Agentic AI isn’t eating software – it’s feeding market volatility

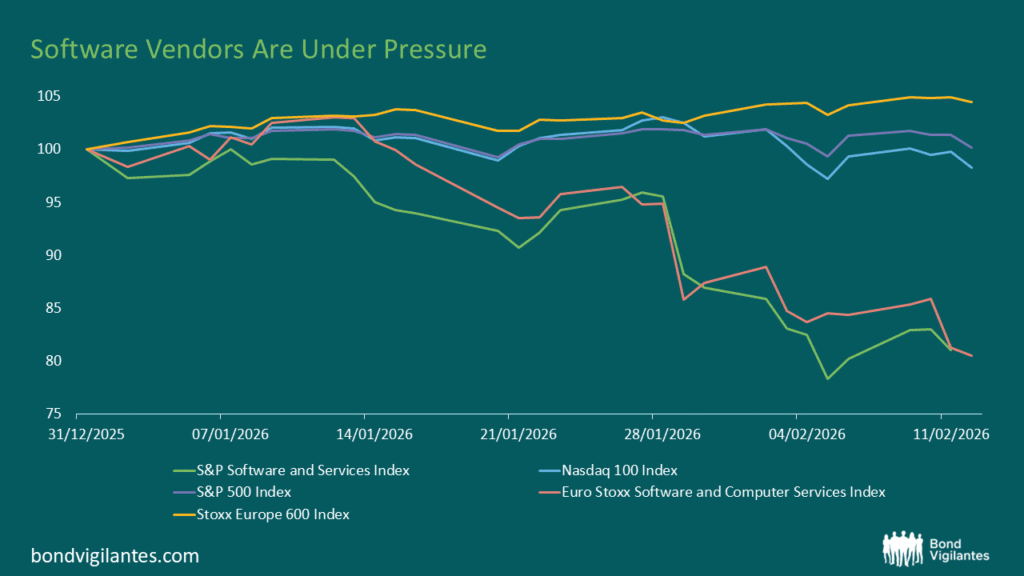

The sharp sell‑off across software names in recent weeks has prompted questions from investors, many centred on whether the rapid rise of agentic artificial intelligence marks the beginning of a deeper structural shift in enterprise technology.

The catalyst was the latest demonstration from Anthropic’s Claude platform, whose new “Cowork” and “Code” capabilities promise to automate tasks that were once firmly in human hands, from drafting documents and synthesising research to generating production‑ready code. Equity markets were quick to draw conclusions, punishing enterprise software companies without drawing any distinctions, based on the assumption that their software tools and embedded long term relationships were significantly devalued.

Discussions among technology specialists, both within M&G and across the broader industry, agree that the market move has been overdone. Rather than reflecting the pace or scale of disruption in the software environment, prices have been driven lower by perceived risk rather than evidence that software company valuations have been impaired by the AI revolution. The degree of weakness bears little resemblance to what is actually happening inside real enterprise businesses. Instead of a measured repricing based on a quantifiable change in credit quality, this has been a largely sentiment-driven reaction to a headline‑grabbing demonstration.

Source: M&G, Bloomberg Indices (Ref. S5SOFWTR, NDX, SPX, SISCSE, SXXP) as at 13 February 2026.

Most enterprise software vendors have already embraced the need to incorporate AI into their architecture. Many large vendors have spent years developing their products, integrating machine learning into their platforms and automating processes in compliance, risk management, customer analytics, IT operations and more. The emergence of tools like Claude sits within this longer term evolution rather than representing a sudden and existential shock. While impressive in isolation, few AI tools are ready for large scale integration into client processes. Corporate buyers, whilst keen to embrace the latest technologies, struggle to keep pace with the constant rollout of AI-led applications. In practice, procurement cycles, organisational constraints, audit trails and governance requirements will continue to slow adoption, particularly in regulated, core business processes or critical IT systems.

Existing enterprise software systems sit at the heart of major businesses, making software companies more resilient than current market pricing would suggest. Enterprise platforms anchor trading desks, risk management, regulatory reporting, client‑servicing infrastructure and internal control frameworks. They are embedded in workflows and integrated within legacy systems creating substantial financial, operational and regulatory switching costs that represent a significant ‘moat’ for software businesses. For most large organisations, reliability and continuity matter far more than theoretical productivity gains.

Despite the noise around AI agents, there is little evidence of customers abandoning incumbents. A more likely scenario is the opposite, that new AI tools reinforce the competitive position of established software vendors. Incumbents also hold decades of proprietary, structured, client specific data. This could materially improve AI model performance and suggests that partnerships between software vendors and AI agent developers such as Anthropic is a likely out-turn. Far from being disrupted, many Software companies could actually become strategic partners in the development of next‑generation AI tools and systems.

As with any period of rapid technological change, there will be winners and losers. Vendors offering more client-centric or commoditised applications with low switching barriers may potentially face challenges. Pricing structures will likely evolve and we may see linkages to cost savings or productivity introduced alongside more traditional licence based models may evolve too. Change is inevitable from the introduction of AI into almost every business over the next few years, but it is too early to assume AI is sounding the death-knell of large parts of the software sector, or as we have also seen recently, the wealth management sector.

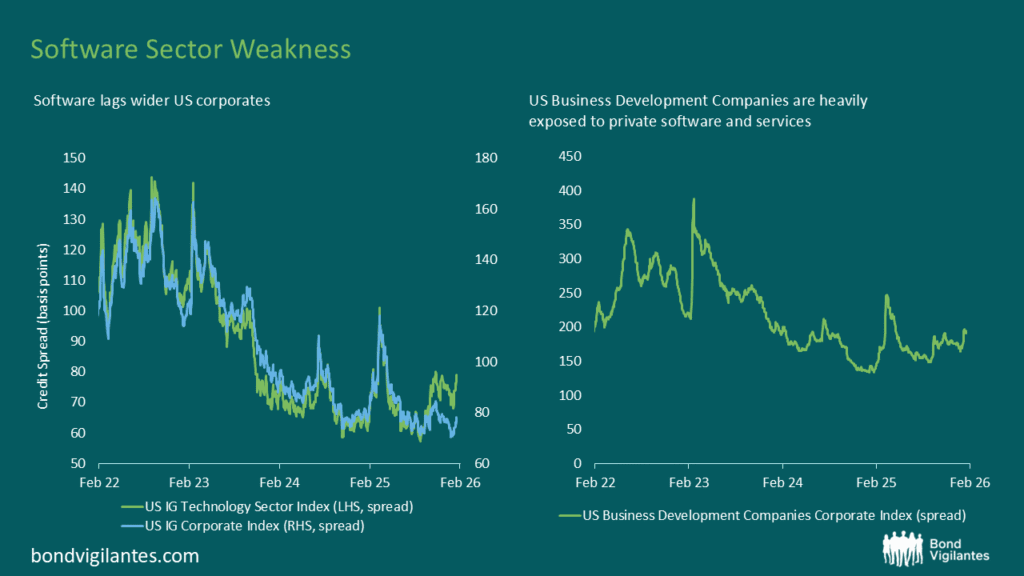

M&G, Bloomberg Indices (Ref. LUACTRUU, I00394US, I40257US) as at 13 February 2026

For credit investors, the more important question is whether the equity‑led repricing signals underlying stresses in cashflows, leverage or financing risk. On this point, the picture remains reassuring. Credit spreads have widened and valuations have compressed, especially among lenders to private software companies where sentiment is fragile, but the underlying credit characteristics of most public issuers remain solid. Software revenues are sticky, renewal rates remain high, and long‑term contracts continue to anchor client relationships. What the sector is experiencing reflects sentiment rather than a permanent change in credit fundamentals.

Markets seems likely to continue trying to anticipate winners and losers across the sector, with software currently at the centre of concern. Current market price action feels overdone and without evidence to the contrary should correct. AI will embed itself into many (possibly most?) industries in the next few years, and market participants will have to inevitably become more pragmatic and discerning as to the likely winners and losers based on evidence rather than over-hyped expectation. Our view remains that AI will enhance rather than replace incumbent software, strengthening rather than weakening the sector’s long‑term foundations.

The narrative that “AI will eat software” has run far ahead of reality. Agentic AI tools marks an important evolution, but it does not constitute an existential threat to the core of the enterprise software industry. For bond investors, this sentiment‑driven repricing may create pockets of value in fundamentally strong issuers whose long‑term strategic positioning remains intact. The foundational advantages enjoyed by enterprise software providers should prove far more durable than current market pricing suggests.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.