The economy continues to lead credit

Two months ago I questioned whether the decoupling between credit spreads and economic fundamentals could continue for much longer. I felt at the time that at some stage the weakening economic data would start to drag credit spreads wider, at least relative to government bonds. I also asked whether we might enter an environment in which high quality investment grade credit could see a flight to quality rally, whilst some of the lower quality, higher beta credit could sell off. Let’s see how government bonds and credit have fared since this blog was posted.

Bunds, Gilts and Treasuries have had a fantastic couple of months as shown in the chart below, with 10 year benchmark returns of 7%, 5.25% and 5%, respectively. However, this did not happen solely because economic data turned so horribly south, although it clearly did. These government bonds were boosted because of the peripheral sovereign debt concerns in Europe, and debt ceiling negotiations almost bringing about a technical default in the US. The markets panicked and sold risk and bought traditional, relative safe havens.

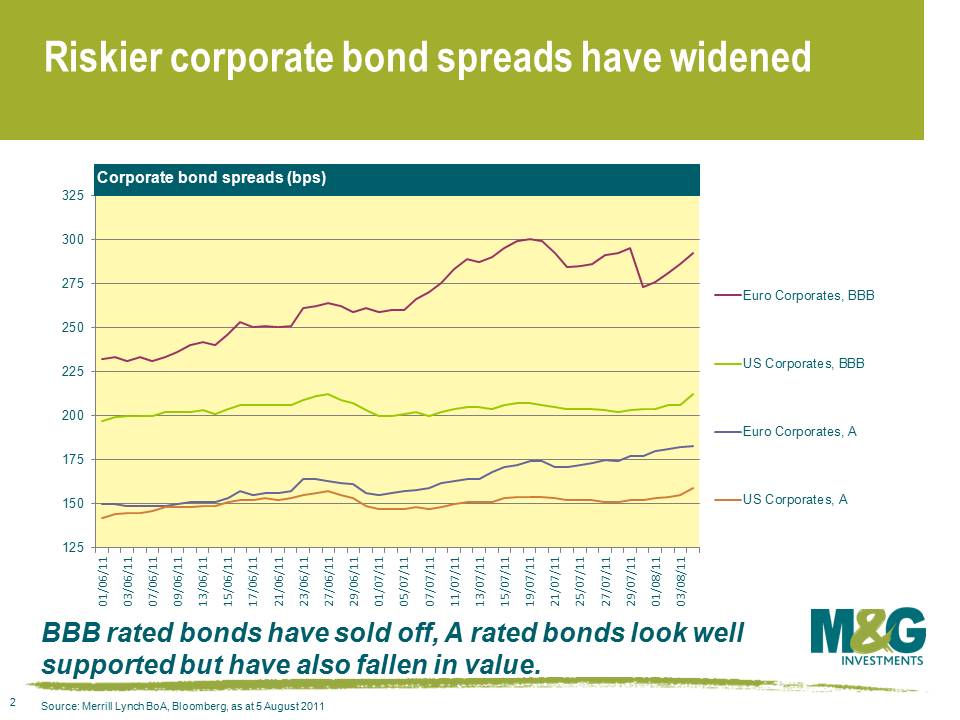

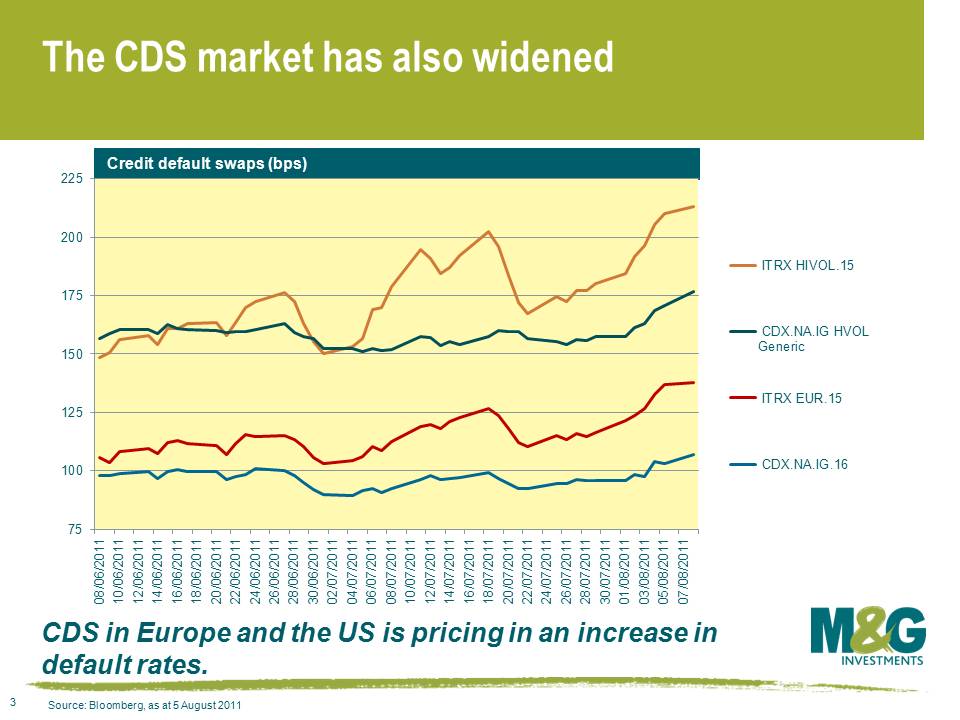

How has credit performed over the same period? The broad European, Sterling and US investment grade indices’ spreads have widened over the last two months. European spreads have risen from an average of +143 basis points to +172 (20% spread widening), Sterling spreads have risen from +193 to +218 basis points (13% spread widening), and US spreads have risen from +162 to +173 basis points (7% spread widening). Credit default swap spreads paint a similar picture of rising credit premia and rising risk aversion in the last two months, although the extent of the credit spread sell off has been greater in this market than in cash, largely due to far superior liquidity and therefore activity. The index of the 125 investment grade names in Europe has risen from a weighted average spread of 104 to 134.5, or a 29% spread widening, and the equivalent US index has risen from 96 basis points to 105 basis points, a widening in spreads of 9%.

Market participants in all risk assets have reacted typically: selling higher risk assets for perceived lower risk ones. In fixed income, we have observed this both in the cash market and in the CDS market.

However, in June I expected to see this as a result of a fundamental worsening in the economic data and environment, rather than as a result of a global panic in risk that has actually transpired. But the panic sell off in all types of risk has seen all sorts of participants sell whatever they can and buy anything traditionally perceived as risk free. Assets of all classes have been sold into higher quality government bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox