High yield – reasons to be positive

There are undoubtedly reasons to worry about taking credit risk today. Central banks are tightening fast. The Fed just raised rates by 75 basis points (bps) bps as markets expected, while the Riksbank raised its policy rate by 100 bps with more on the way from the European Central Bank, Bank of England and others. Deutsche Bank points out that the ratio of global hikes to cuts over a rolling 12-month period has been as high as 25:1 recently having not being above 5:1 over the past 25 years of available good quality data. Central banks have insisted they will continue on this path until they see the whites of inflation, even if recession is the end result. Whether or not they will stay the course is a question for another blog.

Add to that war in Ukraine, a real estate crash in China, an inverted US yield curve, falling confidence indicators, substantially higher energy bills and mortgage rates plus capital markets that have been in retreat all year, along with likely overly optimistic earnings forecasts for the second half of 2022, and you can see why investors are concerned.

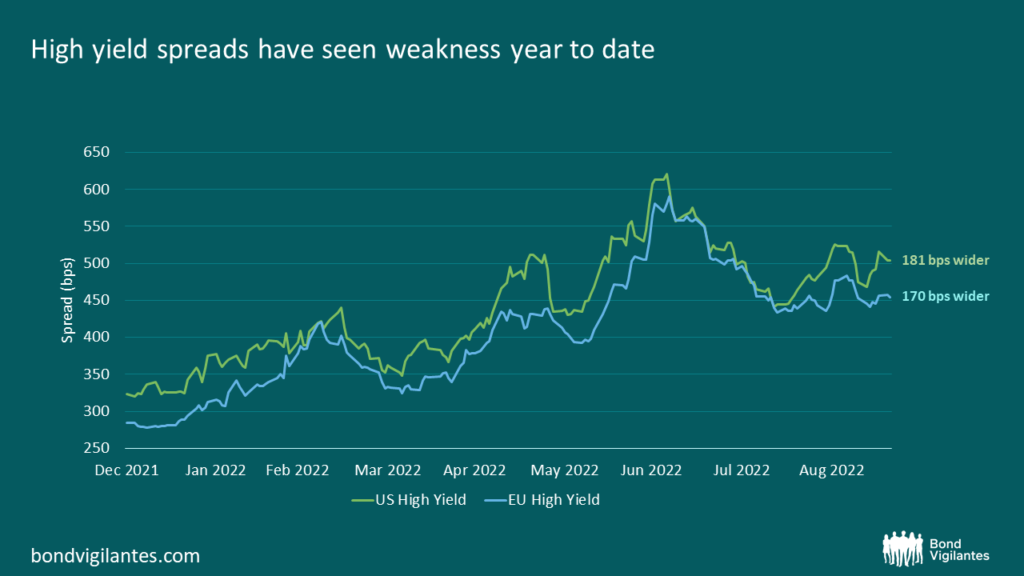

With that in mind, why are US High Yield (HY) spreads ‘only’ 181 basis points wider year to date, and Europe 170 wider? Several factors are at play.

First, it’s worth noting that the technical in the HY market remains very strong. Surveys often point to relatively defensive positioning amongst investors running high cash allocations. But this is merely the tip of the iceberg. According to data from Morgan Stanley, the US HY market shrunk by 8% in 2022. New issuance plus outflows has totalled -$96bn. Yet on the demand side, coupons, calls, tenders and upgrades to Investment Grade (IG) have totalled $246bn.

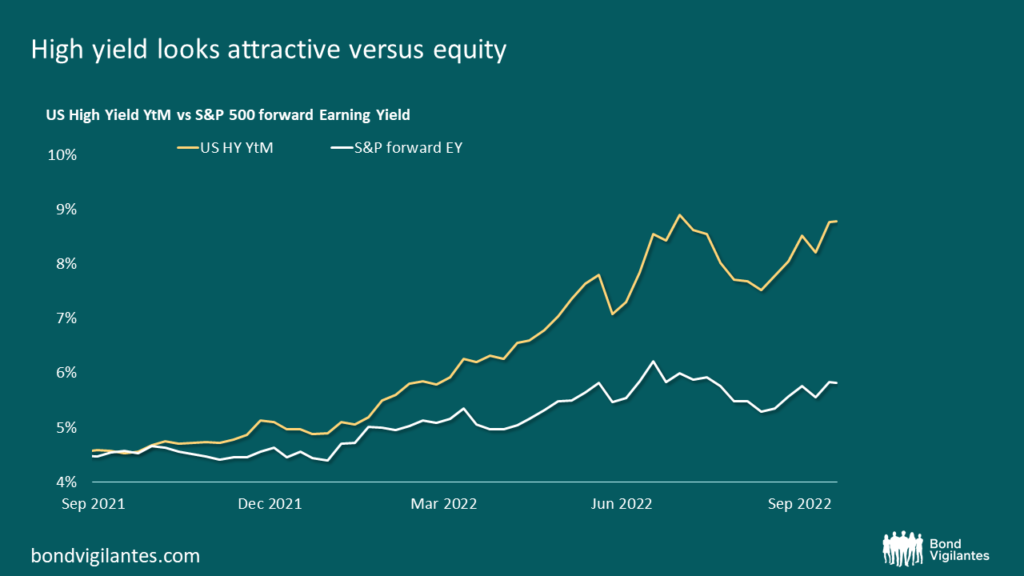

Second, whilst US HY spreads may only be in their 53rd percentile (measured over a time period since Lehman Brothers filed for bankruptcy up to today), all-in yields are in their 86th percentile. For European high yield it’s 72nd and 79th respectively. Put simply, all in yields have moved substantially higher and, at 8.8% and 7.3%, there is a lot more cushion in the price. Viewed relative to the earnings yield on the S&P 500, the yield US HY looks more attractive than it has for many years.

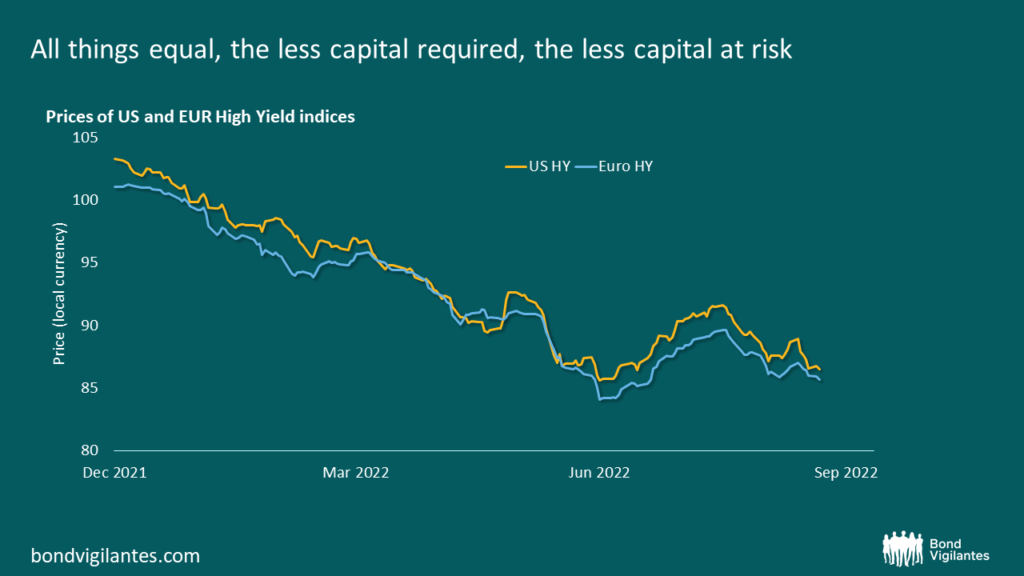

Third, the average price paid for a € HY and $ HY bonds is currently 86%. That compares to 101% and 103% at the start of the year. All things equal, the less capital required, the less capital at risk.

Fourth, and in stark contrast to the IG and leverage loan markets, the average credit quality of US HY universe has improved over time. Over the past five years, the BB–rated cohort has gone from 48% to 53%, whilst CCC risk has moved in the opposite direction. The picture isn’t as rosy for Euro HY.

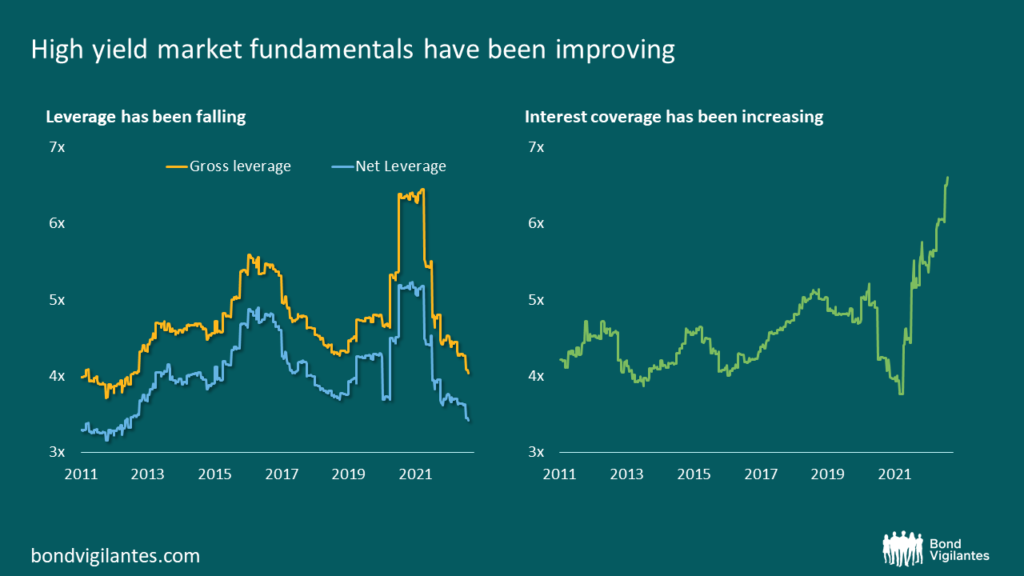

Finally, corporate fundamentals across the high yield markets currently stand in very good shape by almost any historical comparison, albeit there are signs these are beginning deteriorate.

As ever, the entry point, default rates and ultimately loss given default will be key in determining future returns for High Yield investors. We anticipate default rates will rise but ultimately peak below levels we have associated with past recessions. Risk premia may still have to rise given the challenges at a macro level but all is far from bad in the world of high yield.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.