Divergence in Eurozone bond yields: threat or opportunity?

Guest contributor – Maria Municchi (Fund Manager, M&G Multi-Asset Team)

The following blog was first posted on M&G’s Multi-Asset Team blog, www.episodeblog.com. M&G’s Equities Team also regularly post their views at www.equitiesforum.com.

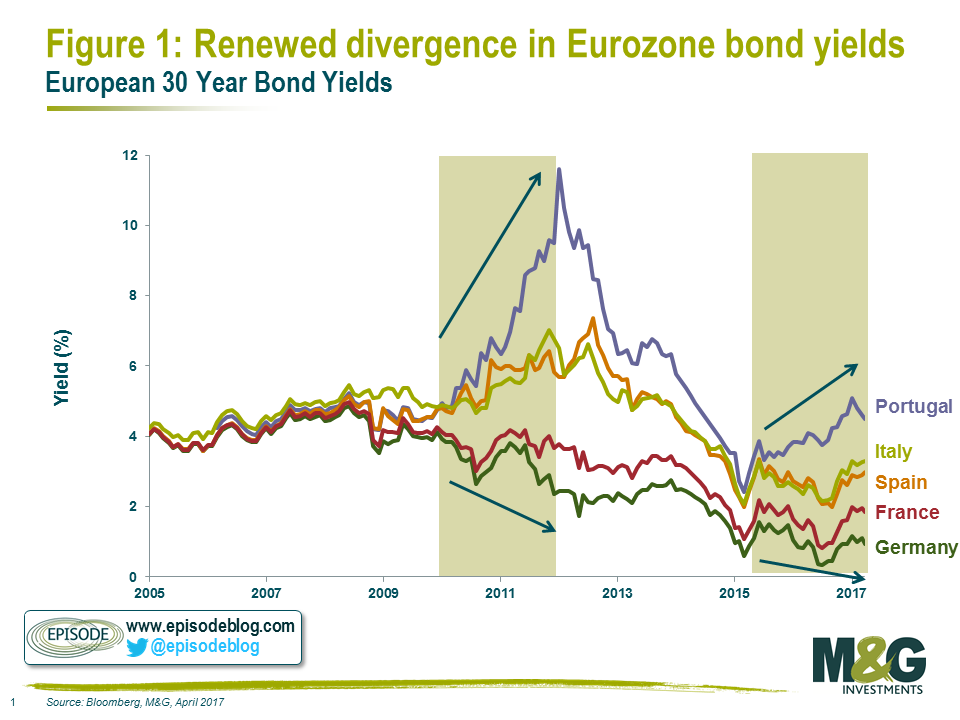

Despite the partial realignment of European long-dated government bond yields following the Euro crisis in 2012, there has been renewed divergence in yields in the last few years.

On a simplistic level, this runs contrary to improving fundamentals. While sharply accelerating Portuguese and Spanish debt levels partly explained yield moves in the Euro crisis, levels have plateaued since 2013. At the same time GDP trends have been improving, and the risk of deflation seems to have abated.

How then can we justify the increased divergence of yields across long term EU sovereign bonds?

Juan wrote in 2015 how the relationship between debt to GDP and bond yields is not a straightforward one, particularly when the sovereign is able to print its own currency. In the Eurozone this relationship is further complicated. First, debt levels become more important because individual Eurozone countries cannot control their own currencies. Second, the conditional nature of ECB support means that whether Eurozone bonds represent more of a “credit risk” or a “rate risk”, is subject to the willingness of local politicians to comply with the EU and IMF. This was evident in the experience of Syriza in Greece, and more recently was a key factor in the blow out in Portuguese bond yields at the start of 2016.

This does mean that, although fundamentals may have stabilised and even partly improved in some areas, the unstable risk characteristics of the assets themselves are subject to change. An investor’s job is to assess whether price moves reflect genuine changes in these characteristics or simply shifts in investor perceptions of them.

While the risk of default of Eurozone countries has been extensively debated ever since the crisis, there have been no defaults so far (though the Greek “haircut” can be seen as the equivalent). So the question is: are we simply overweighting the risk of default of those countries just because we have experienced the Euro crisis? Is the emotional trait of availability bias distorting our thinking and decision making?

What has changed?

2012 was indeed a genuine and profound crisis for the Euro area but we are now in a better situation and while some issues still remain, the macro environment has improved significantly, and the budgetary efforts undertaken by Portugal and others, have been material. European GDP has increased to a solid 1.8% while labour market has improved with unemployment falling below 10%. Sentiment is also improving sharply across countries pointing towards a stronger economic convergence within the Eurozone (which Mario Draghi has emphasised in recent speeches).

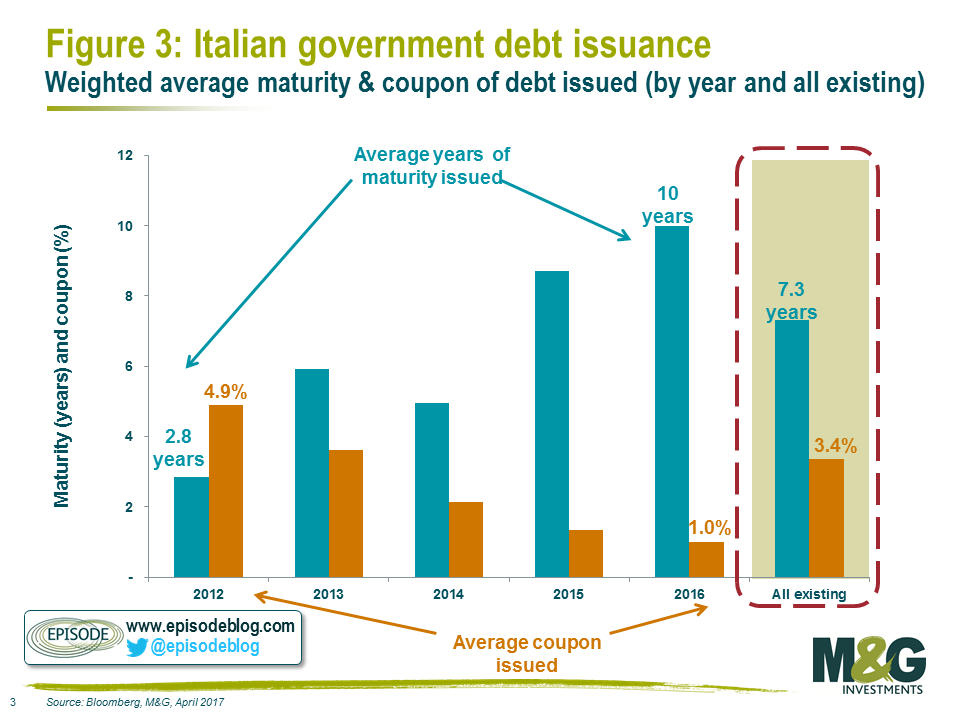

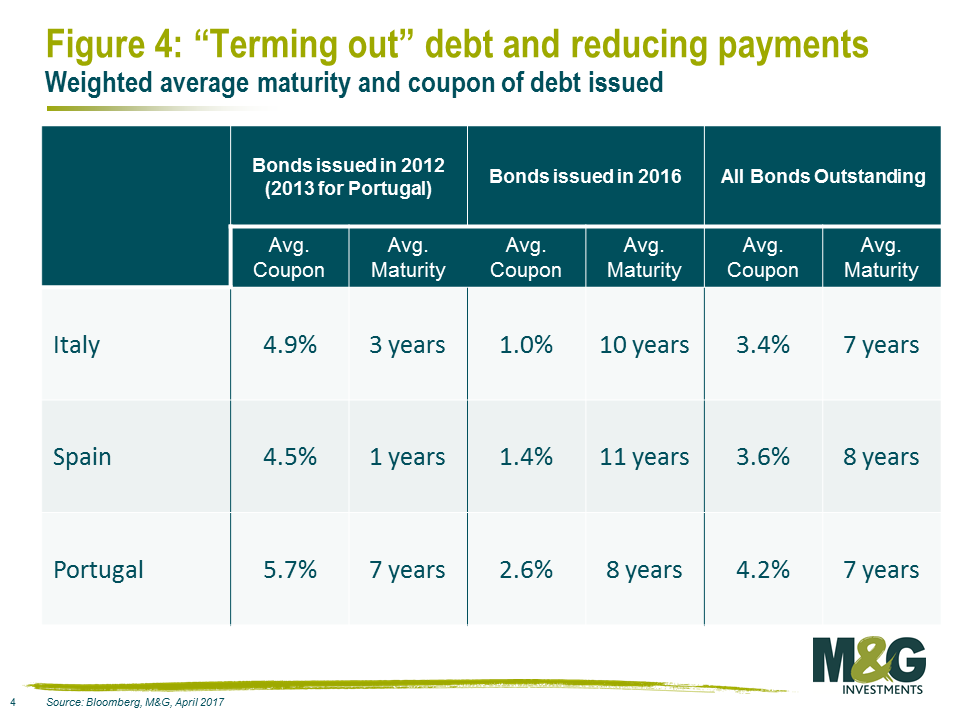

Also, thanks to the very low interest rate environment and intensive QE that followed the Euro crisis, even the most indebted countries have been able to refinance themselves at attractive levels of yields. And they have done so significantly extending their maturities in order to benefit from lower yields for longer. Although debt levels may be similar to those three years ago, with the help of the ECB, the composition of that debt has changed.

