Damsels in distress – Chesapeake and distressed exchanges

2009 through 2013 were some very good years for the US high yield market. And the energy subset was no exception. Returning 51%, 13%, 9%, 12% & 6% in each of those years, it’s not surprising that the BofA Merrill Lynch US High Yield Energy Index practically trebled in size. Voracious issuance, much of it to fund shale oil development, was met with equally intense buy-side demand and with it came the all too familiar weakening of covenants.

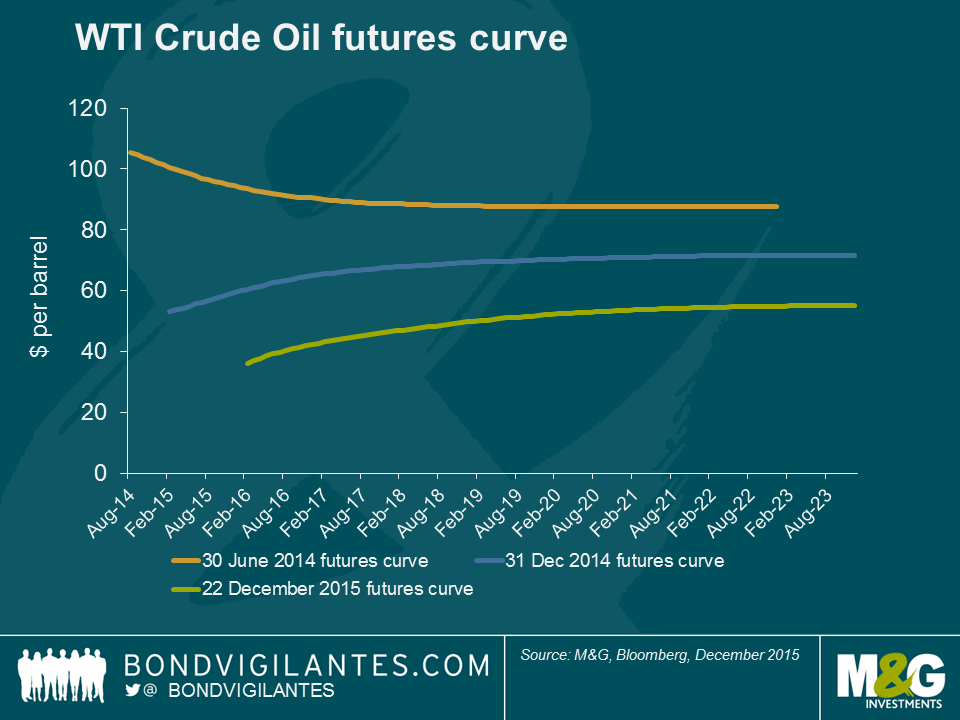

But after a number of golden years, the energy market began to fall out of bed in 2014. Expectations of weaker global demand, especially from the Far East, coupled with a supply glut and a stronger US Dollar saw a radical reappraisal of the future prospects for prices.

It’s easy to forget that back in mid-2014, only some 18 months ago, WTI was priced to sell for around $88 five years forward. By the end of that year that number had fallen to $70, and now the same figure looks set to finish 2015 around 51 bucks.

Such a rapid reappraisal of the future value of oil and gas has had drastic consequences, especially for the most levered of producers. And with little expectation of a significant recovery in prices, the focus has turned to liquidity and its management via distressed exchanges.

Distressed exchanges, defined by Moody’s as an offer to creditors of ‘new or restructured debt, or a new package of securities, cash or assets, that amounts to a diminished financial obligation,’ became a notable feature of 2015. We count at least eleven significant exchanges during 2015.

The latest and perhaps most significant has come from Chesapeake Energy. Collapsing natural gas prices and little prospect of attracting equity capital has left the company with a looming liquidity crunch. In response, Chesapeake offered earlier this month to exchange up to $3bn of their unsecured liabilities for second lien secured debt, with bondholders accepting a write-down on their existing claims. So in a nutshell, the company reduces its debt load in return for offering some security over its asset base.

Which immediately begs a number of questions. What’s in it for the company? What does it mean for its stakeholders, especially investors in the company’s bonds? And finally, is this exchange enough to ‘right size’ the company’s balance sheet?

Having seen the yield on its five year debt rocket towards 50% during the second half of the year (see chart below), Chesapeake has little prospect of refinancing over $1.5bn of bonds that come due in the next eighteen months. The company does, however, have significant room to incur secured debt. By offering to exchange near-term maturities into longer dated debt, as well as asking bondholders to accept a write down on their claims, the company is able to reduce its liabilities and buy precious time whilst praying for a recovery in gas prices.

The outcome for stakeholders, especially bondholders, is less straight forward. Without going into the detailed mechanics of the exchange, it is difficult to opine on the best course of action without the benefit of hindsight. At its core, and this is true of most of these exchanges, bondholders must weigh the future prospects for the business versus the variety of options put to them by the company and the costs involved. Given the outcomes are many and uncertain; the decision process is far from straightforward.

Ultimately, whether the exchange offered by Chesapeake –and the dozen or so others we have seen this year– serve to sufficiently right size the balance sheet, only time will tell. What we can be sure of is that distressed exchanges and financial engineering is a likely feature of 2016.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox