Brexit: The winners and losers in sterling high yield

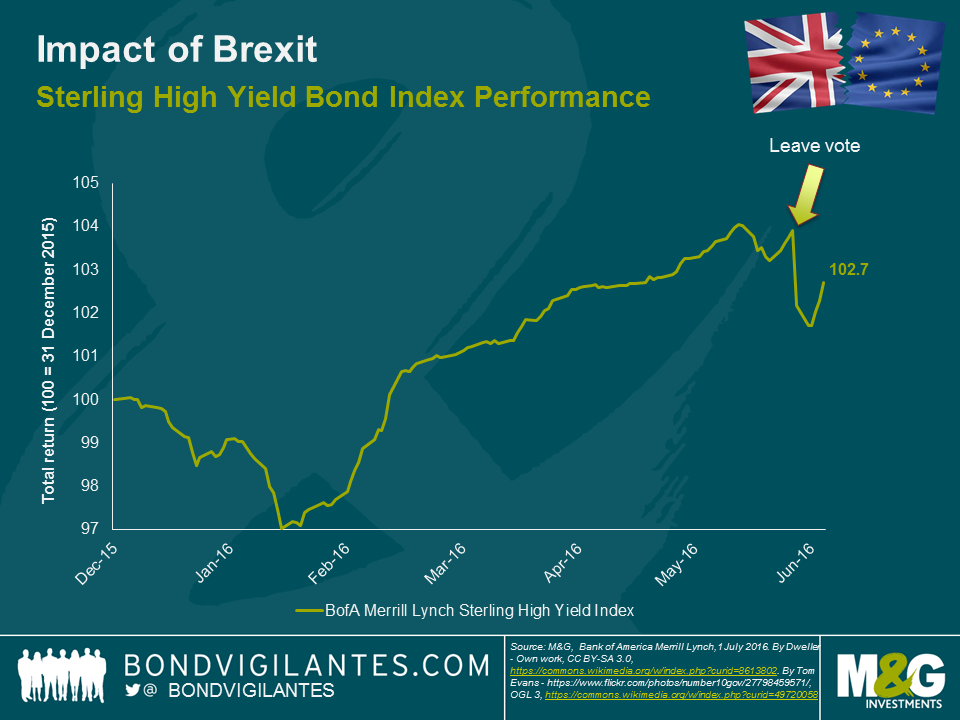

Much has been written about the impact that the referendum result has had on gilts, the pound and equity markets. In sterling high yield bond markets, we have seen some repricing with the market 2% lower in price terms since the vote. In my opinion, this has been a fairly benign reaction if you consider that the FTSE 250 is around 10% lower over the same time period. One explanation for the muted market reaction could be the expectation for further monetary easing in the near term. Governor Carney has signalled that the MPC is likely to ease policy rates over the summer. The possibility of direct central bank action in credit markets also hangs over fixed income markets at this point in time, helping to support market valuations. Of course, monetary policy can only do so much to support a deteriorating economy and Chancellor Osborne’s less austere approach to fiscal policy is also providing some hope that a possible UK recession would be a shallow one.

There could be other reasons why the reaction in the high yield market has been relatively benign. Like the FTSE 100 (up 2% since the vote), the high yield market is not a very good reflection of sentiment surrounding the UK economy. In fact, there is a significant number of international issuers that have non-investment grade ratings and issue bonds in sterling. For example, Anglo American, Gazprom, Petrobras and Enel are all constituents of this market. This has a dilutive impact on any UK-specific re-pricing of risk. Also, the supportive moves by various central banks in the aftermath of the vote has helped support all risk assets, including credit.

There will be some winners and losers in terms of the underlying issuers of these bonds and in order to forecast these, we need to make a number of qualifying assumptions. These are:

- The UK experiences a sharp slow-down (possibly recession) in coming months due to a contraction in private sector investment;

- This in turn leads to a rise in unemployment and a fall in consumer confidence;

- There is no swift recovery in growth given the timescale of exit negotiations which continues to weigh on sentiment;

- Sterling remains weak due to both a loose fiscal and dovish monetary policy response.

