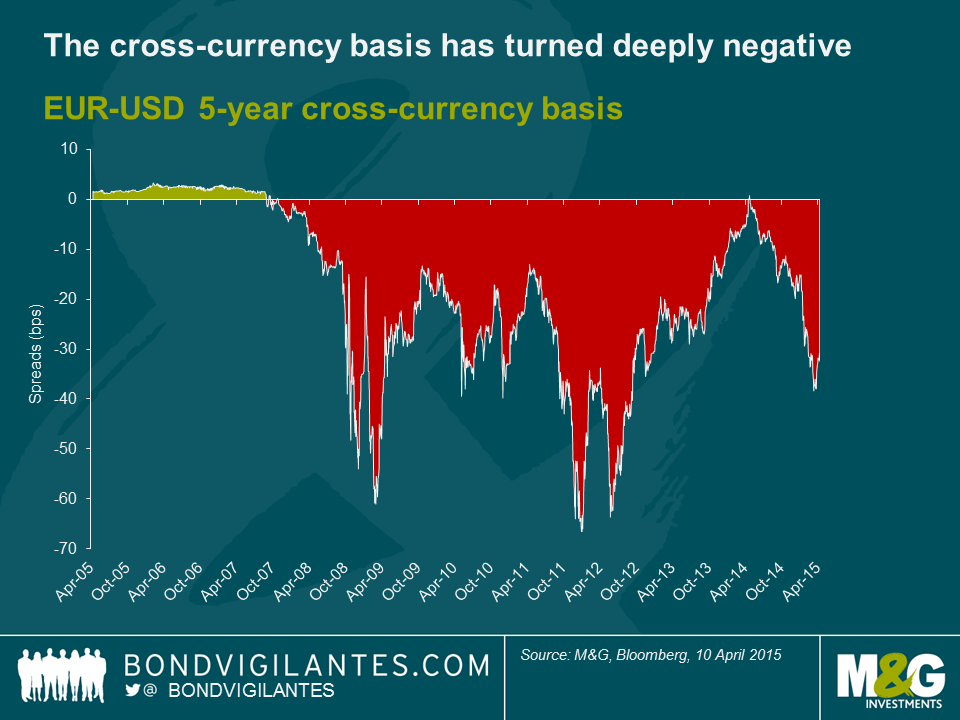

The cross-currency basis moderates market supply and demand for one currency over another. For example, when many US issuers want to issue euro-denominated bonds, as we have seen in the past year, the terms get worse. In other words, the cross-currency basis their counterparties are willing to pay them will decline. As the chart below shows, this is exactly what has been happening: the EUR–USD 5-year cross-currency basis has moved deeply into negative territory to around -35 bps.

The fall of the EUR–USD cross-currency basis thus makes it less appealing for issuers to raise funds in EUR than in USD. Since bond issuers and bond investors are two sides of the same coin, this means that a negative cross-currency basis improves the relative attractiveness of EUR bonds over USD bonds. To put it the other way round, we have to adjust USD–EUR credit spread differentials downwards by essentially adding the negative cross-currency basis to USD spreads.

While this is a simplification, as it ignores other factors affecting credit spread differentials between comparable bonds issued in different currencies, such as home bias, it provides a general indication. The key message is: USD credit spreads are attractive versus EUR spreads for bond investors at the moment, but the valuation difference is less appealing than it looks at first glance.

US credit spreads facing headwinds

Additionally, even if USD corporate bonds are offering attractive spreads compared to EUR bonds, there may be good reasons for this seeming discrepancy. USD credit spreads are currently facing a number of headwinds, the result of the US economy being at a later stage of the credit cycle than that of Europe. Firstly, leverage has been ticking up and merger and acquisition (M&A) event risk has been rising, at least in certain sectors, notably telecommunications, healthcare and consumer goods. Secondly, export-driven US companies have been hurt by the strengthening of the US dollar against most major currencies. Thirdly, unlike the European Central Bank, which is in fully fledged quantitative easing mode, the Federal Reserve is now providing less monetary stimulus and is likely to hike interest rates in the relatively near future, making refinancing activity for US companies more costly going forward. Fourthly, the energy sector has a much higher weight in USD BBB indices than in EUR indices, and thus average USD credit spreads have been suffering more severely from suppressed oil prices. And finally, many US companies have also been distinctly shareholder-friendly, engaging, for instance, in debt-financed share buy-backs.

All of these points are valid and need to be considered on a case-by-case basis when comparing the relative attractiveness of USD and EUR credit. Yankee bonds, as US dollar-denominated bonds issued by European or other non-US entities are known, offer a way of getting around most of the credit-negative aspects of the US bond market while still getting exposure to the favourable USD credit spreads. In addition, Yankee issuers are often less well researched by US analysts, and thus frequently offer a spread premium to engage the interest of US investors. Similarly, we can often find compelling relative value opportunities in the USD bonds of many US-based issuers at the moment. But within these categories, which maturity band currently presents the most interesting opportunities for corporate bond investors?

Today: record term premiums on offer in USD credit

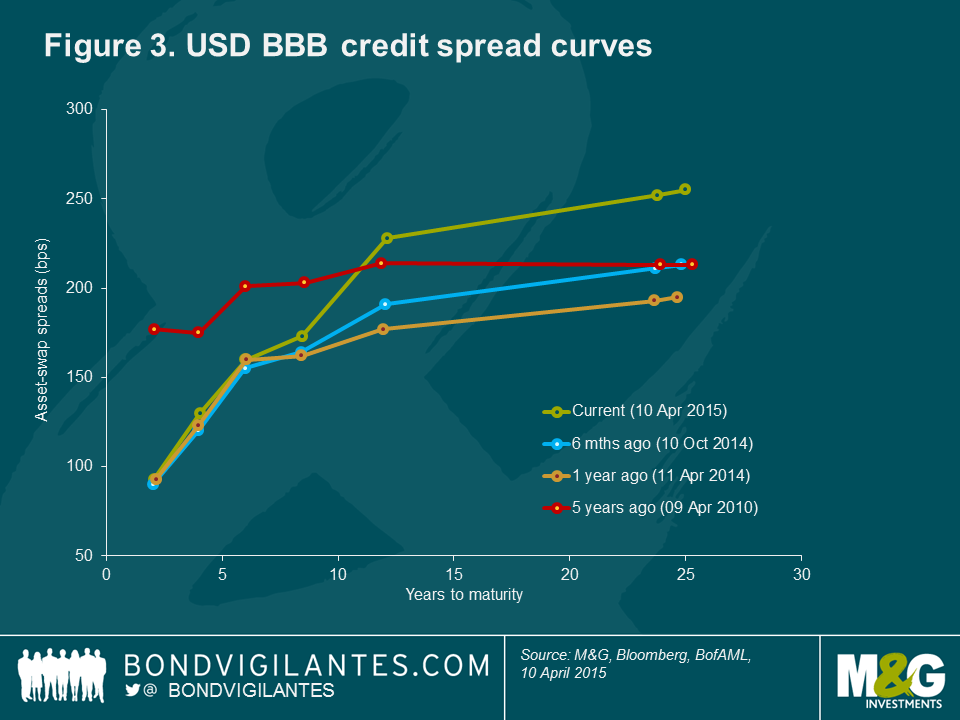

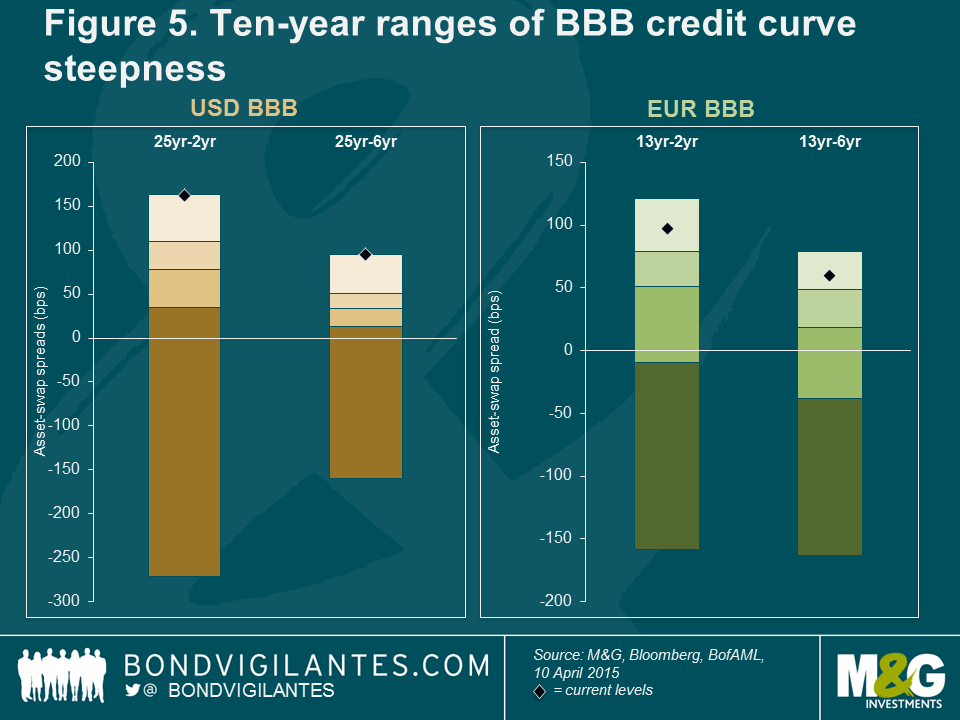

To answer this, we need to look at the steepness of credit spread curves. In figure 3, we have plotted the latest USD BBB credit spread curve alongside historic curves. Over the course of the last year, a considerable steepening has taken place. Interestingly, spreads remained pretty much unchanged at the lower maturity end, but have widened substantially beyond the six-year mark. The 25-year to 6-year spread differential has increased by 60 bps to 95 bps since April 2014. The current 25yr–2yr term premium amounts to 162 bps – about four-and-a-half times that of five years ago.

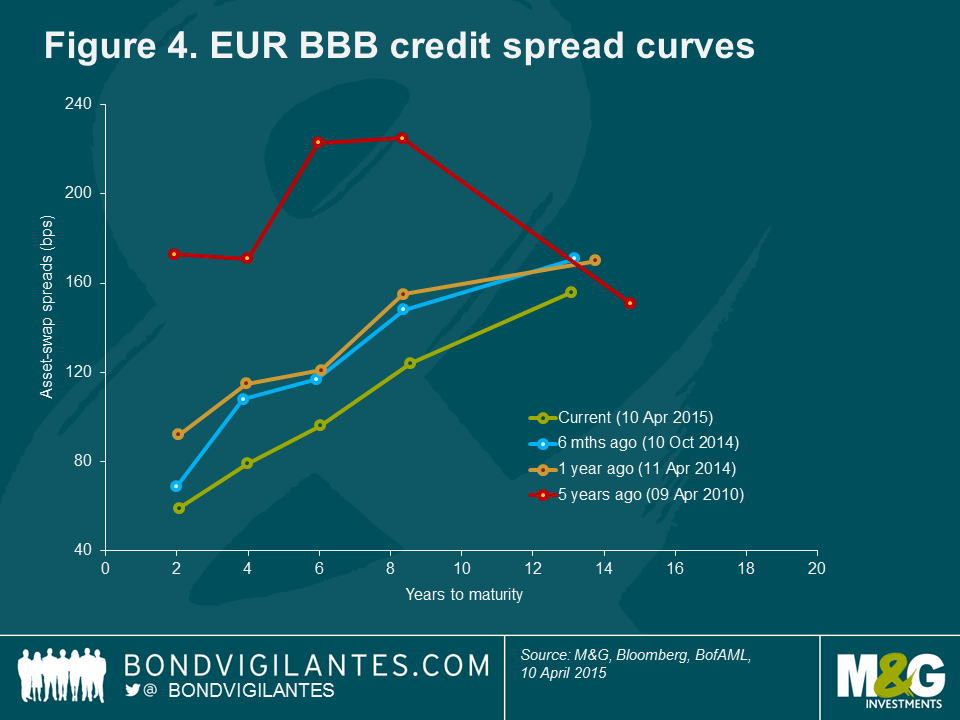

Things are a little different for EUR BBB credit, as shown in figure 4. Lower average maturities in the EUR corporate bond markets result in shortened credit curves. Over the past year, term premiums have moderately increased to 97 bps (13yr–2yr) and 60 bps (13yr–6yr). In contrast to the USD curve, however, the steepening of the EUR credit curve has not resulted from underperformance at the long end. Instead, the whole curve has shifted downwards and spreads at the short end have slightly outperformed those at the long end. In the vast majority of cases, credit spread curves are upward-sloping, which makes sense intuitively, as bond investors typically demand a higher credit risk term premium for lending for a longer time. In times of financial distress, though, credit curves can adopt less regular shapes. The EUR BBB curve from April 2010, for instance, as the eurozone debt crisis gained momentum, displays a significant hump at intermediate maturities.

A comparison of the most recent USD and EUR steepness readings versus their 10-year ranges highlights just how steep credit curves are at the moment. All current term premiums shown in figure 5 are located within the top quartile. The situation in the USD BBB bond market is particularly extreme as both the 25yr–2yr and the 25yr–6yr differentials are at record highs, opening up an attractive relative value opportunity. Investors who are willing to take long-dated credit risk exposure in the USD corporate bond market are handsomely compensated in terms of credit spread.

It is worth remembering that a large portion of the steepening in the USD credit curve has been counteracted by the simultaneous flattening of the US Treasury curve, making the total yield pick-up at the long end less compelling. However, for those investors able to lock in pure credit risk exposure, for instance by using US Treasury futures to remove or reduce their duration exposure (their sensitivity to a change in interest rates), long-dated USD credit looks highly appealing at the moment.

Tomorrow: where will the most attractive opportunities lie?

There is little argument that USD corporate bonds are currently attractively valued on a credit spread basis, particularly when compared with their euro-denominated counterparts. Even taking unfavourable cross-currency basis adjustments into account, there is a decent spread pick-up to be gained from switching into USD corporate bonds from EUR corporates. The steepness of the USD credit spread curve has become so extreme that ample term premiums can be earned at the long end.

But this currently favourable valuation of long-dated USD credit represents merely a snapshot in time. The ranges across which both credit spread differentials in global corporate bond markets and credit curve term premiums move are remarkably wide. Adopting a sufficiently flexible global corporate bond strategy enables investors to take advantage of the myriad cross-market relative value opportunities that inevitably present themselves one way or another over time.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox