The Era of Swiftonomics: is the Bank of England ‘Ready for It’?

Taylor Swift’s record-breaking Eras Tour has become a global economic juggernaut, redefining the economic impact of entertainment on an international scale. As she concluded her eighth electrifying night at Wembley Stadium (thrilled to say I was there for the eighth night; Jim was there on Friday – yes, Jim Leaviss is a Swiftie), her influence has become undeniable. Extending beyond the realm of pop culture, Swift’s tour is generating billions in GDP, potentially influencing monetary policy decisions and presenting a unique challenge to policymakers.

Welcome to the world of Swiftonomics – a defining feature of 2024’s economic landscape, where a global superstar’s cultural clout has real economic consequences.

The Global Experience: “Bigger Than the Whole Sky”

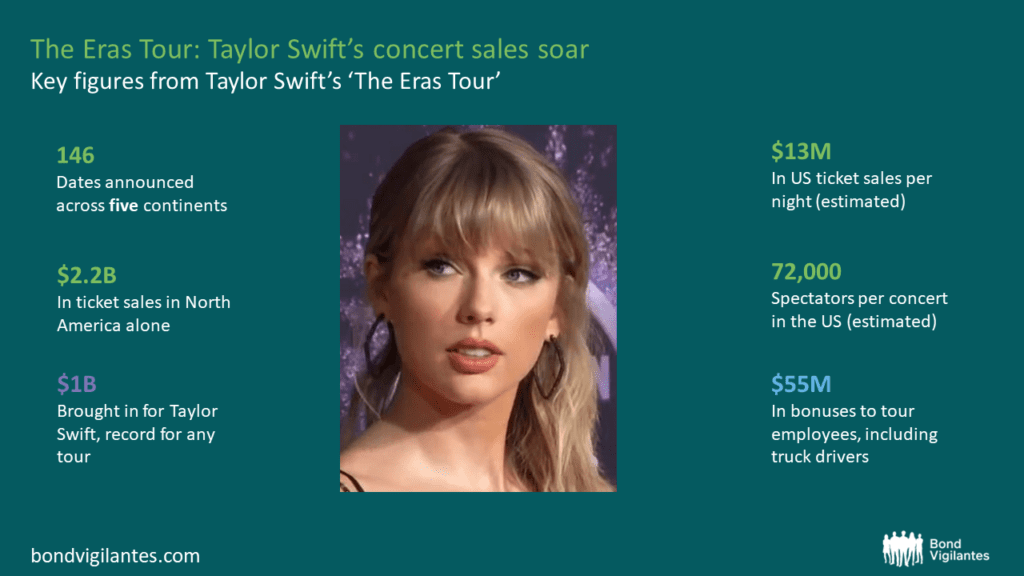

In recent years, high-profile tours have undeniably contributed to GDP growth. Last year alone, Beyoncé’s ‘Renaissance Tour’ and Harry Styles’ ‘Love on Tour’ injected significant capital into local economies. But Taylor Swift’s Eras Tour is operating on a different scale altogether, both in terms of sheer economic impact and cultural relevance. Beyond the ticket sales, the merchandise, and the travel expenses, her influence spans across fashion, politics, and even social issues, making her tour a multi-faceted event that impacts various sectors of the economy in unique ways.

Image source: Wikipedia, Cosmopolitan UK. Green figures: Statista research (as of Oct 10, 2023), Purple: Yahoo Finance (as of July 2023), Blue: Inc (as of August 2023)

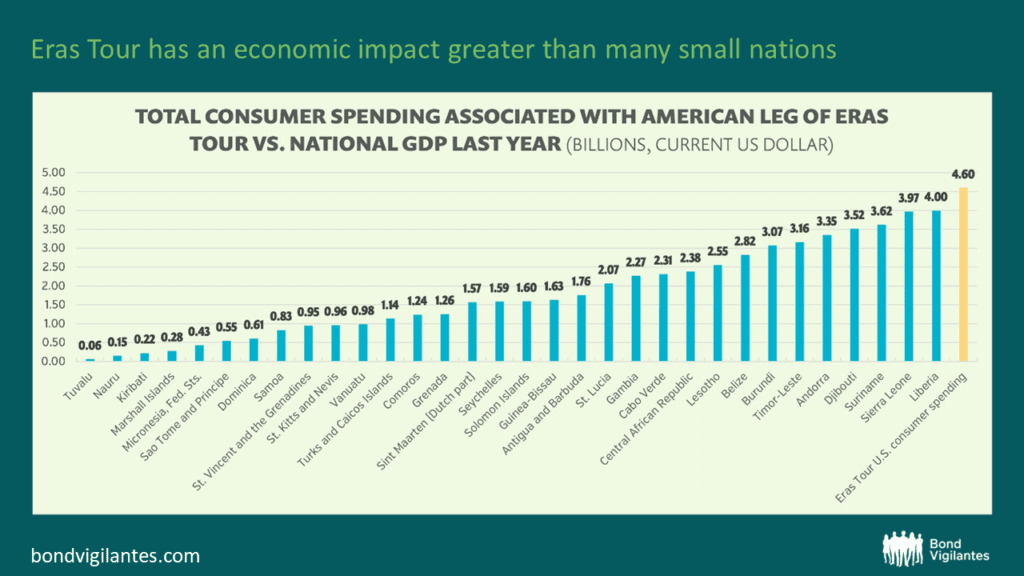

The numbers speak for themselves – in the US, the tour generated a staggering $4.6 billion in consumer spending. To put that into perspective, that’s larger than the GDP of many small nations. Remember, Swift is also the first artist to achieve billionaire status solely on the basis of her music and tours (others are billionaires, but largely from beauty brands, fashion lines, and other investments, e.g. Rihanna and Fenty Beauty).

Source: Eras Tour spending projection by QuestionPro, correct as at June 2023

In continental Europe, Swifties have driven a 45% year-over-year increase in airfare sales to destinations like Milan and Munich during concert dates (according to United Airlines Holdings Inc.). Her fans are spending “All Too Well” – when the tour landed in Paris, top-tier hotels benefited from larger booking spikes than when the Olympics came to town (according to Bloomberg). The Shangri-La Paris saw a 120% increase in bookings over Swift’s May tour dates, with such high demand from luxury travellers that the hotel launched a Concert Concierge in response.

A “Gold Rush” for the UK Economy

While the full scale of the impact in the UK is still being analysed, estimates expect the UK leg of the tour could generate an additional £1billion in GDP (from Barclays). The eight-night run at Wembley is unprecedented – and marks her as the first artist to ever perform there eight times in the same tour. She also sold out three stadium shows in Edinburgh, three in Liverpool, and one in Cardiff – some quick maths indicates the UK shows will have had around 1.2 million attendees in total.

Taylor performed her first ten UK concerts in June (three of these were at Wembley), and subsequently, the June inflation (CPI) data revealed continued resilience in the services sector. At 5.7% year-on-year this was 0.6% above the Bank of England’s Monetary Policy Committee’s (MPC) May monetary policy forecast (MPR) and the upward surprise was largely attributed to hotel prices. Hotels in London reported record occupancy rates during both Wembley runs, and Collinson data shows that 77% of travellers arrive one or two days before a concert, and around 80% will stay one to three days after.

Undoubtedly, the influx of spending in specific sectors from Swift’s tour – hospitality, retail, transportation – can lead to localised price increases, job creation, wage increases and multiplier effects on other areas of the economy.

Can the Bank of England “Shake it Off”?

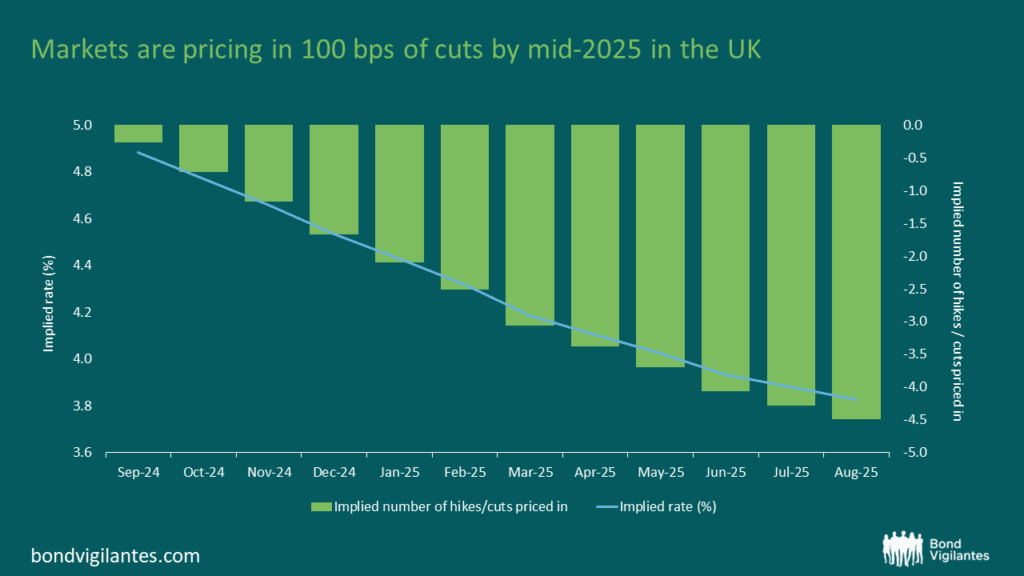

After a sustained period of sticky inflation, expansionary fiscal measures and high interest rates, the rhetoric is starting to change. Central banks are beginning to respond to weakening economic momentum with likely rate-cutting cycles, with subdued inflation figures and downside surprises in labour market data having taken hold of bond markets over summer.

At present, markets are pricing in around 100 basis points (bps) of cuts by mid-2025 in the UK, compared to around 80bps in June (in the US this change in narrative is even more stark, with around 100bps of cuts being priced by the end of this year, compared to less than 50bps in June).

Source: Bloomberg, August 2024

Of course, if the tour’s impact leads to stronger-than-expected GDP growth, or if it further entrenches inflation, the pivot away from monetary tightening and to looser policy may be premature. Bond yields have already seen plenty of volatility as investors oscillate between expectations of new-regime-inflation and fears of recession. Whilst a temporary boost to growth could help with the latter (cue more headlines on ‘soft landings’), added layers of unpredictability brought on by events like the Eras Tour only complicate the BOE’s job of balancing supporting growth and taming inflation.

With the UK (among other key economies) grappling with increasingly high debt-levels post-pandemic, fiscal policy has come back into focus. While the impact of Swift’s tour might seem minor in the grand scheme of things, any delay in rate cuts due to unexpected consequences on the economy therefore could delay the expectation of lower government borrowing costs. Continued higher yields potentially force a recalibration of fiscal policy, even possibly leading to elevated bond supply as the government seeks to finance its deficit at higher costs (maybe we could call these “Betty” bonds).

The bond market is essentially looking for a “Love Story” between fiscal prudence and monetary policy, and any mismatch – like a surprise growth boost from the Eras Tour – could disrupt that equilibrium.

Taylor’s Influence: More Than Just Economic?

Swift’s influence doesn’t stop at economics. In recent years, she’s become more politically engaged, taking public stances on social issues and even endorsing political candidates. During the 2020 U.S. presidential election, Swift was vocal in her support for Joe Biden, leading some Republicans to accuse her of “conspiring” with the Democrats. As the U.S. gears up for the 2024 presidential election, it’s worth considering whether Swift’s tour – and her influence over millions of fans – could sway political outcomes.

With voter turnout being a key determinant in elections, Swift’s ability to mobilise her enormous fanbase, particularly younger voters, may prove critical. While her primary impact may be economic, her sway over public opinion is not to be underestimated. Now Donald Trump has used social media to share AI-generated images of Taylor endorsing him, he may have inadvertently forced her hand to publicly engage in November’s election.

Conclusion: “The Man” vs. Swiftonomics

Taylor Swift’s Eras Tour is rewriting the rules of economic impact, pushing the boundaries of what a single artist can achieve. As the UK experiences its own version of Swiftonomics, policymakers and economists must grapple with the consequences of this unexpected growth driver. The BOE faces a “Delicate” challenge – how to manage inflationary pressures while fostering long-term economic stability in the face of such unprecedented consumer activity.

The next few months (crucially August data) will reveal just how much of an impact Swiftonomics has had on the UK economy. Will it create new headwinds for the BOE’s monetary policy path, or will it be a fleeting phenomenon that provides temporary relief? One thing is certain: Taylor Swift isn’t just performing in the UK—she’s reshaping its economic narrative, leaving central bankers, bond investors, and policymakers to wonder, “Are You Ready for It?”

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.