25 Years of the £2 Coin

15th June marked the 25th anniversary of the £2 coin entering into circulation in the UK. The history of the £2 coin goes back just over a decade more. There were commemorative £2 coins struck for the 1986 Commonwealth Games hosted in Edinburgh – the first sporting event to be commemorated on a coin in the UK. More commemorative coins followed in 1989, 1994, 1995 and 1996; celebrating the 300th anniversary of the Bill of Rights and Claim of Right (Scotland), 300th anniversary of the Bank of England, 50 years since the end of World War II, 50th anniversary of the founding of the United Nations and England hosting the tenth European Football Championship respectively. The coin was due to be launched in November 1997 but, as a result of delays, it entered circulation on 15th June 1998.

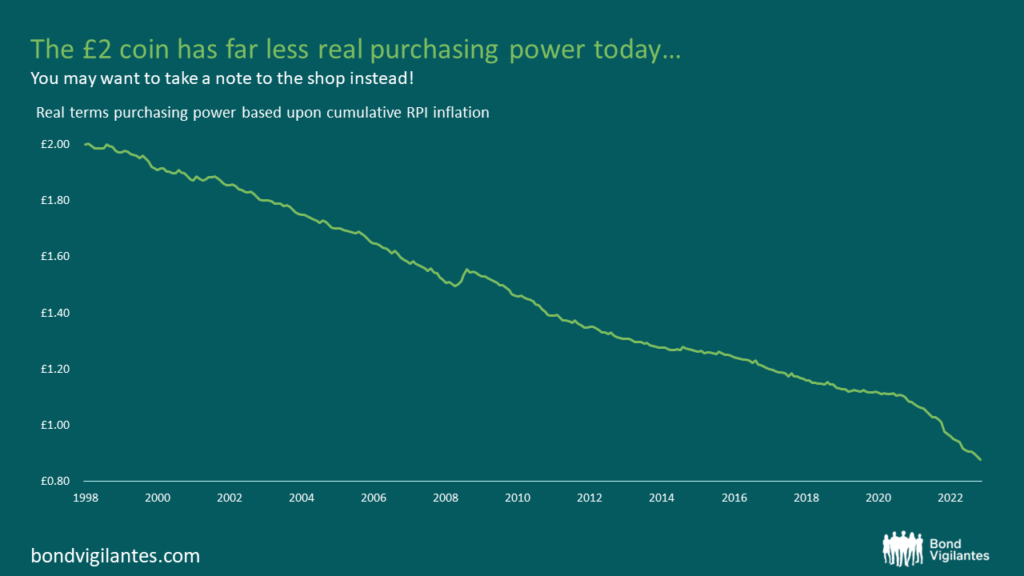

If you had kept your shiny new £2 coin in your pocket since 15th June 1998, your shopping basket would have less in it today than it would have done on day 1. That £2 coin would be worth the equivalent of a bit less than 90p in real terms today, reflecting a cumulative (RPI) inflation rate of around 125%. Based on cumulative CPI inflation, it would be worth about £1.07.

Source: Bloomberg, M&G (May 2023)

If you were to invest your £2 coin, different assets would have performed very differently over the past 25 years. When discussing long term asset performance, most investors will point to the US equity market. This has experienced extraordinary returns, but driven primarily by a few technology companies. But what if we look at the rest of the equity market? The below chart shows the total return of world equities (ex US) versus a series of bond indices. For those willing to take on credit risk, corporate bonds have outperformed equity for most of the period. However, once into the territory of high yield debt, bonds have blown away equities and given a significantly better total return. A compelling picture of the extent to which bonds can provide growth in a portfolio.

Source: Bloomberg (May 2023)

In terms of performance against other currencies, you wouldn’t be able to buy as much in the US today if you exchange your £2 for dollars. The pound has weakened in the last 25 years against the dollar, as the USD sealed its place as the global reserve currency and the power of the pound waned in global significance. You would have $3.27 to spend 25 years ago if you exchanged your two-pound coin, but only $2.54 to play with if you exchanged it today. Post Global Financial Crisis, GBP has not truly recovered, and post-Brexit has struggled to assert its importance again. This has translated through to Sterling bond issuance, where levels have been on one trajectory, and that is down.

Source: Bloomberg (May 2023)

The story for the £2 coin has been one of declining value and waning global influence. But it’s not all doom and gloom. As we have shown, despite living through a global financial crisis, a pandemic and much much more, our little £2 coin can have grown into an investment with healthy returns. Fixed income investments have provided capital protection and capital growth. However with inflation running high, beware the dangers of leaving your coins in your pocket – there might not be as much left as you thought!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.