The MAS and its peculiar tightening policy

In its latest semi-annual statement, the Monetary Authority of Singapore (MAS) said it would slightly tighten monetary policy by increasing the slope of appreciation of the Singapore dollar Nominal Effective Exchange Rate’s (S$ NEER) policy band. This is the second increase this year, following one in April, and it confirms the broader monetary tightening recently seen in many Asian economies, such as South Korea, Malaysia, Indonesia, India and the Philippines – they all have recently raised rates to control inflation.

It may seem rather unconventional that the MAS’ primary tool for adjusting monetary policy is direct intervention in the spot and forward currency markets rather than using interest rates. Yet, the country is not alone: Costa Rica, Laos, Lebanon, Nigeria, and Vietnam all have similar arrangements, although these countries typically manage their currency versus the US dollar, rather than against a trade-weighted basket like Singapore does. A study published in 2014 by Chow et al¹ confirmed that for small and open economies like Singapore (trade represented over 300% of GDP in 2017), exchange rate-based monetary regimes were more appropriate to deal with external shocks than an interest rates-focused approach.

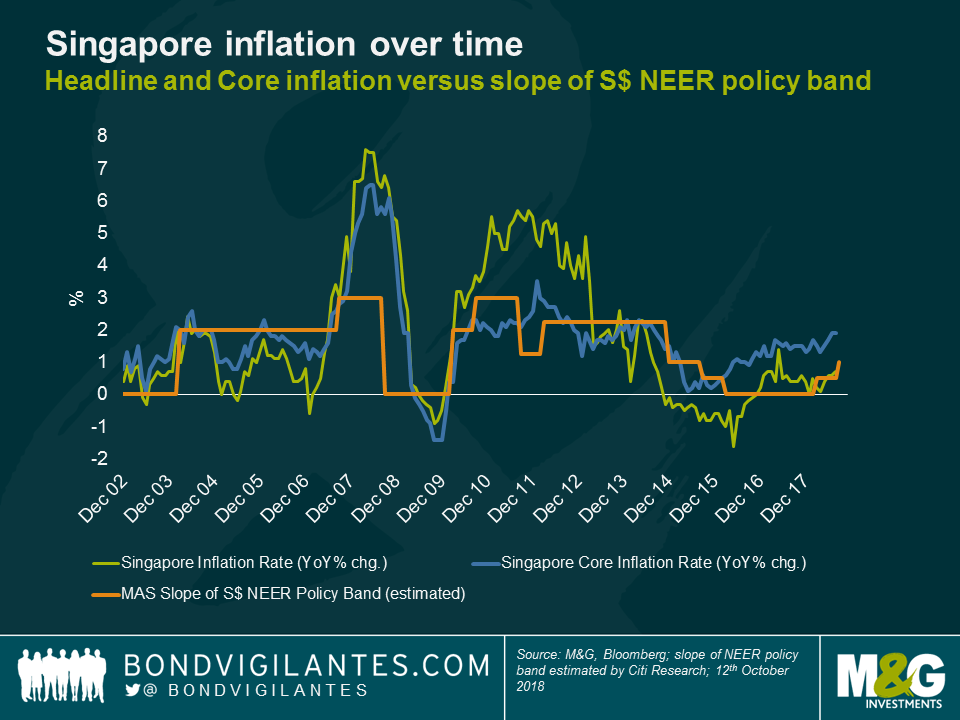

Singapore’s managed floating exchange rate system has been in place since 1981 and has a relatively good track record in providing price stability, as the chart below shows.

The chart also shows the estimated slope of the S$ NEER policy band (orange line), expressed in % appreciation of the S$ vs the trade-weighted basket per year (as estimated by Citi Research). Historically, the MAS has increased this slope when inflation breached the implicit 2% inflation target (for example in October 2007 or October 2010), and reduced it when inflation was more muted (October 2008 or January 2015). With the perspective that the chart shows, we also see that, despite this year’s hikes, monetary policy still remains broadly accommodative – the S$ NEER slope is still relatively low, probably around 1%, according to Citi Research.

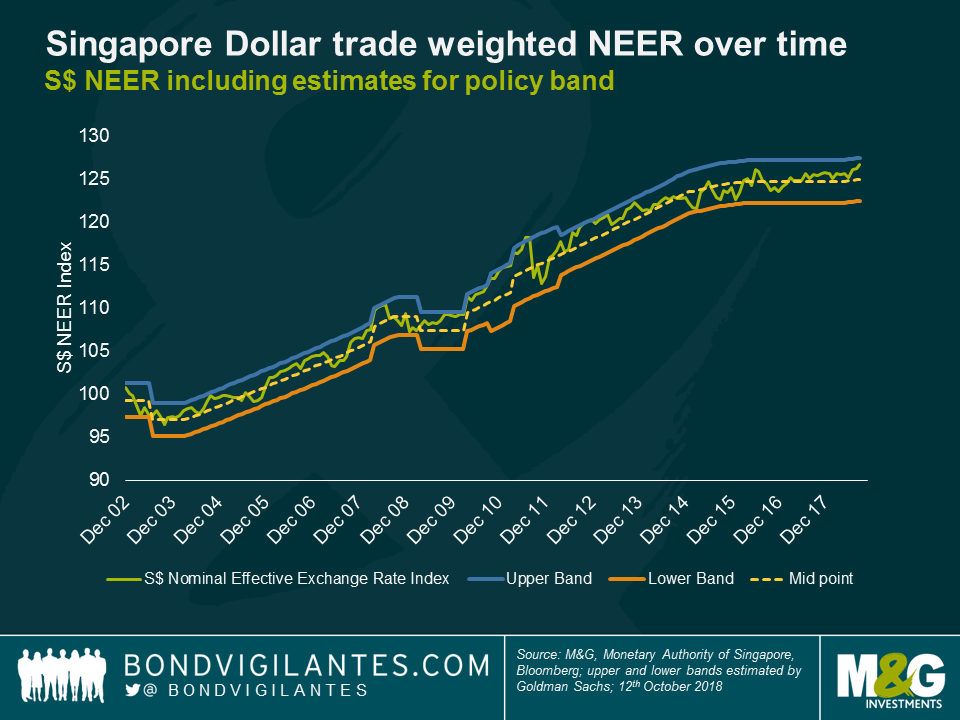

As for the currency itself, the S$ has been relatively stable against the trade-weighted basket over the past two years, although it has started to appreciate in recent months. This can be seen in the chart below, which shows the S$ trade weighted exchange rate as calculated by the MAS, as well as estimates for the policy band according to Goldman Sachs. The MAS’ objective to achieve a gradual appreciation of the S$ over time reflects the country’s strong fundamentals and high productivity growth, which help ensure stability of capital flows.

The use of the exchange rate as the main tool to adjust monetary policy implies that the MAS cedes control over domestic interest rates, which are now guided by market forces and investors’ expectations of currency movements. This corroborates a principle known as “The Impossible Trinity,” which states that a country cannot simultaneously have free movement of capital, a fixed foreign exchange rate and control of interest rates.

The chart below shows one measure of interest rates in Singapore, 3-month S$ SIBOR, vs 3-month USD LIBOR rates in the US. While there is a positive relationship between the two, this has diverged recently, with USD LIBOR now higher than S$ SIBOR. This is partially because investors now expect the S$ to appreciate relative to the USD over time and are therefore willing to accept a lower yield on the S$, on the basis that currency appreciation will make up for the yield differential. This is a concept known as uncovered interest rate parity.

Looking ahead, aside for the domestic headwinds caused by elevated house prices and an ageing population, the economic outlook remains relatively robust for Singapore. Growth is expected to slow marginally but remains above trend, and core inflation should edge up further and stabilise just above the 2% inflation target as slack in the labour market decreases. In addition, the central bank has accumulated huge amounts of foreign exchange reserves over time and Singapore’s government debt is one of the few in the world to be rated AAA by all three major rating agencies.

For this reason, owning S$ assets within a global bond portfolio could be quite beneficial over time. Should global growth continue on its upward trajectory, the S$ is likely to continue to gradually appreciate vs the currency basket, as intended by the MAS. On the other hand, should global trade tensions and geo-political risks take a significant turn for the worse, Singapore’s strong fundamentals and the MAS’s interventions should help limit the extent of the depreciation. For example, the $S comfortably outperformed the EUR and the GBP during the last global financial crisis.

¹ “Monetary Regime Choice in Singapore: Would a Taylor Rule Outperform Exchange-Rate Management?”

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox