Just like 2008? Oil up, ECB tightening – all we’re missing is a credit accident

As we pass the 10-year anniversary of the Lehman default and we started thinking about what we were doing back in 2008 (desperately moving my savings out of certain banks was high on the list for me, whilst listening to MGMT and Los Campesinos; album of the year? TV On The Radio’s Dear Science), I went back to our blog, to see what the early warning signs were in the summer of that year.

It is useful to have a record to be able to look back on a market moving event to see what was actually the concern at the time, rather than just remembering the post-event narrative. We had been worried about the state of the US housing market (here’s just one example of our doom and gloom coverage of US housing in Richard Woolnough’s blog in January of 2008: but during trips to the US in June that year it was something else that was grabbing the 24 hour news channels’ headlines: oil.

House prices still get a mention in the June blog, but oil was at the top of America’s worry-list. And rightly so, as a spike in the oil price preceded 11 out of the last 12 US recessions. Rising energy prices slow the economy dramatically; the impact might be lesser today, especially in developed markets where energy efficiency is much higher than it was in, say, the 1970s, but higher oil prices hit both consumers and businesses. Which brings us to today. In the past 12 months the price of WTI oil in the US has risen from around $50 per barrel to $75 per barrel, a 50% jump. Gasoline prices remain way below the $4 per gallon they reached in 2008, but are still elevated at nearly $3. Growth will be slower in 2019 as a result.

If you don’t believe that this 50% rise is going to slow the US economy, then you might have more sympathy with the view that emerging market countries, with currencies that have fallen sharply in 2018, are going to be more severely hit. The chart below shows that for Turkey, an oil importer, the cost of oil has more than doubled year to date. I’d expect the US to outperform the rest of the world in growth terms in 2019, albeit with both at a lower level thanks to this mini energy shock.

What else did I find in the “Summer of 2008” blogs? Well lots of talk about ECB tightening. The rise in energy prices had led to a headline CPI rate in the Eurozone of 4% in June 2008, double the central bank’s mandate. Short dated bunds were selling off as Jean-Claude Trichet stated that the ECB was on “heightened alert”. This is what we wrote at the time:

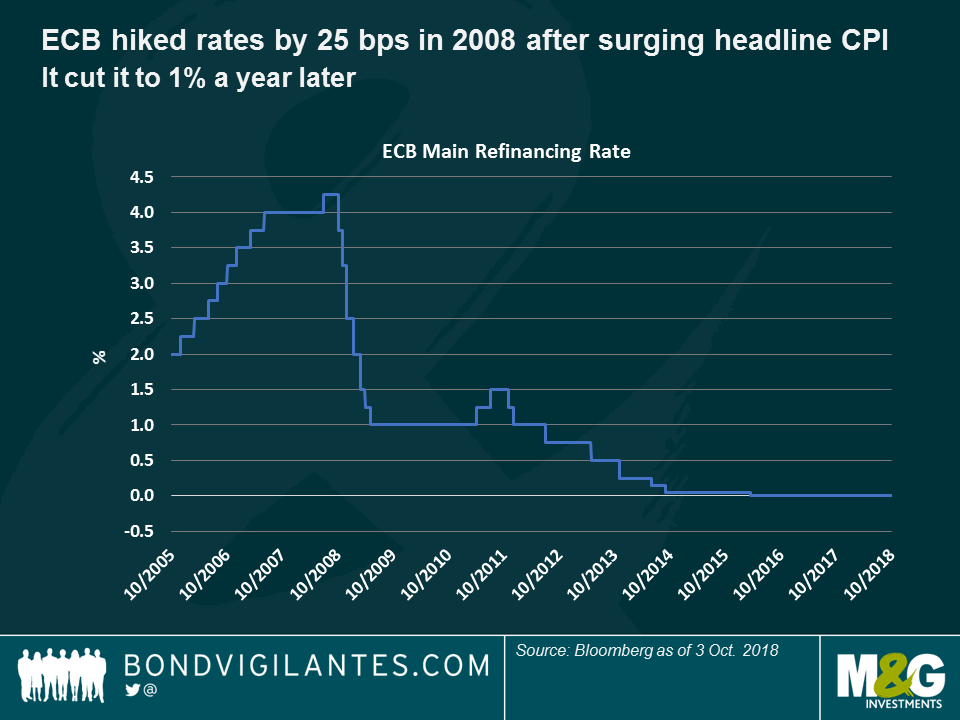

Trichet hiked rates by 25bps in July, despite the existence of a now defunct website http://www.stoptrichet.com/ collecting signatures to try to hold off rate rises. Rates at 4.25% would, of course, be the peak of that rate hiking cycle, and a year later rates would be at 1%.

Today we have an echo. Whilst we are not seeing anything like the 4% inflation that the Eurozone experienced in 2008, the recent trend is firmer, especially in Germany which just printed CPI at 2.3% year on year. And we have a central bank that is tightening in this environment. On 1st October the ECB halved its Asset Purchase Program (APP) from €30 bn per month to €15 bn, and anticipates that the programme will finish in December “subject to incoming data”.

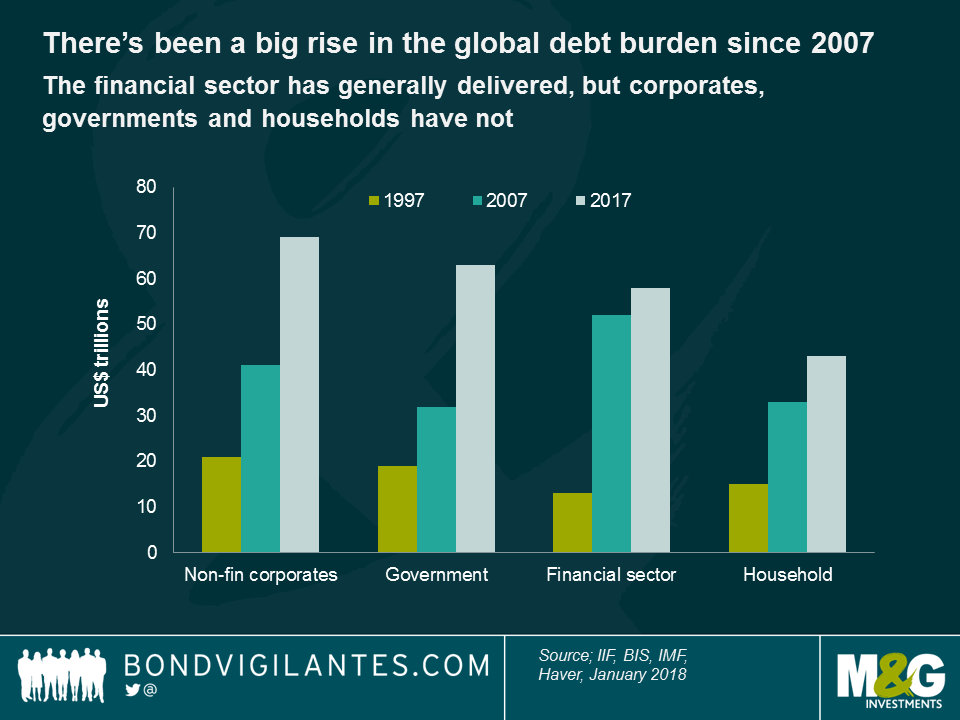

So, add monetary tightening from the European Central Bank (and of course from the Fed, Bank of England and many EM central banks) and a 50% rise in the oil price, and we have a scenario similar to the one we saw in the summer of 2008. But it IS different this time: we have substantially more debt in the global system than we did going into the last crisis. Gulp.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox