The rise in UK inflation expectations since Brexit

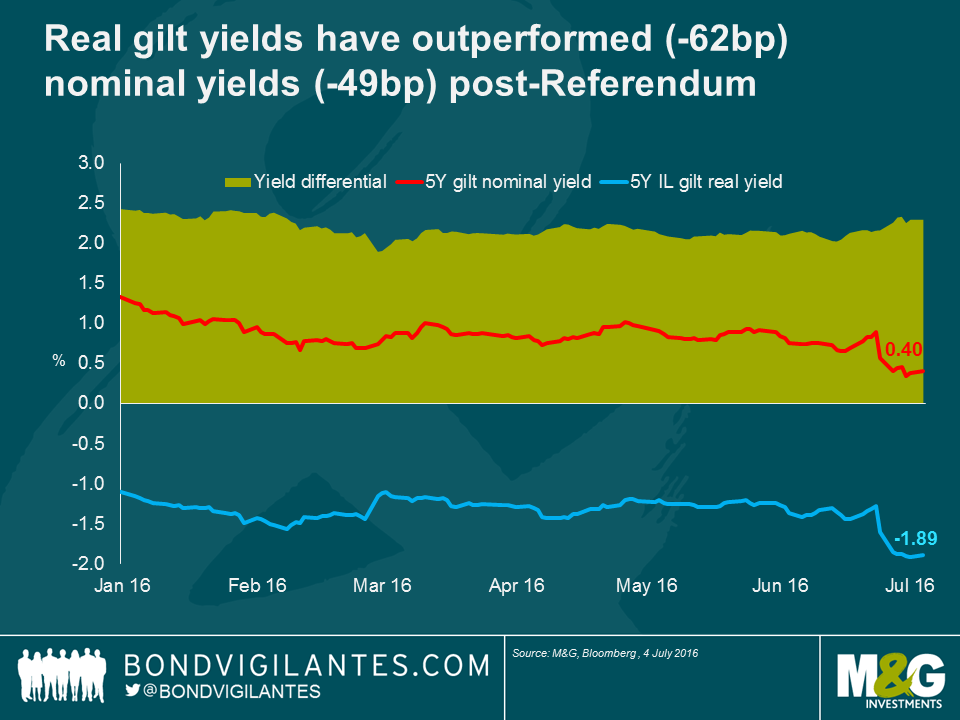

I wrote ahead of the UK referendum that I felt front end index-linked bonds were a good way to play the uncertainty surrounding the result, given the fact that they have crucial non-binary hedge characteristics. Since the result, breakevens (i.e. the market’s expectation of future inflation) have behaved exactly as expected, rallying. The chart below shows how nominal yields have collapsed to record lows but real yields have fallen even further, meaning that 5-year breakevens have rallied since the result was announced. This is exceptionally strong relative performance for index-linked gilts.

The major driver of this outperformance, which is all the more remarkable given it has occurred in an environment of falling nominal yields, has been an expectation of rising import inflation owing to sharp falls in sterling. On a trade-weighted basis, sterling is down around 9% since the referendum. The old rule of thumb that UK and Eurozone Economist at Scotiabank (aka inflation guru) Alan Clarke uses is that there is a 10:1 pass-through of sterling to inflation or, in other words, that a 10% fall in the pound will add 1% to inflation. When taken in light of this, the market’s response to the near 10% fall in the pound is not irrational, as a 20bp increase in inflation expectations in each of the next 5 years is pretty close to adding 1% to inflation compensation over that period of time.

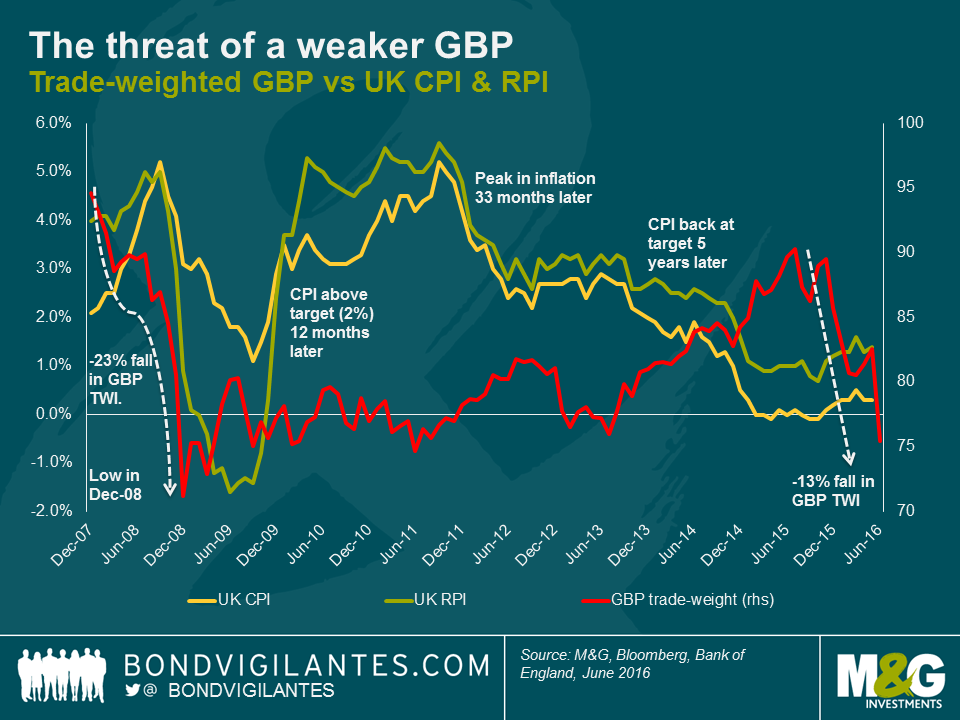

The above chart suggests that there is good reason for the market to look at the weakness of sterling and start to price in more inflation. Looking back at the global financial crisis, the pound weakened by 25% and, after a lag, RPI rose by more than 6%. This suggests that the scope for inflation expectations could have further to run.

Doing some simple calculations, a 6% inflation uplift after a 25% fall in sterling is closer to a 25% pass-through than to 10%. Indeed, Kristin Forbes of the Bank of England told markets last year that the BoE estimates a 20% to 30% pass-through from the exchange rate to CPI. This could mean that the 9% fall in the pound since the vote could bring a 2% increase in inflation over the short term. It is also important to point out that sterling has been on the slide for almost exactly 12 months now, over which time it has fallen by nearly 16%. Some of this weakness will start to show through in inflation imminently (given a 12 to 24 month time-lag). If we apply the experience following the financial crisis, and the Bank of England’s pass-through estimate, the UK might be on its way to seeing 3% to 5% higher inflation in the not too distant future.

At this point, it is important to acknowledge that there could be some downward pressure on UK inflation going forward. UK RPI includes around 15% to 20% of housing, made up of both house prices and mortgage interest payments. Mortgage interest payments now look even less likely to move upwards following the referendum, and you could convincingly argue they are more likely to fall now. House prices also look set for a fall, which means RPI will be dragged down. Perhaps more importantly, though, is that CPI does not contain these items, and so the wedge by which RPI is greater than CPI looks to me at this point to be set for a fall.

Besides the currency, there are other reasons that are making me positive on inflation-linked assets going into the second half of this year and into 2017. One is that we are nearing the point at which oil price moves will cease being a negative drag on inflation. January to April 2016 saw oil languishing below $40, so the first quarter of 2017 should see some strong positive contributions to inflation numbers, assuming commodity prices don’t plunge from current levels. In addition, the UK’s large and near record current account deficit could put further pressure on the already fragile pound. I expect these factors to outweigh and disinflationary impact from falling interest rates or house prices. As a result, even with the strong performance since the referendum result, I would continue to argue that there is still good value to be had in short dated index-linked bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox