High Yield On Course for Record Issuance in 2011. Are lenders already repeating the mistakes of 2006/7 ?

It has been almost three years since the collapse of Lehman Brothers back in September 2008. The High Yield market has staged the sort of recovery few imagined possible, with each recent month bearing further witness to increased risk taking, evidenced by falling risk premia, record issuance and ever looser lending standards. With dividend transactions (Ardagh Glass), portable cap structures (House of Fraser/Odeon) & CCC issuance (Gala) all in evidence of late, is complacency setting in amongst investors? Is the HY market repeating the mistakes of 06/07 ?

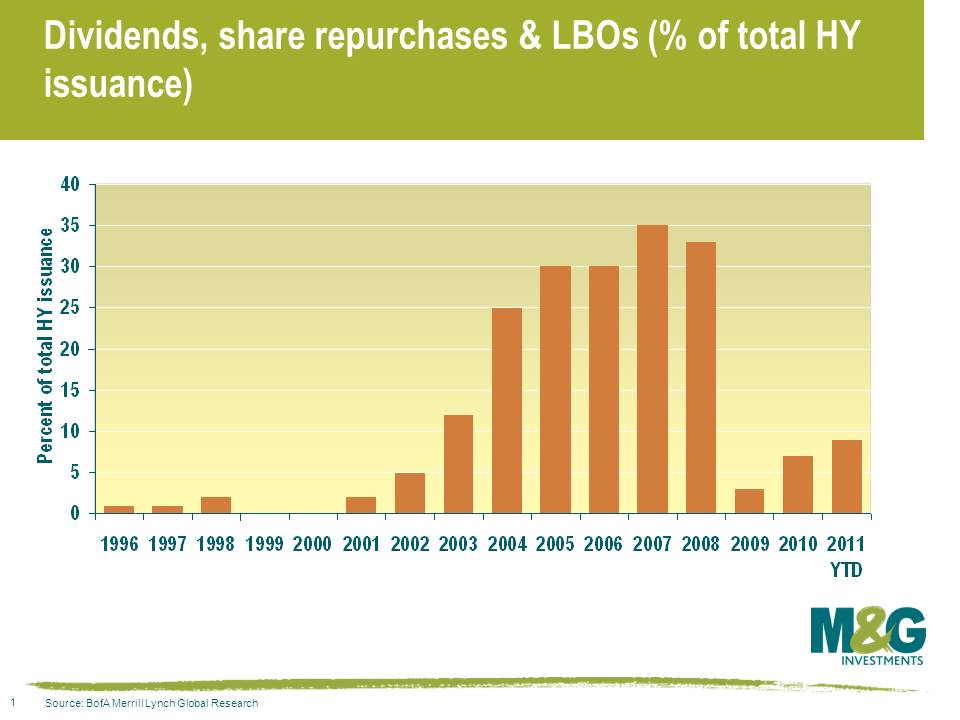

In two words; not yet. Comparisons will understandably be made between the lending practices of 2006/7 & 2011 but they currently remain fundamentally different. Consider first the use of proceeds of debt raisings. Unlike 2006-2008 the vast majority of new issuance has been to refinance existing bonds or loans rather than to finance new LBO’s. The more aggressive activity of 2005-7 – dividends, share repurchases and LBO issuance, remain at early cycle type levels (see chart 1). New issuance in EHY has been predominantly focussed on refinancing leverage loan debt rather than underwriting the sort of mega LBOs witnessed pre Lehman.

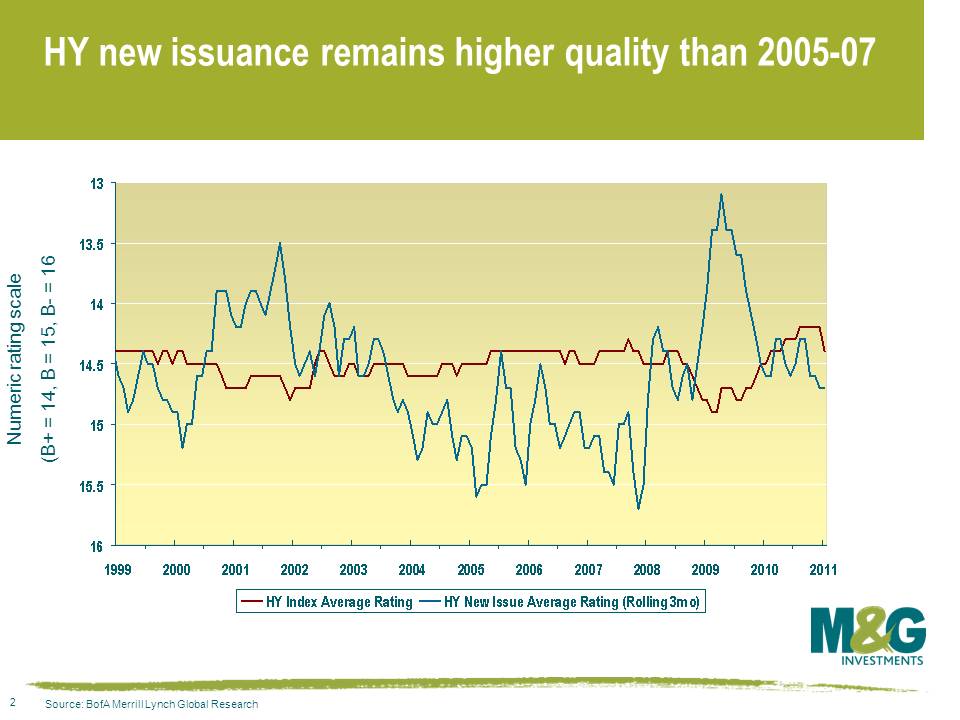

Credit ratings and leverage are other ways of comparing the two time periods. Whilst the market has indeed been willing to countenance lower ratings of late, CCC rated paper accounts for approximately 10% of issuance by volume against 16% in 2006. Despite the credit quality of new issues trending lower of late, it is still some way off of the quality seen in 2005-2007. (see chart 2) Leverage, or the amount of debt relative to earnings (net debt/ebitda), also suggests that current lending standards remain early/mid cycle like. According to Morgan Stanley, 1Q11 new issues saw leverage of around 4.6x, considerably lower than the 6x multiples of 2007. And finally, perhaps the biggest difference worth noting is the amount of senior secured paper being issued. Whilst 2006 saw €2.5bn of secured issuance, some 12% of the year’s total, Euro high yield has already surpassed €12bn so far this year, which is almost 38% of total issuance.

Talk of bubbles in high yield appears premature and the market is still some way off the heady pre Lehman days. That said, the on-going demand for yield may continue to pressure investors to take ever more risk, with issuers and sponsors looking on keenly. A pull back in risk appetite may yet prove healthy. Vigilance remains as relevant as it ever has.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox