The Modern American Dream?

Popularised after the Second World War, the idea of the American Dream has long centred around the idea that anyone, from any background in the United States, can achieve prosperity and success. For nearly 75 years, this idea has often been symbolically represented by a middle-class family with two dogs, two kids, an American-made car and a suburban home with a white picket fence. While the “Modern American Dream” continues to include pets and children (increasingly more pets than children) and an automobile (now more evenly split between American pickup trucks, electric vehicles, and various international brands), one piece of this dream is becoming increasingly unattainable for the average American: owning a home.

Supply/demand imbalances of housing stock in the US, exacerbated by an ageing population clinging to homes that they either own outright or with extremely low mortgage rates, combined with a large pullback from developers following the 2008 financial crisis, continue to ripple through the economy and the fixed income universe in unexpected and meaningful ways.

Where are we today?

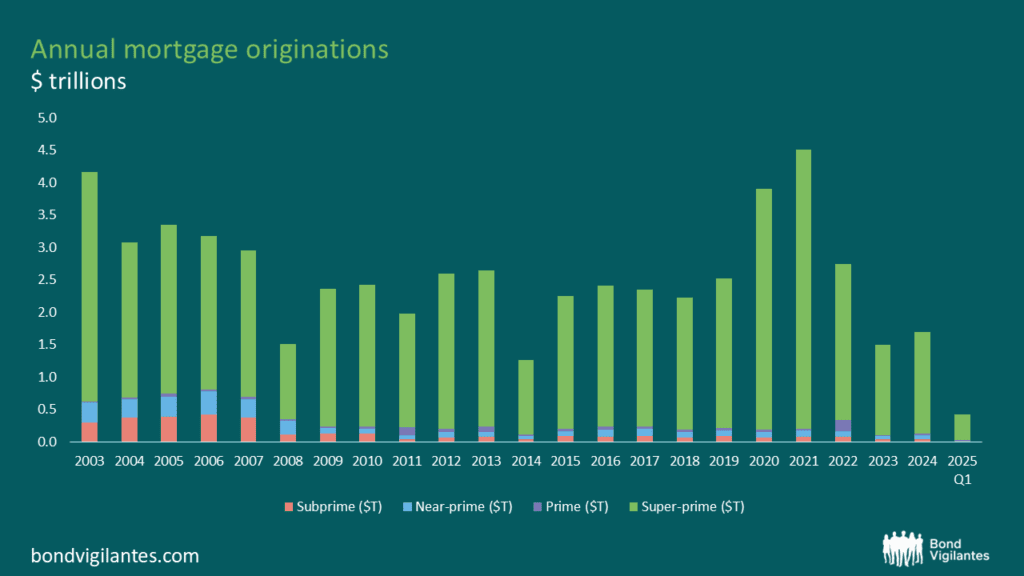

Activity in the US housing market has ground to a halt, as older homeowners who have locked in low interest rates, or have paid off their homes altogether, are choosing to hold tight to significant amounts of housing inventory. Originations of mortgages in the US (which include new financing and refinancing) could hit two-decade lows, with the majority of transactions among the highest income (highest credit score) borrowers.

Source: LendingTree (31 March 2025)

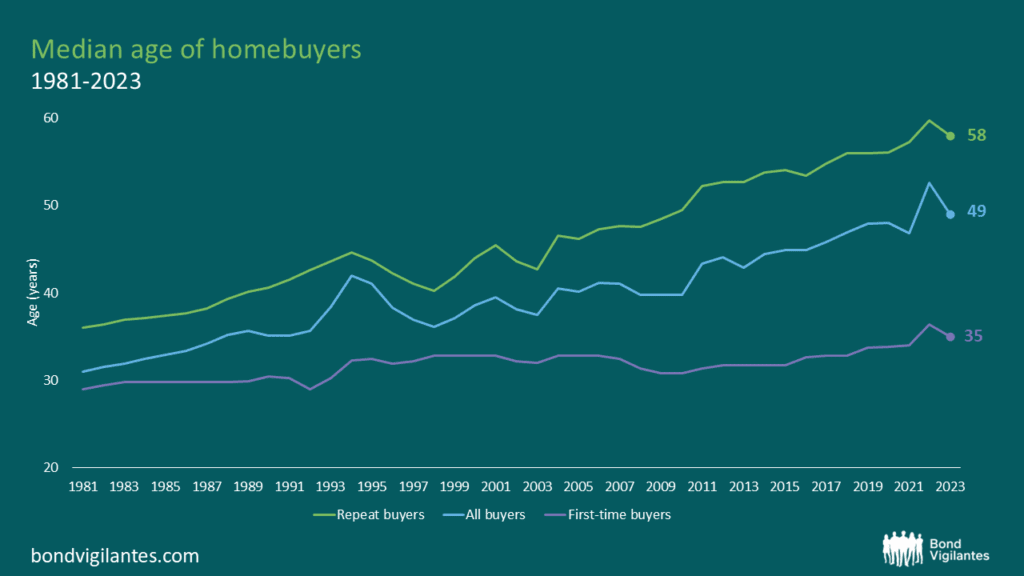

The median age of both first-time and repeat homebuyers continues to rise, as the combination of an undersupply of homes (both new and existing) and higher mortgage rates continues to keep younger buyers on the sidelines, with wages unable to keep up with parabolic increases in homeownership costs.

Source: National Association of Realtors (data to 2023)

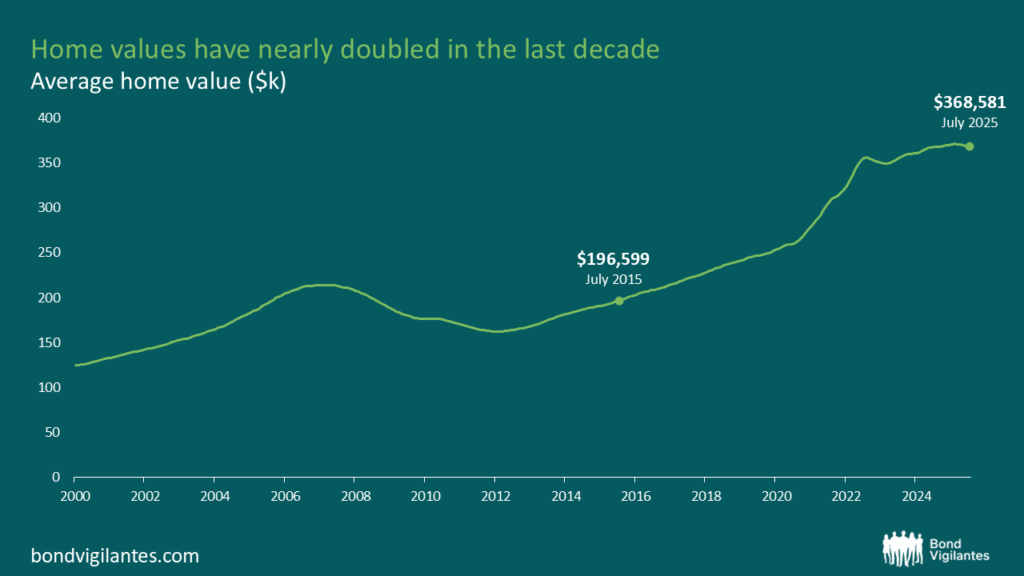

Source: Zillow Home Value Index, July 2025

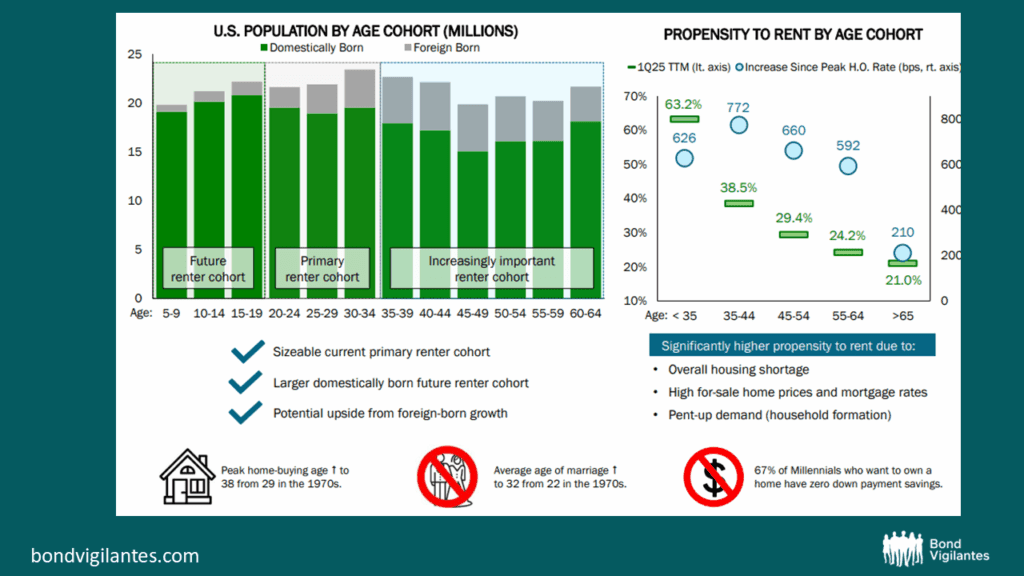

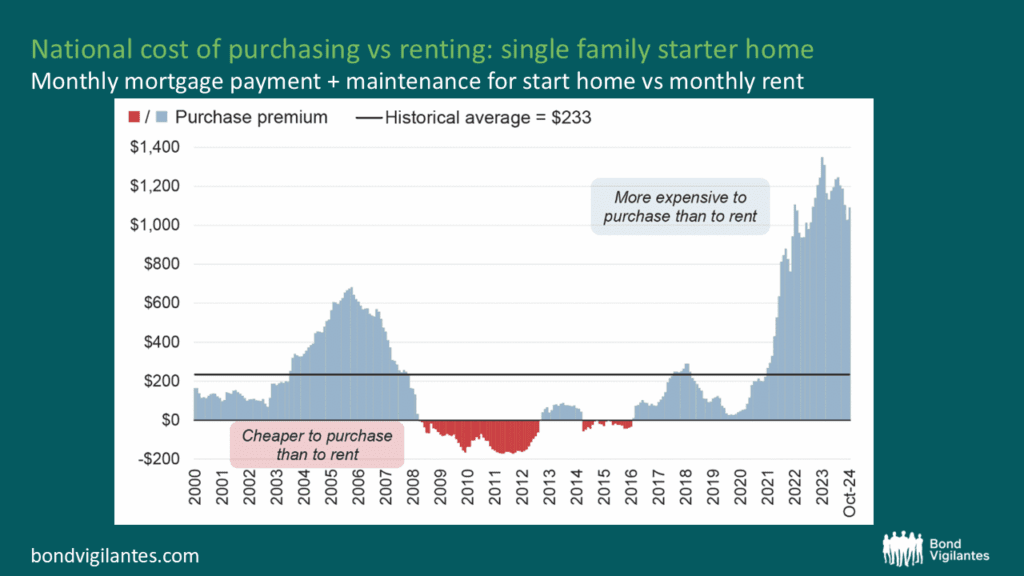

Additionally, despite meaningful increases in rents nationally during COVID, it is still significantly more expensive to own a home than rent in almost all US markets. Some question if current trends point to a potential psychological shift among US consumers, with homebuying seen as unattainable and many likely to become “forever renters”.

Source: UDR May 2025 investor presentation

Source: John Burns Research and Consulting (Data; Oct 2024, Published Dec 2024)

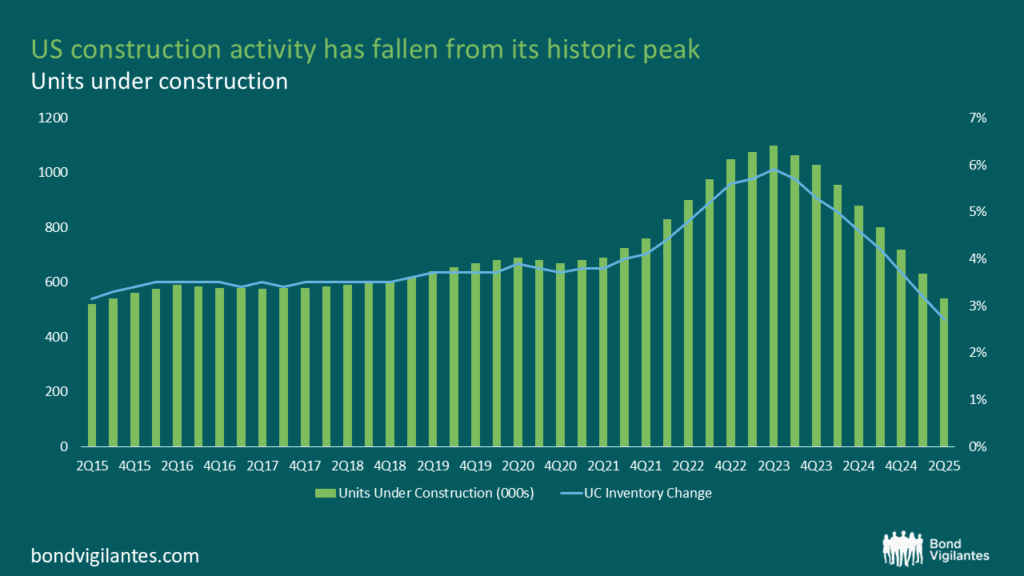

And finally, it appears that desperately needed construction of new apartment complexes is grinding to a halt, as higher interest rates, regulatory burdens, natural disasters, and various other factors discourage development of larger-scale projects, which could further constrain national housing supply.

Source: RealPage Market Analytics

Where do we go from here?

While the current macroeconomic cross-currents are difficult to navigate, and the path of future Fed policy remains uncertain, it is difficult to find a sector that isn’t influenced by the current activity levels and trends seen in the US housing market. Direct impacts to sectors like building materials, consumer-facing industrials, homebuilders, mortgage lenders, and REITs are felt rapidly, but more subtle effects can ripple across the market. The US consumer increasingly stretches their budget on rents and mortgage payments and looks for “value plays” in other areas of daily life (vacations, groceries, cars, clothes, services, etc.).

Perhaps most importantly, housing represents over 30% of the Consumer Price Index (CPI) which is arguably the single largest factor in guiding Fed monetary policy decisions. This certainly affects every asset class and company in the world. For active investors, having a view on US housing and the subsequent knock-on effects across sectors and companies can make a significant impact. This is especially true when credit spreads over Treasuries are near all-time tights. While uncertainty and volatility appear here to stay, monitoring the trajectory of the “Modern American Dream” will be key to forward-looking fundamentals and valuations globally.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.