For example in Italy, the average coupon fell from almost 5% for the bonds issued in 2012 to less than 1% coupon for the bonds issued in 2016, while maturity was extended from 2.8 to 10 years on an issue size weighted average.

This trend has been mirrored in Spain and Portugal.

Taking advantage of lower yields to refinance on more attractive terms is apparently now being considered in the US (just as rates start to rise) and seems appealing (though the benefits may not be as obvious as they appear). However, with cheaper debt on their balance sheets and improving economies those European countries should be better placed, despite the many political troubles, to avoid default (and therefore deserve a tighter spread to the German bund!).

Overall, it looks like the story about bad debt dynamics isn’t compelling enough and in fact it has not been the fulcrum of investors’ attention for a while. So, what is driving prices? Certainly, the busy European political agenda has been taking centre stage. What about Marine Le Pen? And Brexit elections in the UK? Aren’t those all pointing to a greater risk of Euro area break up?

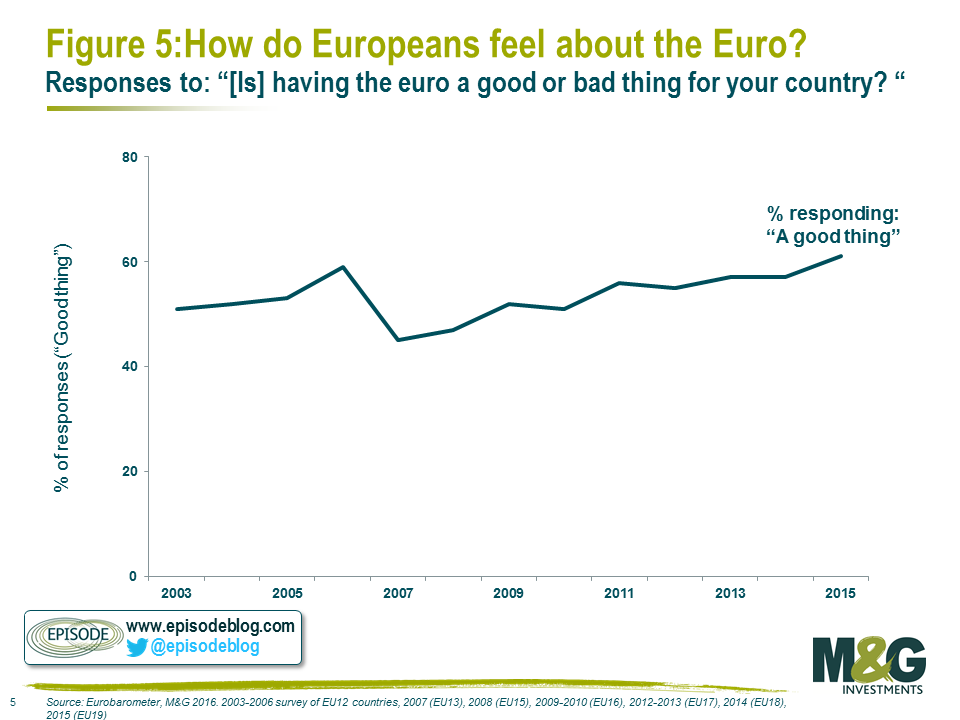

Well according to recent polls, despite the rise in populist sentiment and politicians calling for more EU referenda across various countries, Europeans might be more favourable to the Euro than some people think…

Interestingly, even within Marine Le Pen or Movimento 5 Stelle parties, leaving the Euro is one of the most divisive aspects, so much so that some people are wondering if including it as part of the programme was a good idea at all. As I discussed with regards to the Italian referendum last year, we should be wary of allowing the fact that Brexit has taken place to influence our perceptions of dynamics in other European nations.

As always, it is critical to differentiate between change in investors’ sentiment and genuine changes in the economy. We cannot know who will win the next elections or what Brexit will actually mean for Europe but we can know if we are being appropriately compensated for the risks we are taking.

It seems that the legacy of the events in the Eurozone five years ago, and Brexit last year, have played a meaningful role in influencing perceptions over the last twelve months. The economic reality is complex, but the recent divergence in bond yields seems to have been more related to these perceptions than underlying fundamentals. As such, an Italian 30 year bond yielding 3.2% or a Portuguese 30 year bond yielding 4.4% relatively to a German 30 year bonds yielding 0.9% looks more like an opportunity than a threat.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox