Bullet dodging – European high yield in 2015

As the year draws to a close, 2015 has actually been a solid if unspectacular one for the European High Yield market. Total returns of a little under 3%* compare well to negative returns in the US and Global High Yield markets. European default rates also continue to trend lower, hitting 0.14% for the last twelve months to the end of November according to data from Bank of America Merrill Lynch. All good then?

Well, not really. The overall numbers look ok but this masks some dramatic pockets of weakness within the market. Several bonds have seen some large losses. The most notable perhaps being an 86% price drop by bonds issued by Abengoa SA, the Spanish renewables company. This has not been an isolated incident either. Investing in this environment brings to mind an iconic scene in “The Matrix”, when Neo, the main character, survives a sustained hail of bullets by effectively dodging them. He takes a few marginal hits but the point is he survives by ducking the more dangerous, fatal projectiles. Likewise, a successful 2015 for most European high yield investors has been defined in similar terms: you’ve had a good year if you dodged most of the bullets.

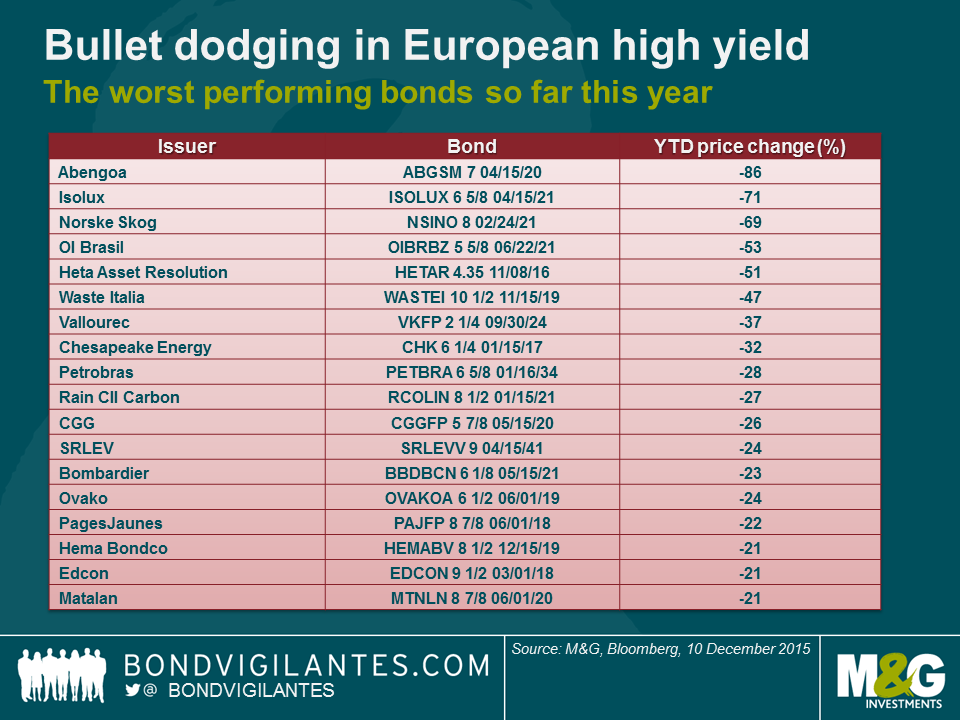

So where has the damage been done? In the table below, we show the worst performing bond issuers this year in percentage terms. For the sake of simplicity, where there are multiple bonds issued by the same company, we have simply included only the worst performing amongst them.

From the above, we can draw out a few themes. The big losses have been experienced in the following situations:

- Engineering companies with complex funding needs and emerging market exposure

- Brazilian corporate issuers

- Any company that has significant exposure to falling energy prices

- Steel makers

- Struggling retailers

Indeed, I think it’s fair to say much of the recent weakness in the US high market has been driven by many of the same factors (not least the moves in the energy and commodity related space). The difference is that exposures to some of the poorer performing sectors are comparatively much higher in the US, so the overall impact is more meaningful.

What I think is interesting here is that this shows the European market has not been immune to such forces and investors still need to be cognisant of the risks, particularly as the market has held up so well this year. Bullet dodging, therefore, is still likely to be a useful skill going into 2016.

*Total return of +2.8% year to December 9th, BofA Merrill Lynch European Currency HY Index

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox