Can Ukraine continue outperforming?

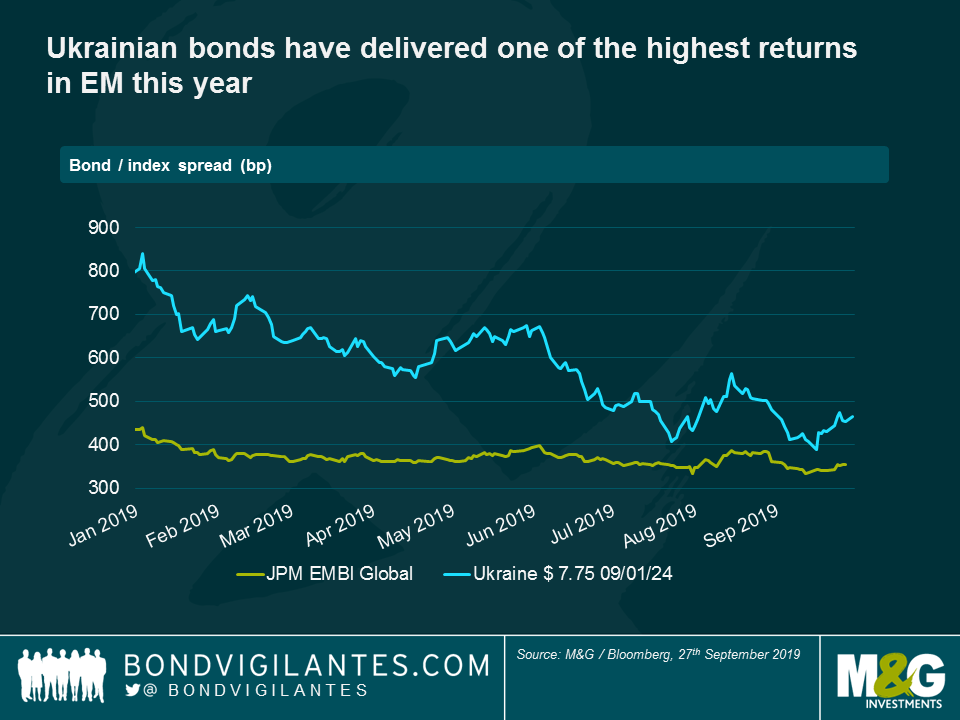

Ukrainian fixed income assets have performed better than expected this year, and delivered one of the highest returns in the emerging market universe. Since the beginning of 2019, Ukraine’s five-year USD bond spread has tightened by about 370bp, while the JP Morgan EMBI saw spread compression of just 70bp year to date. Political novice Volodymyr Zelenskiy and his Servant of the People (SP) party managed to achieve very convincing wins both in the presidential and parliamentary elections. The new market-friendly technocratic government has swiftly launched reforms and restarted negotiations with the IMF over a new financial support programme. Is the widespread market optimism warranted and likely to continue? Our view is yes, but with some important caveats.

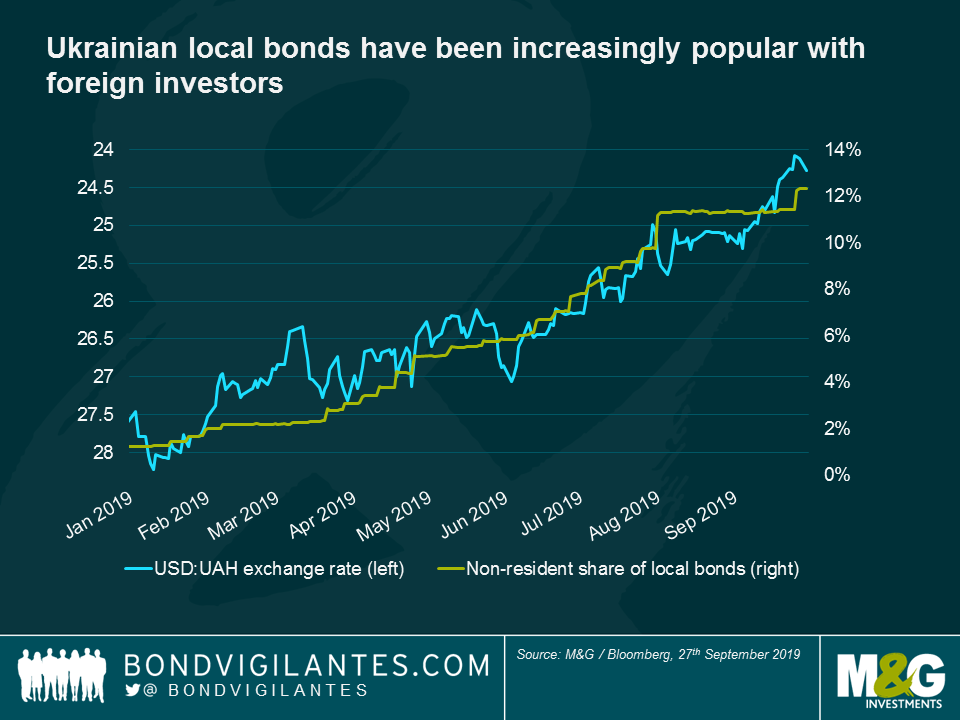

Macroeconomic indicators in Ukraine have improved significantly over the past couple of years. Tight fiscal policy has helped to contain budget deficits, allowing government debt (including guarantees) to drop to below 60% of GDP this year, down 20 percentage points from its 2016 peak. Growth has resumed, current account deficits have shrunk and international reserves have increased, while tight monetary policy has finally pushed inflation back into single digits. Foreign demand for local debt securities has been spectacular this year, boosting the share held by non-residents from 1% to 12%, and helping the UAH to appreciate by around 13% versus the USD. As stellar as this seems, there are reasons to believe there is room for further improvement.

The potential gains stemming from the implementation of various market reforms are huge. In particular, the government estimates that land reform (allowing the sale of land) alone could add as much as 3.5 percentage points per year to GDP growth and raise budget revenues starting from 2021. More conservative estimates from the private sector still point to an impact of 1-2 percentage points per year, representing a meaningful boost to the circa 3% growth the economy is currently enjoying.

Closing the judicial gap with neighbouring Poland just by half could add another 1 percentage point to growth over the next few years; there is further potential upside from a large-scale privatisation programme, new tax system and labour market reforms. Importantly, all of these reforms are not just wishful thinking with a vague implementation schedule. This was often the case previously. Now, while the new parliament and government assumed power only a month ago, the above-mentioned reforms are already being worked on actively with unprecedented speed. Indeed, the land reform bill was submitted to parliament last week.

Meanwhile, the IMF mission was in Kiev over the past couple of weeks, conducting talks with the government over a new three-year Extended Fund Facility programme of around $5-6 billion. While successful local market issuance this year has significantly reduced the urgency for Ukraine to receive the next tranche disbursement, the government understands the importance of IMF support and seems to be ready to comply with most (if not all) of the conditions attached. An agreement within the next month and a disbursement by year-end therefore remains the base case scenario. Provided an agreement is reached, other donors (including the World Bank and the EU) are also expected to contribute, increasing the total size of the external financing support to $10-12 billion.

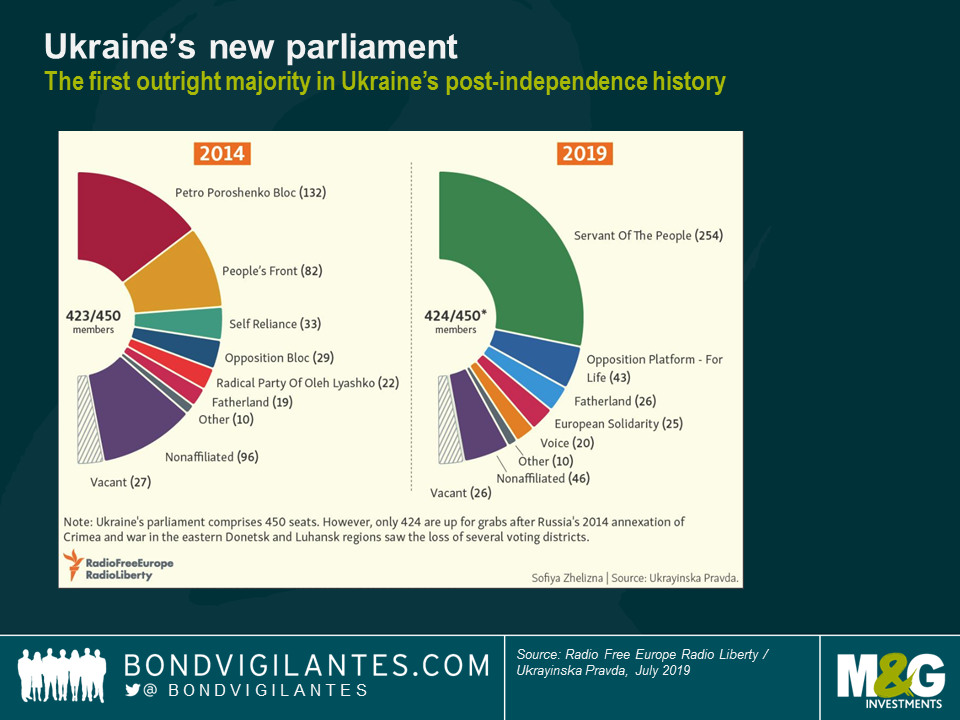

While macroeconomic risks have declined significantly, political risks are higher than they seem at first glance. In the July parliamentary elections, Zelenskiy’s Servant of the People (SP) party gained a solid majority in parliament, occupying 254 seats out of 450 in total. However, elected deputies from SP in fact represent a very diverse group of people: many joined the party only during the election campaign, and more than half (130) were elected from single-mandate districts, owing their victory almost entirely to the new president’s strong political image. The vast majority of SP deputies have no political experience, coming from all walks of life and often having differing views. Some local observers note already-emerging factions within SP that are becoming vulnerable to the influence of particular oligarchs whose interests are being undermined by bold reforms. The challenge of keeping the SP party together could increase with time: the government itself acknowledges the need to enact the most important reforms as soon as possible. More positively, a smaller, pro-reform party called Voice appears to be ready to support the government’s initiatives should the SP majority start to crumble. The problem is that Voice has only 20 deputies in parliament, so the potential for this support is rather limited.

Local analysts also note that further political risk may come from an excessive concentration of power in Zelenskiy’s team. Their full control over a largely inexperienced parliament gives the presidential administration a carte blanche to initiate all reforms and pass them rather quickly and without much debate. While such speed is commendable compared to the long delays in previous years, it can also lead to mistakes in the absence of proper checks and balances. A similar argument applies to the perceived desire to replace the majority of current civil servants in Ukraine, including judges, election commissions and potentially even central bank management. The pressure on the latter is of special concern to the IMF, for whom central bank independence is crucial to providing financial support. The unresolved case of Privatbank’s nationalisation could become another obstacle. The still-pending final court decision could do significant damage to the banking system in case the 2016 nationalisation decision is deemed unlawful. While the IMF might be willing to show flexibility regarding other issues (such as full liberalisation of the gas market by January 2020), any review of the terms of the Privatbank nationalisation could become a red line for the lender.

Regarding international politics, and on a positive note, under the new Ukrainian leadership there seems to be a higher chance of progress in resolving the ongoing conflict with Russia. One of Zelenskiy’s pre-election promises was to end the war in Eastern Ukraine, and a recent prisoners’ exchange between the two countries gives ground for some cautious optimism on this front. Though there are multiple obstacles and the full resolution of the conflict still seems far away, stability in Eastern Ukraine will be important to the government at a time of large-scale reforms.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox