Stablecoins: A quiet revolution in finance

With geopolitics taking centre stage, the seismic tremors of Stablecoin activity go largely unnoticed. Stablecoins sit at a fascinating intersection of finance and technology. They promise the speed and programmability of cryptocurrencies with the price stability of traditional money. What began as a niche settlement tool for crypto markets is now being discussed as a parallel monetary system—with profound implications for banks, credit creation, and financial stability.

What are stablecoins?

Stablecoins are digital tokens designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. While there are several types, fiat-backed stablecoins dominate the market, accounting for roughly 90% of usage.

Two of the most widely used examples are USDC (Circle) and USDT (Tether). Both are backed by reserves, but the composition of those reserves varies:

| USDC (approx.): | USDT (approx.): |

| 75% in short-term US Treasuries (average maturity 43 days) 25% in cash deposits at regulated US banks | 70% in US Treasuries and cash equivalents 7% in cash and short-term deposits 9% in corporate bonds, precious metals, and other investments 5% in Bitcoin 8% in secured loans to unaffiliated entities |

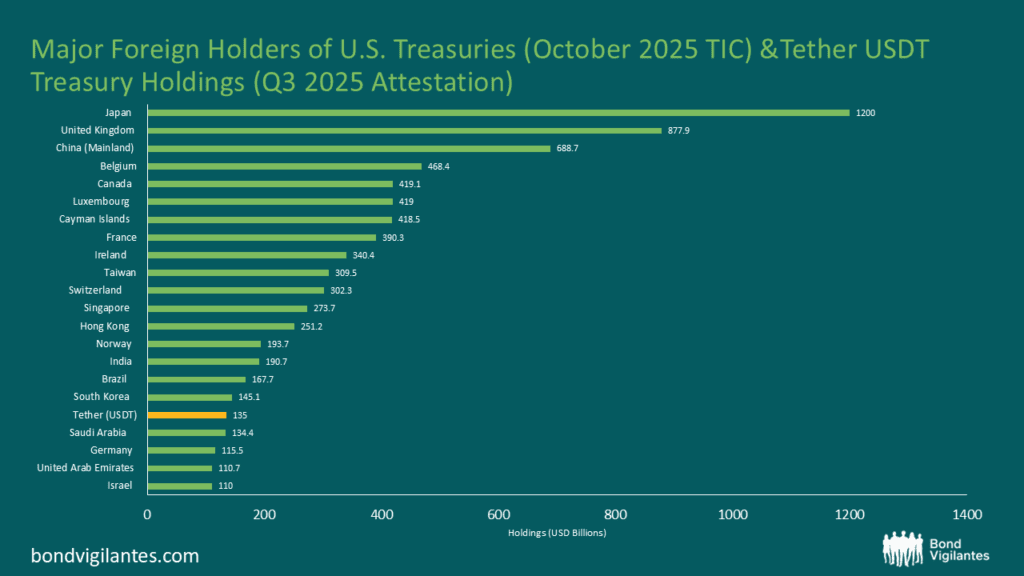

Stablecoins are becoming major players in the treasury market with Tether now the 17th largest holder of treasuries on the planet.

Source: US department of Treasury as of October 2025

How are stablecoins different from cash?

If you can already pay with a bank card, does it matter if settlement takes two days instead or instantly? For most consumers, the benefits of stablecoins look incremental compared to existing digital banking services.

But there is one notable difference: interest.

The GENIUS act and interest rules

The GENIUS Act, proclaimed by Donald Trump to have been named after himself, was signed into law in July 2025 and created a federal framework for stablecoins. Its aim is to provide regulatory clarity, consumer protection, and oversight. Crucially, the Act prohibits stablecoin issuers from paying interest directly to holders, ensuring they behave like cash rather than investment products.

However, third-party platforms, such as Coinbase or Binance can still pass through yield to users. That is, the interest earned by Circle or Tether from holding the interest bearing reserves is passed on to the exchanges, which then pass through to holders of the stablecoins through a process called ‘staking’. It is important to note that these yields are not guaranteed to be passed through and remain poorly understood, which has likely limited adoption.

Core use cases driving adoption

Payments and Settlement: Stablecoins enable near-instant, 24/7 settlement without relying on correspondent banking networks. For cross-border payments, this can be far cheaper and faster than SWIFT. Global remittance costs on average about 6.5% per transaction on flows of roughly $900 billion. Stablecoins could cut that close to zero. It’s no surprise Western Union is exploring its own stablecoin as its business model faces disruption.

Cryptocurrency market infrastructure: The cryptocurrency universe has gone from strength to strength (less so lately). Stablecoins act as the base currency of the crypto ecosystem, allowing traders to move in and out of risk assets without touching the banking system.

Financial Inclusion: In countries with weak banking systems or high inflation, dollar-pegged stablecoins offer a stable store of value without requiring a bank account. With the US dollar as the world’s reserve currency, adoption in South America and Africa is easy to imagine. Asian markets may lean towards both US-backed and yuan-backed stablecoins. Financial inclusion can cut both ways, as it may accelerate capital flight from emerging economies and funnel more funding into US debt markets.

The funding threat to banks

Banks rely on deposits to fund loans. Stablecoins disrupt this in three ways:

- Deposit disintermediation: If households and corporates hold stablecoins instead of bank deposits, banks lose a cheap and stable source of funding.

- Reduced credit creation: Stablecoin reserves are typically invested in:

- Treasury bills

- Reverse repos

- Cash at central banks

This shifts money away from private lending and towards government financing. For the US, this is convenient given its $38 trillion debt stock, with 40–45% needing rollover in the next 18 months.

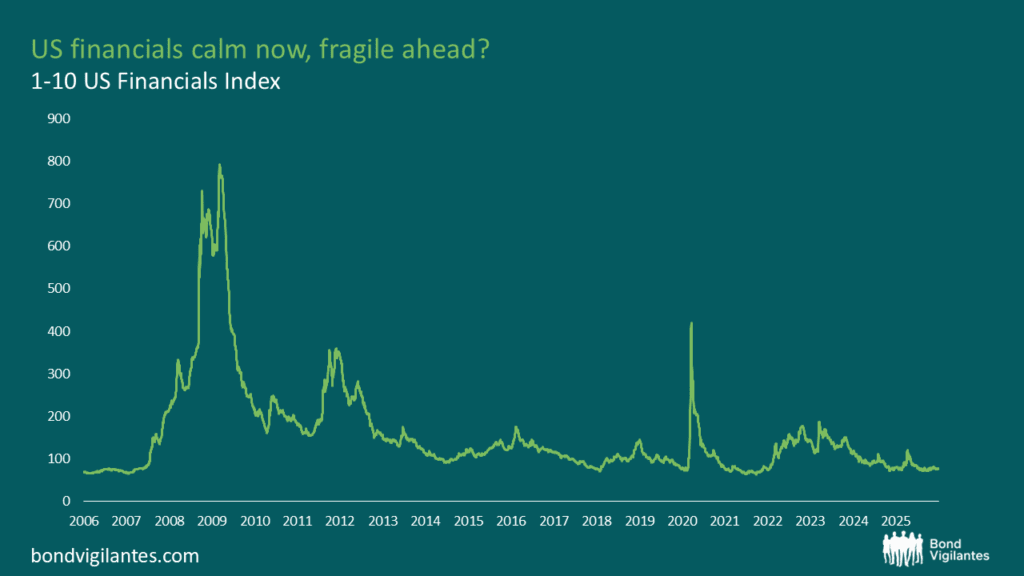

- Pro-cyclicality risk: In a crisis, depositors may rush into stablecoins perceived as safer, amplifying stress on bank funding and making bank runs increasingly likely.

The stablecoin market is currently $300 billion in size, with bullish growth forecasts of $4 trillion by 2030. If this growth is realised, it will likely come at the expense of bank deposits and not from new external sources. This is a problem for the banks, and it won’t come as a surprise that recent crypto legislation stalled just last week amid banking industry lobbying against stablecoin interest payments. Stable coins are not necessarily a catalyst for widening but is another concern for a sector which has spreads trading at all time tights.

To summarise, for everyday consumers, stablecoins offer little beyond what bank accounts already provide. For banks and the economy, the stakes are much higher. If stablecoins disintermediate banks, lending costs rise, credit availability shrinks, and growth slows, unless alternative credit channels scale up quickly. The US Government will welcome the extra demand for short-term debt, but the cost could be a fundamental reshaping of the banking system.

Sources:

1 https://ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html

2 https://tether.io/news/tether-attestation-reports-q1-q3-2025-profit-surpassing-10b-record-levels-in-us-treasuries-exposure-accelerating-usdt-supply-amidst-worlds-macroeconomic-uncertainty/

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.