Leverage ain’t always a shareholder’s best friend

The temptation to ‘juice-up’ shareholder returns with low yielding corporate debt has been too much to bear for many companies and their investors in recent years. This fad has been well documented and though it may not be a trend we creditors like to observe, we haven’t been entirely surprised to see it play out in 2015 given the seemingly large valuation disconnect between the cost of debt and equity; even if the comparison is often far too simplistic.

But having taken on more debt, and despite often doing so at record low yields, this has not translated into a winning strategy in 2015. Take the example of the four UK listed mining majors – Anglo American, BHP, Glencore & Rio Tinto. Back in March/April of this year Anglo was able to borrow five year € money at 1.5% and Glencore at 1.25%. Although earnings and hence equity prices had already come under pressure by Q1 2015, bond markets appeared somewhat sanguine.

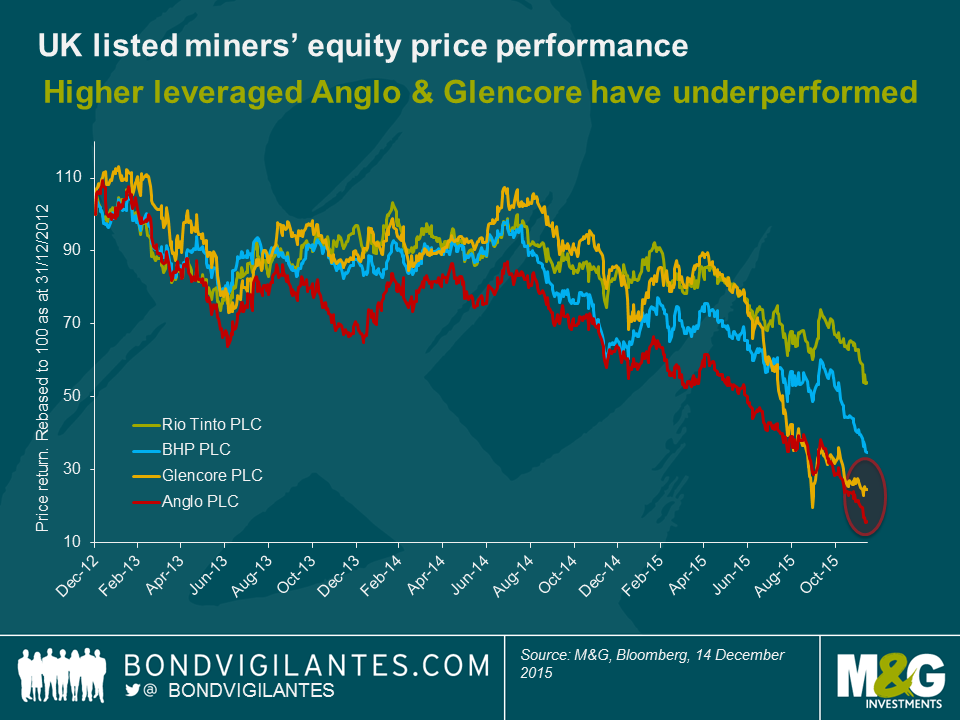

But it has been tough going since then. Whilst all four miners have continued to see share price falls through 2015, the underperformance has been stark for the more levered & lower rated Anglo American (Baa3/BBB-) and Glencore (Baa2/BBB).

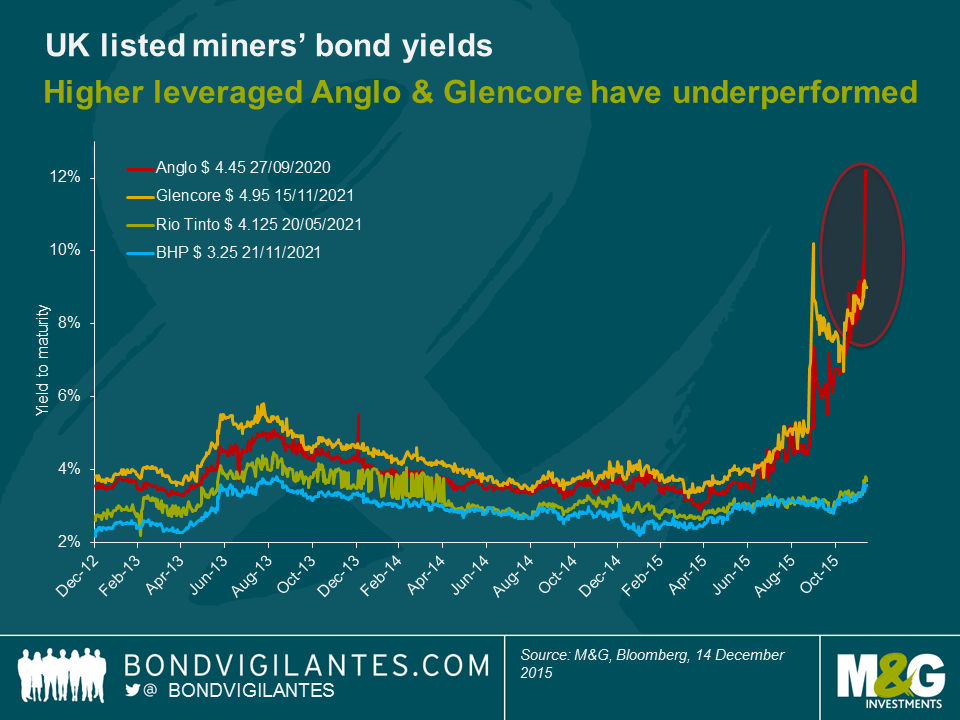

And the same relationship can be observed in bond markets. Spooked in part by the more aggressive financial policies followed by Anglo & Glencore (at June ‘15 their ratio of net debt to EBITDA was 2.2x & 2.7x) their five year $ funding jumped from 4% to approximately 9% and 12% respectively. Higher rated Rio (A3/A-) and BHP (A1/A+), both with much lower ratios of net debt/EBITDA, saw a far smaller move higher in yields from 3.2% to 3.7% and 2.8% to 3.7%.

In fact, things had got so bad by the second half of 2015 that both Glencore and Anglo were forced into something of a ‘U-turn’, announcing plans to focus on debt reduction, an equity raise, asset sales, and dividend suspension for Glencore, and major operational restructuring and dividend suspension for Anglo (Anglo has so far avoided issuing more equity but the pressure remains). Suddenly, the interests of bond holders and shareholders seemed very much aligned, with investors questioning the wisdom of running so much financial leverage, scrutinising the quality of assets and cash flow generation – bondholders especially demanding answers.

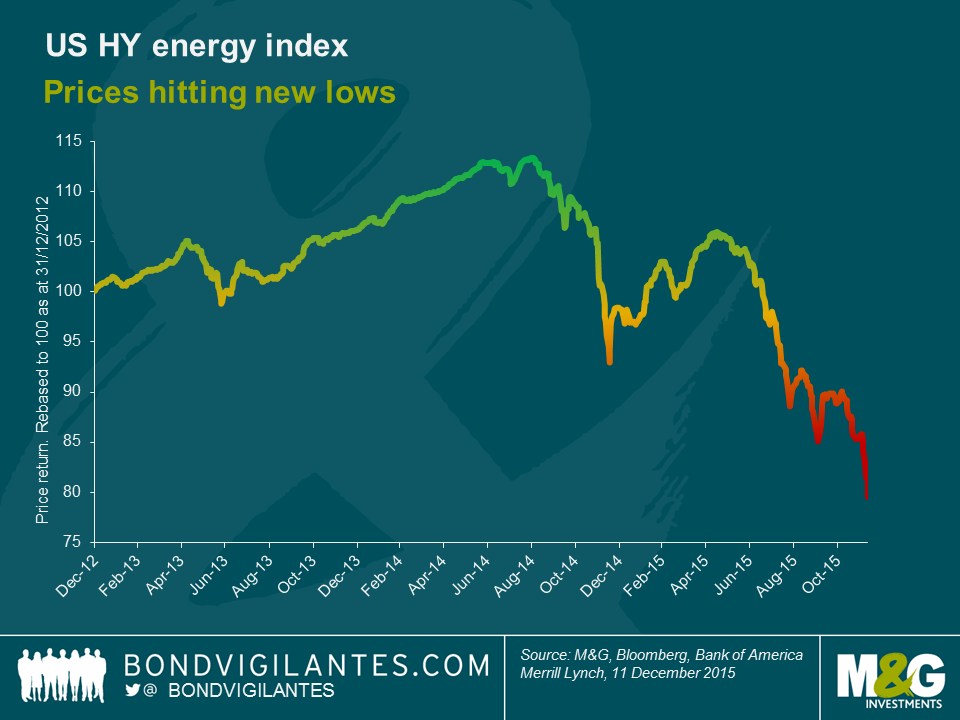

But nowhere has the risks of leverage and cyclicality been more evident than the recent experiences of the US high yield market. Having funded much of the recent shale oil & gas revolution, US high yield investors are nursing serious wounds. With oil prices almost half of where they were earlier in the year, both bondholders & shareholders are sitting on large losses as we head into 2016, with the prospect of further restructurings to come.

It seems clear that debt and equity investors alike should continue to question just how well a cyclical industry lends itself to heavy indebtedness. By their nature, cyclical industries will always be exactly that – cyclical. Debt may very well be a mainstay of a company’s balance sheet today, allowing for growth and investment, but it is rarely a panacea for an underperforming share price. We should be wary of any company that treats it as such.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox