The debt reduction playbook: Can today’s governments learn from the past?

Government debt levels continue to linger in uncomfortable territory across developed markets, with fiscal deficits stubbornly high despite reasonably resilient growth and employment – especially when compared to past norms. This is not a post-crisis or post-war moment, yet debt levels resemble those of an economy fighting its way out of recession.

Runaway levels of debt, and the question of how they can be contained, could well be the defining macro story of the next decade. This not only has implications for public finances, but also the trajectory of yields, inflation, and the credibility of future policy.

High debt is not new, with history being full of examples of governments facing daunting fiscal positions, and each era has found its own way out: sometimes through discipline, sometimes through inflation, and sometimes through quiet financial engineering. Earlier this year, Rob Burrows explored options for dealing with debt in this blog. Following on from that, below I explore if there are any useful lessons in history which could provide a solution for today’s backdrop.

- Financial repression: The silent partner in debt reduction

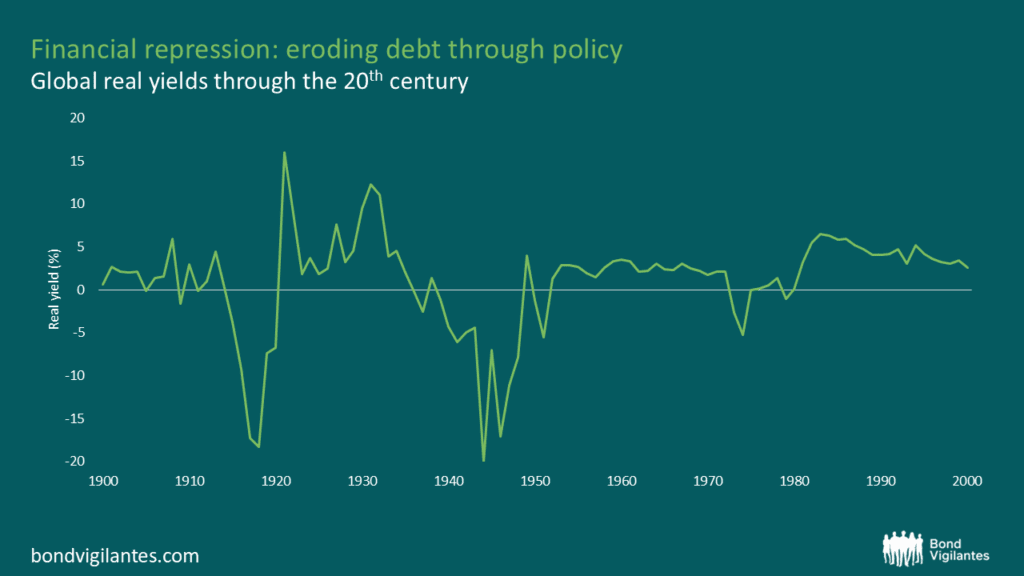

After World War II, both the US and the UK emerged with debt-to-GDP ratios well above 100%, with the latter at 250%. Yet over the following decades, those burdens shrank dramatically, and without large fiscal surpluses or deep austerity. The solution was financial repression.

Governments and central banks effectively capped interest rates while letting inflation run high. With capital controls in place and a banking system that was required to hold government paper, real interest rates stayed negative for years. Investors earned less than inflation, and debt quietly melted away in real terms.

Source: Bank of England’s Eight centuries of global real interest rates, R-G, and the ‘suprasecular’ decline, 1311–2018

By the mid-1970s, the UK’s debt ratio fell to roughly 50% of GDP. Much of that adjustment came not from paying debt down, but from the erosion of its real value.

Could it work today? Not easily. Financial repression relies on closed capital systems and willing domestic savers, both of which are in short supply today. In open markets with moveable capital, measures such as yield caps or mandated sovereign debt holding would likely require complex regulatory interventions or indirect support from central banks. Such policies would be difficult in a globalised, market-oriented system.

- Growth as the denominator: Britain after the Napoleonic Wars

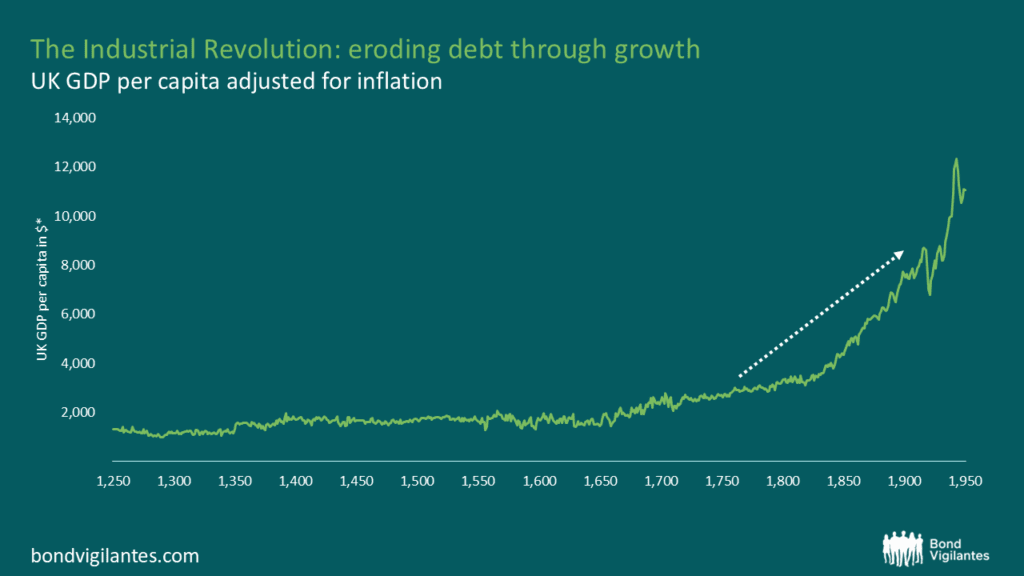

After the Napoleonic Wars, Britain’s public debt exceeded 200% of GDP. Over the next half-century, it fell steadily, not through inflation (the gold standard ruled that out) but through real growth and persistent, if modest, budget surpluses.

The Industrial Revolution transformed output and tax revenues, while the state held spending flat. The result was a slow but powerful denominator effect: GDP grew faster than the debt stock, even as prices remained stable or fell.

Source: https://ourworldindata.org/

* Definition of ‘International $’ on which this data set is based, can be found here: https://ourworldindata.org/international-dollars

Could governments grow themselves out of debt again? That depends on whether today’s economy can find an equivalent productivity revolution. Demographics, slower innovation diffusion, and lower investment all weigh against it. Unless of course, AI proves to be the answer…

- Inflation: The blunt instrument

Inflation has historically been one of the fastest ways to reduce debt. Weimar Germany in the 1920s and Japan in the immediate post-war years both saw real debts wiped away by surging prices. Even moderate inflation, sustained over time, can do significant work: in the 1970s, UK debt ratios fell sharply again as inflation outpaced borrowing costs.

Could governments inflate their way out today? Using inflation to reduce debt today is less straightforward, given that central banks are independent and focused on keeping inflation close to 2%. The recent post-pandemic inflation spike showed how higher inflation can create economic and social pressures, and how institutions respond to keep it in check. If inflation stays above target for too long, it could affect the credibility of monetary policy. Still, a period of slightly higher inflation alongside nominal growth might be seen as a practical path if political constraints make fiscal tightening difficult.

So are there any useful lessons from history?

Perhaps not. Each historical escape route looks less accessible today:

- Lowering debt through austerity is politically challenging, especially in societies already weary from years of spending restraint and rising inequality

- Inflation is broadly constrained through central bank objectives

- Growth remains elusive, unless technology delivers a genuine productivity revolution

- Financial repression, while possible in partial form, risks distorting markets and undermining investor confidence.

That leaves a muddle-through scenario: persistent deficits, modestly higher inflation tolerance, and debt ratios that stabilise rather than fall. Markets may increasingly price this as the new normal: A world of structurally higher term premia and periodic fiscal scares.

History suggests that when governments can’t grow, tax, or inflate their way out, they simply wait it out: relying on time, moderate nominal growth, and the slow erosion of debt through steady, incremental policy.

It’s not a dramatic ending to this episode, but it may be the most realistic one.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.