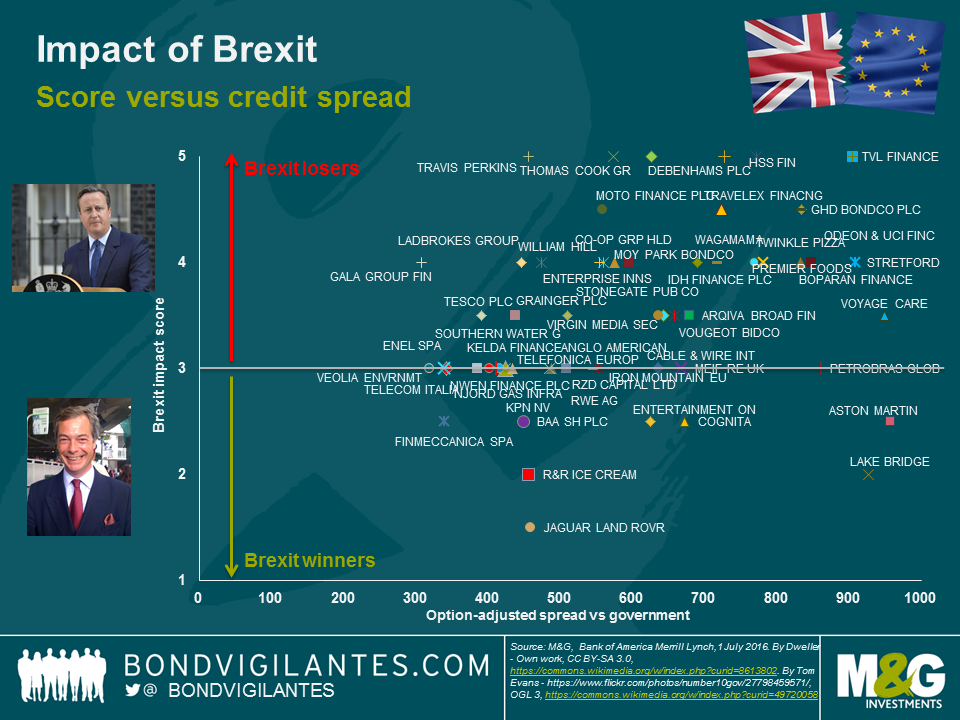

In this environment, domestically focused cyclical businesses that source their inputs from overseas are the most vulnerable (e.g. clothing retailers). Whereas, exporters of goods and services to non-EU markets may actually see a small benefit (e.g. educational service providers). The below chart plots this impact on the y-axis using a (caveat: highly subjective) numerical score between 1 and 5 (with 1 being the most positively impacted, 5 most negatively and a score of 3 denoting little or marginal impact). Current credit spreads are on the x axis to put this all in a relative value context. It should be noted that financial and distressed credits have been excluded, and of course we need to remember that spreads are a function of many other factors than purely Brexit.

We can draw a few interesting inferences from the above analysis. Firstly, most of the issuers will see a negative impact, while the number of companies that could benefit from Brexit constitutes a small minority. Secondly, when relative value is taken into consideration, the potential “winners” that trade cheaply are not without other risks. For example, Aston Martin (ASTONM) is a potential winner as a UK based international exporter and is not dependent on the European mass market. However, it has its own challenges as a small, capital constrained niche producer in a very competitive market. Brexit is unlikely to outweigh existing challenges for the business. Finally, given the muted market reaction and the likelihood of some extended fundamental challenges, the more interesting strategy to take right now is to sell or reduce exposure to the potential losers. Whilst there may be some specific opportunities, the uncertain macro environment means it is difficult to get too bullish on sterling high yield at this point in time. We would want to see a further downward adjustment in valuations before we look to put capital to work.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox