HY spreads: the story behind the story

There is much talk about how tight US High Yield (HY) spreads are, especially relative to their Investment Grade (IG) peers. The difference between the two, of 241 basis points (bps), is less than half of what it was a decade ago – making some market observers quickly conclude that US HY looks expensive, so investors should favour IG bonds instead. But, is this the full story?

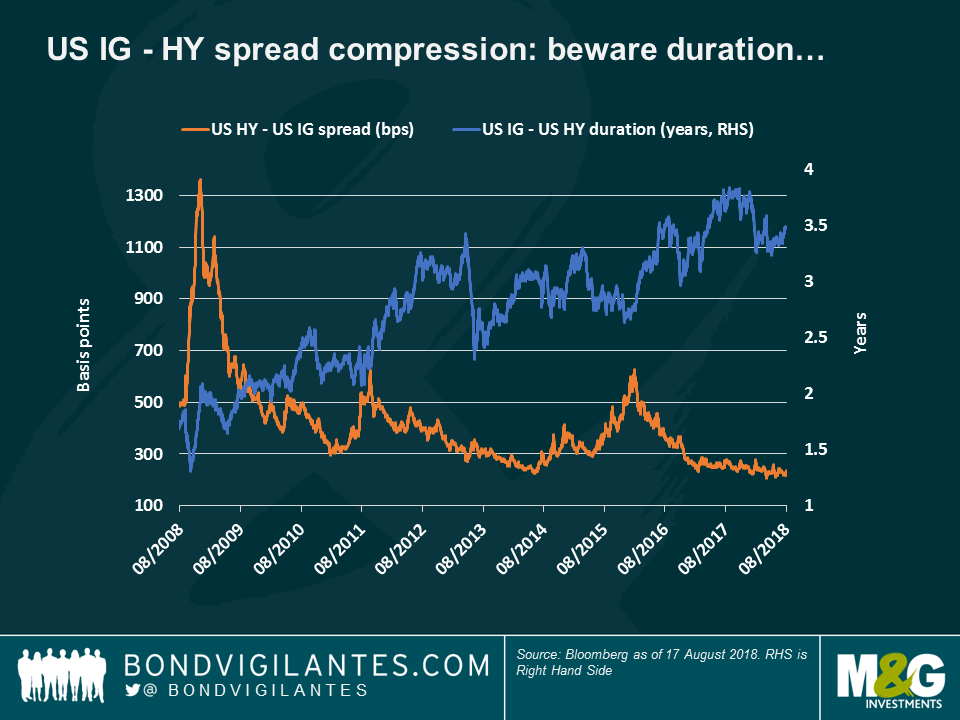

I believe there is more to it. As seen in the first chart, while it is a fact that the spread between the two asset classes has tightened over the past ten years (orange line), it is also true that such reduction also reflects a substantial change in the profile of both: relative to HY, IG interest rate risk has increased over the past decade (blue line), making IG bondholders more exposed in a rising rate environment – such as the one that the US is going through now. This has helped reduce the gap between the two.

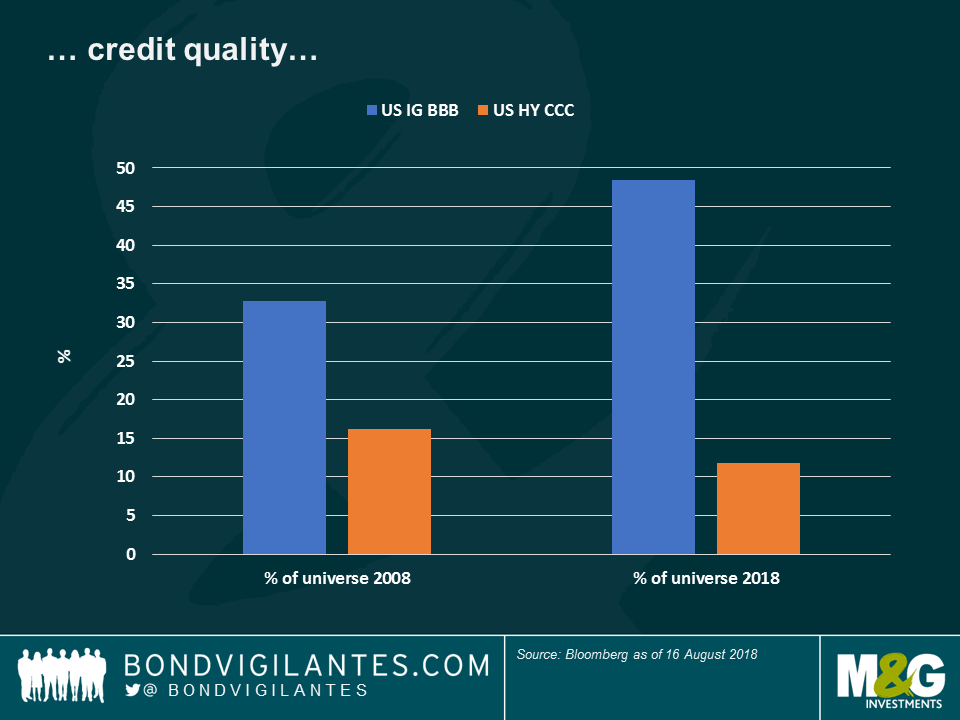

Significant changes in credit quality are also behind the HY-IG spread tightening: as seen in the chart below, the lowest IG credit rating, BBB, accounted for 33% of the asset class ten years ago, but now it has increased to 48%. Instead, CCC, the lowest HY rank, now represents 11.8% of the US HY universe, a drop from 16.2% in 2008.

Apart from having more interest rate and credit quality risk, IG investors are also facing challenging technical factors: as seen in the third chart, IG issuance has ballooned over the past decade as companies rushed to the market, attracted by ultra-low rates. At the same time, HY issuance remained steady or decreased as the asset class suffered certain setbacks, such as the collapse of oil prices in late 2014 (Energy accounts for about 15% of the US HY universe).

None of the above is meant to dispute the grab for yield that has occurred during a period of unprecedented monetary stimulus. But hopefully what we have shown is that a straightforward comparison of IG and HY spreads over the last decade is overly simplistic. As ever the devil is in the detail. HY spreads are relatively tighter to IG at least in part because the asset class’ credit quality has improved, interest rate risk has remained somewhat unchanged and technical factors have not created significant headwinds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.