Can ESG analysis help improve high yield returns?

Some of the worst performing bonds in the European high yield index in 2017 all had weak Environmental, Social, and Governance (ESG) scores according to MSCI. Is this is a coincidence or is it indicative of a relationship between poor ESG metrics and bond performance?

To find out the answer, we analysed the 2017 total returns of the 365 bonds in the European high yield market that were ESG rated by MSCI. Our analysis suggests that returns were not correlated with ESG scores, with a correlation of less than 0.1.

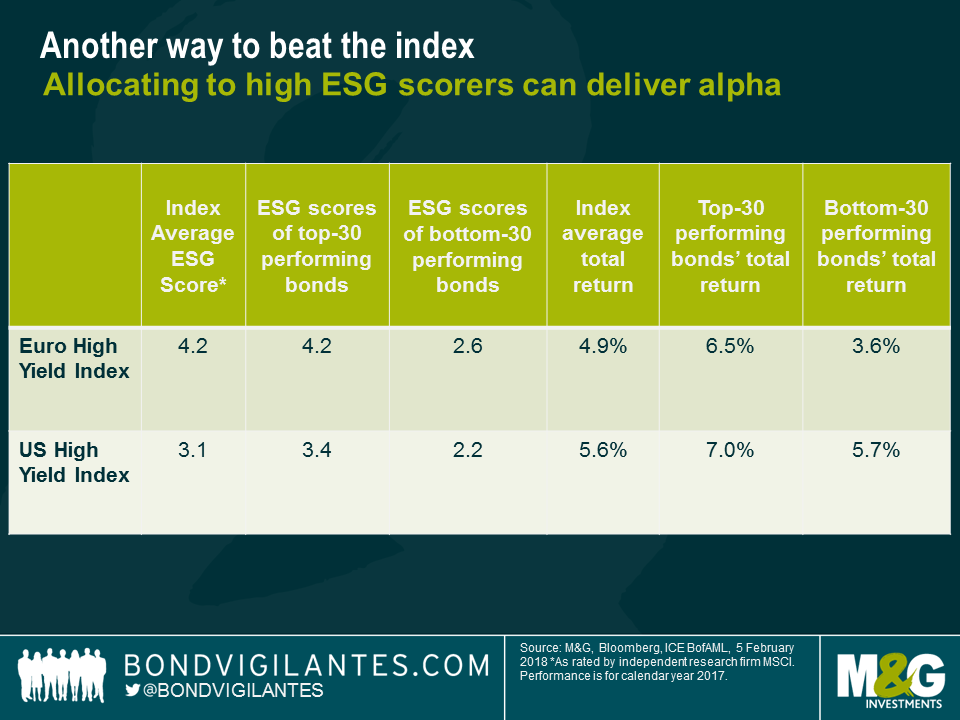

However, despite the wide dispersion of bonds in the chart above, it is still obvious that the three worst performers all have poor ESG scores. Expanding the analysis to examine the 30 bonds with the worst total return, we saw that their index weighted average ESG score was only 2.6 on a scale of 1-10 compared to a 4.2 weighted average for the index. In contrast, the 30 bonds with the best performance over the same period had a weighted average of 4.2, in line with the index. There appears to be a relationship between the worst performing bonds and weak ESG scores, albeit with the caveat that this is a small sample size.

Ranking the index by ESG scores, the 30 bonds with the highest ESG ratings delivered a 6.5% weighted average total return. Conversely, the 30 bonds with the lowest ESG scores returned 3.6% on the same basis. By way of comparison, the index returned 4.9%, implying that an ESG filter applied to a portfolio of European high yield bonds would have enabled an investor to significantly outperform the index in 2017.

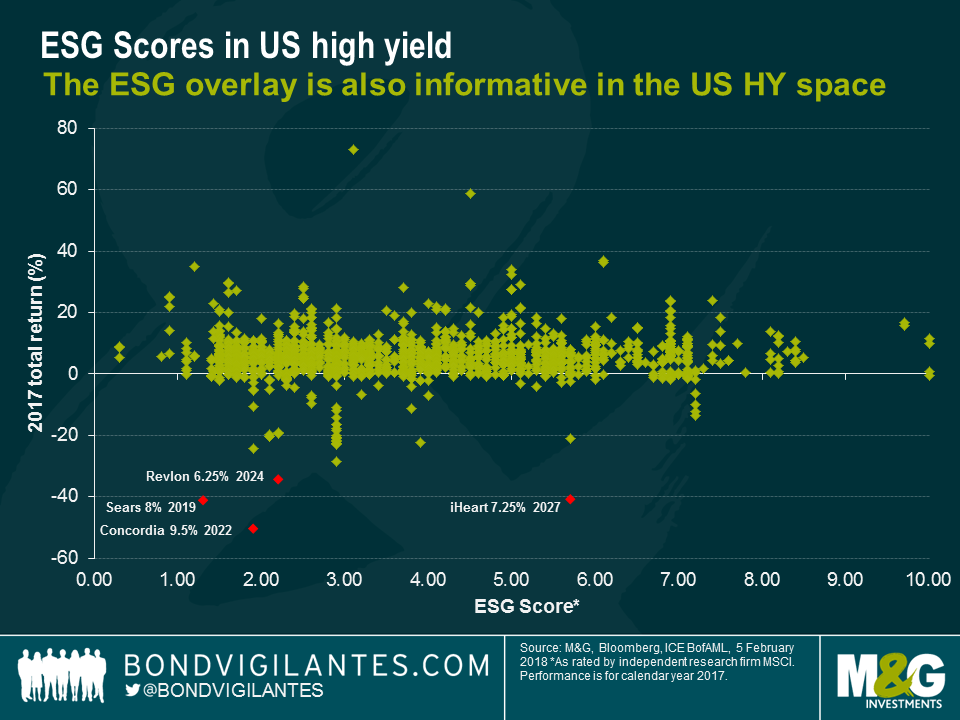

The US index displayed a similar pattern to the European index, with the worst returning bonds exhibiting a low average ESG score.

From this analysis, it appears that high yield bond ESG scores and total returns are not strongly correlated. However, this could be due to the nature of high yield return distributions last year. Most bond returns were clustered around a very tight range, in a relatively low volatility environment, with a fat tail made up of some big negative returns (or in other words, the asymmetry of returns in a tight spread environment demonstrated a leptokurtic bias). This suggests that traditional correlation analysis may not give us any meaningful insights.

Nevertheless, it is noticeable that an ESG filter appears to have some predictive power to avoid underperformers. In this way, ESG analysis can help investors avoid some of the idiosyncratic risk that exists in the high yield corporate bond market.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.