Happy Halloween. Five scary charts that Freddy Krueger would be proud of.

M&G and bondvigilantes.com proudly present the scariest charts on the global economy. Some will make you laugh, some will make you cry. You will be amazed, you will be enchanted, you will be mystified, you will be amused. Of course, the following is not for the faint of heart. You have been warned.

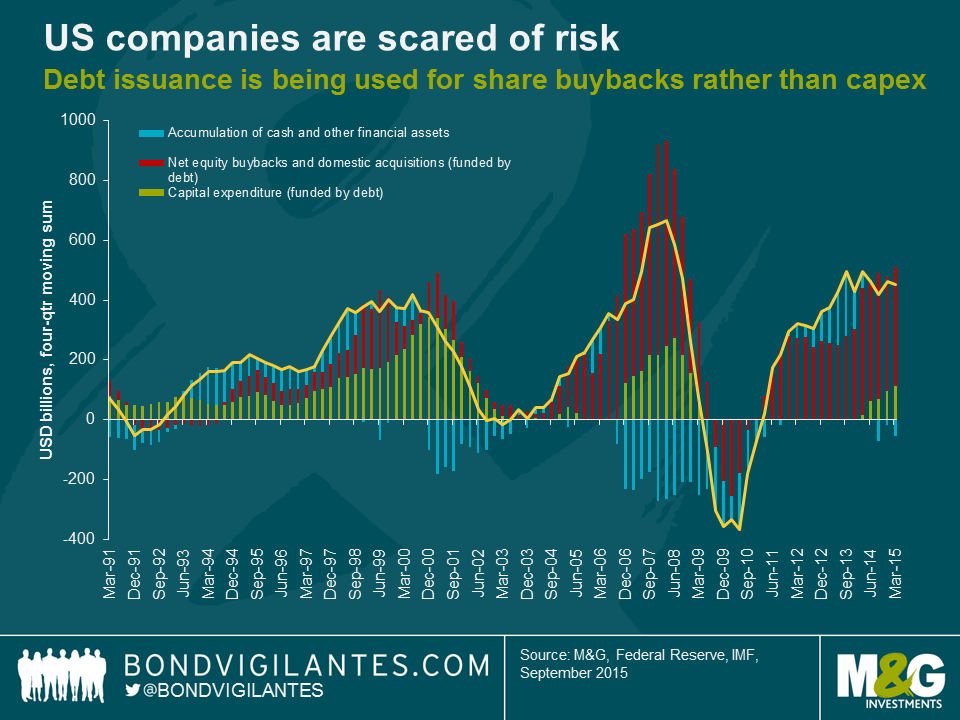

- Companies are scared of risk

There has been a glut of corporate bond issuance since the financial crisis, as companies have issued debt at low interest rates. What have companies done with all that cash that capital markets have leant them? Overwhelmingly, US companies have embarked upon equity buy backs and M&A activity, which has helped shift the equity market higher. Only a small amount of proceeds raised by US companies in bond markets have been used for capital expenditure. This suggests that corporations remain hesitant to take risk, even in an environment where many perceive that the US economy is ready to withstand higher interest rates.

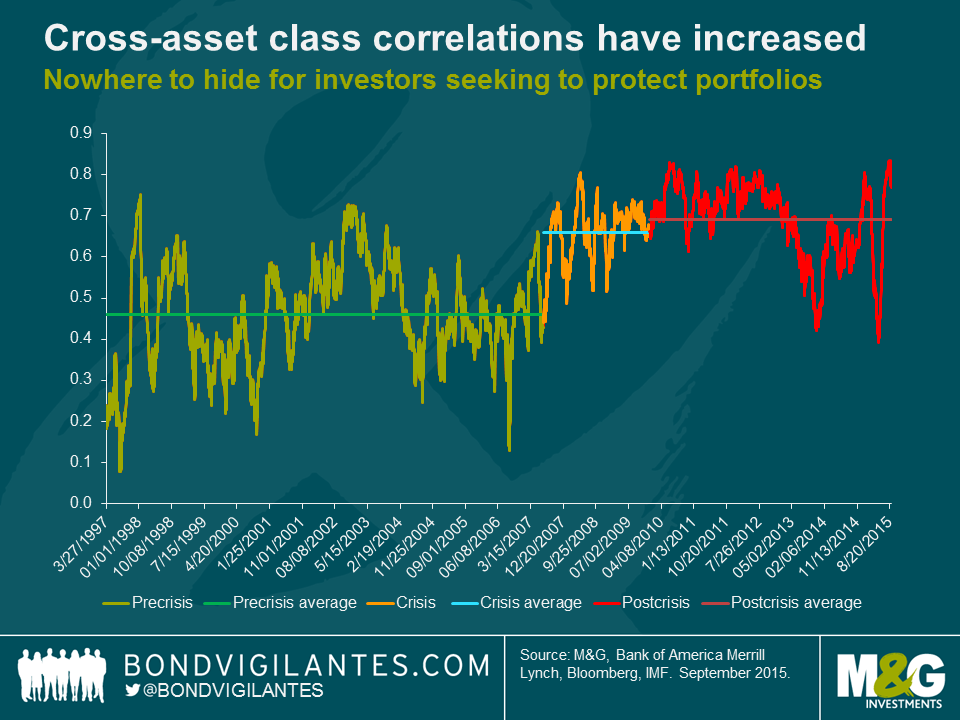

- Nowhere to hide for investors

In the old days, an investor could expect the bonds in their investment portfolio to do well when equities sold off and vice versa. Not anymore. Analysis by the IMF shows that asset classes are increasingly moving in the same direction, meaning that the famous rule of investing – diversification – no longer applies to the same degree that it once did. Worryingly, the tendency for global asset prices to move in unison is now at a record high level and correlations have remained elevated even during periods of low volatility. A large scare in investment markets could really test the fragility of the financial system should asset values deteriorate across the board.

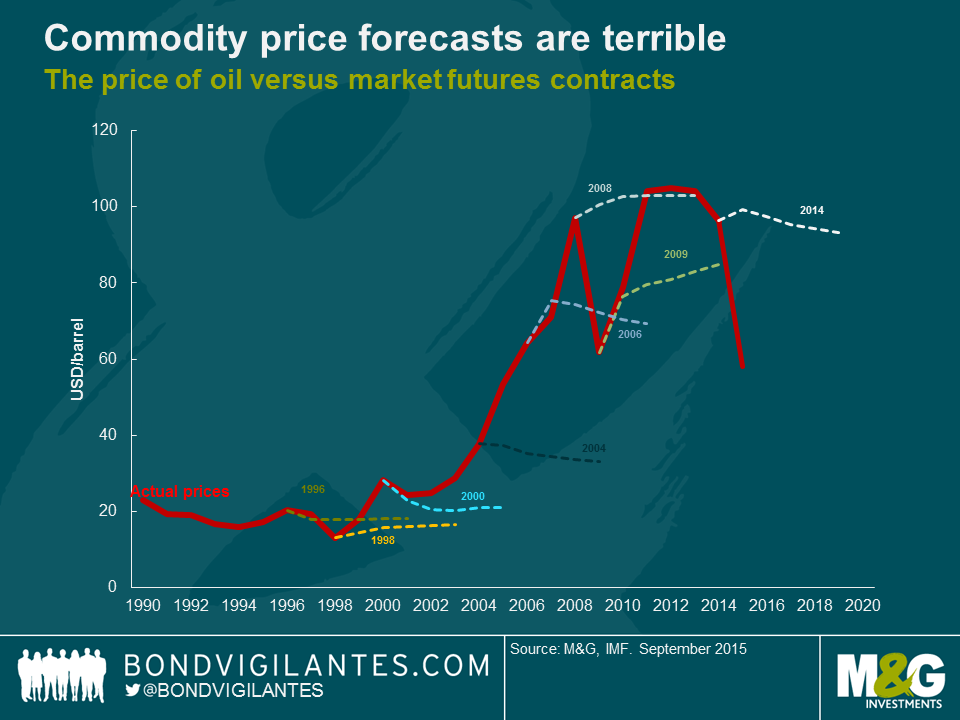

- Terrible forecasts

Commodity prices are highly volatile and unpredictable as evidenced by futures market pricing for crude oil. This poses a significant challenge for policymakers in resource-rich countries. In the majority of commodity-exporting nations, a large share of government revenue is provided by the resource sector. The current shock to commodity prices could put severe pressure on government balances, particularly in geopolitical hotspots like the Middle East, Russia, Nigeria and Venezuela. Those forecasting (hoping) that commodity prices rebound may be disappointed.

- Monstrous derivatives exposure

The notional value of derivatives in the global financial system is around $630 trillion. To put this in comparison, the value of global GDP is $77.3 trillion. Whilst $630 trillion is a huge number, it does overstate the dangers lurking in the global derivatives market. The notional amount does not reflect the assets at risk in a derivatives contract trade. According to the BIS (Bank for International Settlements), the gross market value of the global OTC derivatives market is $20.9 trillion (close to a third of global GDP).

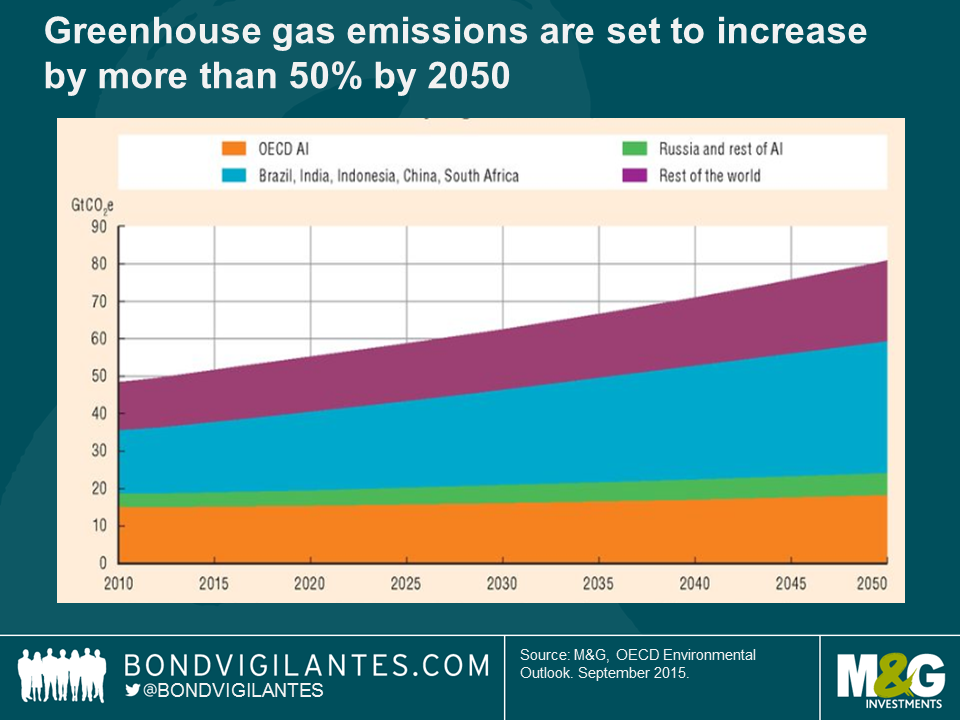

- Not enough is being done to prevent global warming

And finally, the scariest chart of the lot. Global greenhouse gas emissions continue to increase, putting further pressure on the environment. The OECD estimate that greenhouse gas emissions will increase by more than 50% by 2050, driven by a 70% increase in carbon dioxide emissions from energy use. Energy demand is expected to rise by 80% by 2050. Should this forecast prove accurate, global temperatures are expected to increase by between 3-6 degrees Celsius. This is expected to alter precipitation patterns, melt glaciers, cause the sea-level to rise and intensify extreme weather events to unprecedented. It could cause dramatic natural changes that could have catastrophic or irreversible outcomes for the environment and society.

From an economic perspective, the main problem with attempting to reduce carbon emissions is that the developed world must find a way to subsidise developing nations to adopt (more expensive) renewable energy technologies. This could cost hundreds of billions of dollars. Developing countries argue that the developed world should bear the brunt of any emission cuts, as emissions per capita in richer nations are higher.

Fortunately, there are actions underway to attempt to limit the increase in greenhouse gas emissions. Eighty one global companies signed a White House-sponsored pledge to take more aggressive action on climate change. Later this year, France will be hosting “COP21/CMP11”, a United Nations conference aimed at achieving a new international agreement on the climate in order to keep global warming below 2 degrees Celsius. And for the innovators, there is a $20m carbon X prize on the table for anyone who can develop technologies that will convert carbon dioxide emissions from power plants and industrial facilities into valuable products, like building materials, alternative fuels and other everyday items.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox