A tale of two countries

A few days ago, Bulgaria finally reached an agreement with Austria, removing the last hurdle that blocked its entry to the Schengen area. The EU council is now expected to approve the country joining the passport-free travel area in early December. This clearly represents a milestone in Bulgaria’s integration process into the EU and should help cross-border trade and investment. Meanwhile, a much more impactful achievement for the country’s economy – joining the euro area – remains elusive at the moment. Back in July 2020, Bulgaria and Croatia joined the ERM II mechanism, marking an important formal step towards euro adoption. Since then, the seemingly similar economic fates of the two countries have diverged significantly.

In Croatia, the authorities were determined to join the euro area as soon as possible. After the minimum required two-year period in the ERM II mechanism, the European Commission assessed in its June 2022 convergence report that Croatia fulfilled all the required criteria, allowing the country to adopt the euro in January 2023. At the same time, Croatia also joined the Schengen area. Somewhat surprisingly, political stability proved to be the crucial element in the process. The Croatian Democratic Union has ruled the country since 2016, winning three consecutive parliamentary elections, with prime minister Plenkovic becoming the longest-serving prime minister in Croatia’s history. This stability allowed the authorities to consistently push through the necessary legislation and ensure continuous cooperation with the EU institutions.

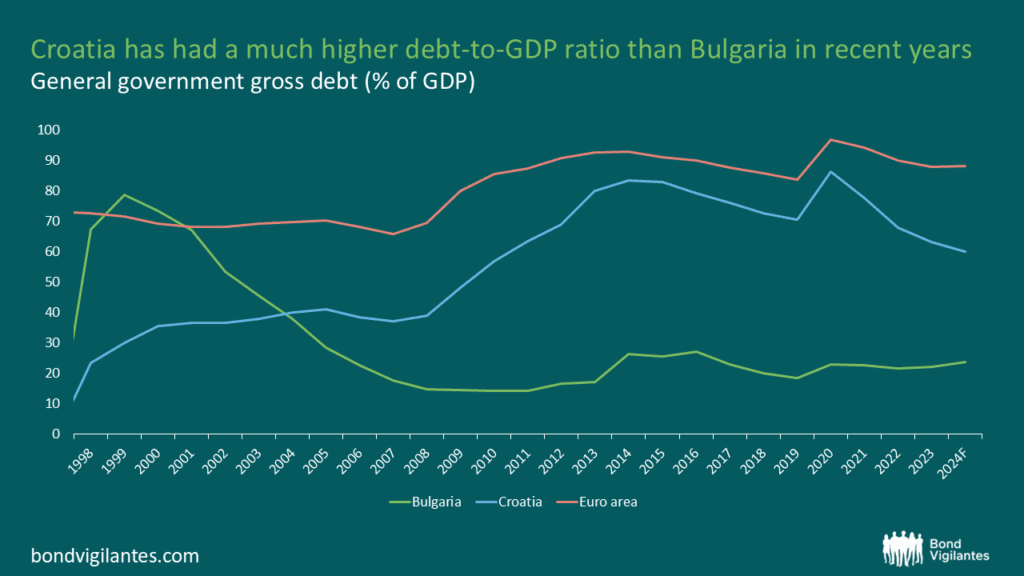

Consequently, the European Commission and the European Central Bank (ECB) were ready to somewhat soften their usually firm stance with regards to meeting the stringent requirements for euro adoption. In particular, the inflation criterion was deemed to be met despite the fact that Croatia’s inflation was likely to exceed the reference rate due to the global commodity price shock in 2022. Furthermore, the sizeable decline in public debt was deemed sufficient to outweigh the fact that it still significantly exceeded the 60% of GDP threshold at the time of the European Commission’s assessment. In the end, the EU institutions had full confidence that Croatia would meet the criteria anyway due to the government’s unwavering commitment to solid policies, so delaying euro adoption was not deemed necessary. And Croatia did deliver – current inflation is roughly equal to the euro area’s average, while public debt is expected to finally decline below 60% of GDP this year.

Source: IMF, M&G (December 2024)

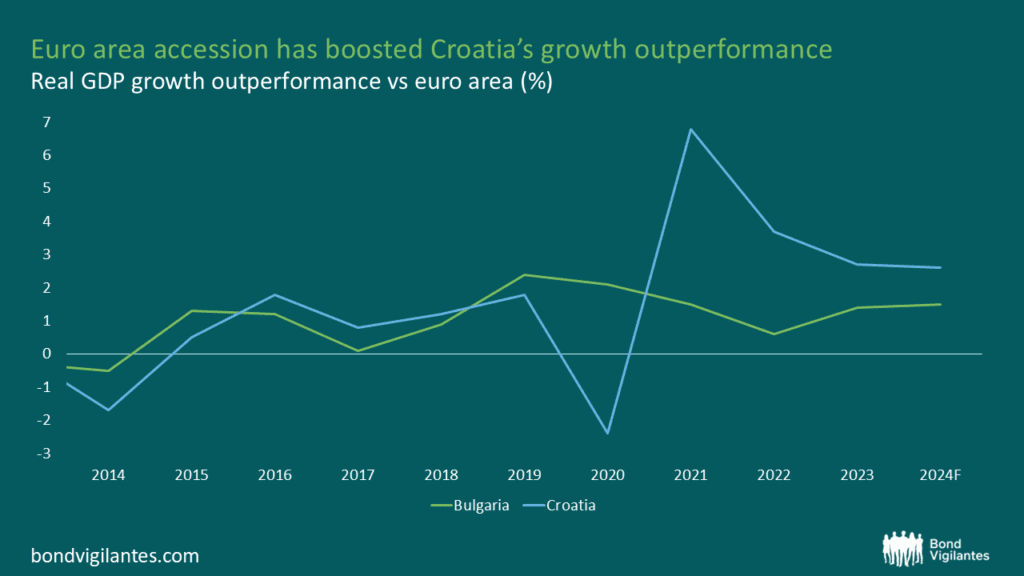

Almost two years later, it is clear that adopting the euro has delivered significant benefits to Croatia. To start with, it has eliminated the foreign exchange risk in the economy, as significant euro-denominated government and private sector liabilities were ‘converted’ to local currency overnight. Euro adoption has also boosted trade, investment, and particularly tourism, which represents at least 20% of Croatia’s GDP. Since Croatia joined the EU in 2013, its real GDP growth was only slightly outperforming the euro area average. However, in the last three years, the outperformance has widened to 3 percentage points. This has allowed the country to accelerate its income convergence with more advanced euro area peers. Croatia’s GDP per capita (PPP) is expected to reach 78% of EU’s average this year, up from 71% in 2021.

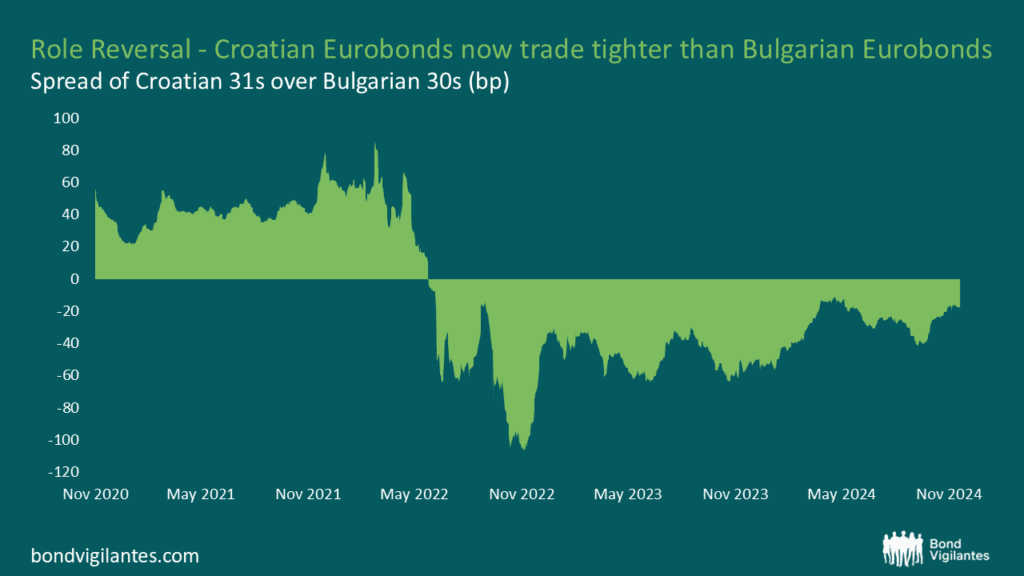

Most importantly, euro area adoption has greatly reduced Croatia’s cost of financing. The speed of the country’s credit rating upgrades has been quite remarkable, perhaps even unprecedented in recent history – less than three years ago, Croatia wasn’t even a full investment grade-rated country with a Ba1 rating from Moody’s. Meanwhile, this autumn’s upgrades allowed the country to join an elite club of about a dozen other emerging market economies that are A-rated by all three main rating agencies. In line with this, the spread of Croatian government bonds over German government bonds has tightened from about 150bp in late 2021 to about 70-80bp now.

Croatia’s success story only highlights Bulgaria’s lack of progress in the past few years. As a reminder, both countries joined the ERM II mechanism at the same time, making January 2023 the earliest possible date for euro adoption for Bulgaria as well. Almost two years later, there is still no scheduled date for this to happen. The delay looks even longer considering the fact that Bulgaria joined the EU in 2007 – if it had managed to match Croatia’s speed of progress, it could have adopted the euro back in 2017.

Source: IMF, M&G (December 2024)

At first glance, the lack of progress looks even more surprising given that Bulgaria has never had a problem with meeting the (arguably most important) fiscal criteria for joining the euro area. In the past decade, budget deficits were consistently around 3% of GDP or below, even in 2020 when for most countries they skyrocketed due to the COVID pandemic. Due to robust budget policies Bulgaria has enjoyed one of the lowest public debt levels in Europe – during the past twenty years, it has never exceeded 30% of GDP. This is in stark contrast with Croatia’s somewhat volatile public debt path, which peaked at 86% of GDP in 2020. On the monetary policy front, Bulgaria has had a fixed exchange to the euro (and previously Deutsche Mark) since 1997, meaning it could have potentially joined the ERM II mechanism much earlier than 2020. Inflation has not been a problem either, staying below 3% (annual average) in the past decade apart from the 2022-23 global commodity price shock.

With economic criteria comfortably met, the reasons for long delays to the euro adoption lie in political and governance issues. According to the Worldwide Governance Indicators, Bulgaria has consistently scored well below Croatia (and most other EU members) in the past decade. In fact, its score notably deteriorated since 2019 due to weaker government effectiveness, regulatory quality and political stability. Since 2021, the country has been subject to a multi-year election cycle, with seven parliamentary elections happening in less than four years. The reason is that none of the elections has been able to produce a stable government due to a high degree of political polarisation, with coalitions between different parties proving to be short-lived. Needless to say, passing the necessary legislation required for the euro adoption and improving the country’s institutions has been slow in such circumstances. The latest election in October has so far failed to break the negative trend, with the largest party winning less than 30% of parliamentary seats and other parties not willing to cooperate with it or each other. This has already raised the likelihood of yet another election next spring.

Source: Bloomberg, M&G (December 2024)

According to the European Commission’s June convergence report, Bulgaria has met all euro adoption criteria except for inflation. However, inflation was temporarily high only due to a global commodity price shock and has in fact already declined below the euro area average in recent months (the European Commission’s assessment takes into account the average inflation in the past year). As Croatia’s example shows, perhaps the inflation criterion could have been softened by the EU institutions – if there had been a stable government to negotiate with. Unsurprisingly, the delay in euro adoption has been costly for the Bulgarian economy, which has witnessed lower real GDP growth and slower income convergence with the EU compared to Croatia.

Back in 2020, Bulgaria was rated higher than Croatia by all three main rating agencies – now it is rated one to two notches lower, having not seen any upgrades since 2020. The most vivid illustration is the relative yields of the two countries – in late 2021, Bulgaria was trading about 60bp tighter than Croatia; now it is trading 20bp wider. A January 2026 euro adoption target is still within reach for Bulgaria, but for that to be achieved, the political parties perhaps need to put their country’s interests first.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.