Housing market stabilising

As many of you are aware, we have been following the developments in housing markets quite closely, particularly in the UK. The housing markets were both a signpost and then a symptom that helped to drive inflation lower and brought the banking system close to collapse. For the UK, the chart we have focused on the most is the use of mortgage approvals as a lead indicator for the strength of the housing market, and therefore the economy (see here). This relationship appears to have broken down, and it is important to explore why.

We are debt investors, so we are used to analysing whether companies’ earnings are sufficient to service their debt. With regard to housing, similar methodologies can be employed to determine the health of the housing market and the consumer. The simplest method is to plot the average house price versus average interest rate charged so that we can derive the cost of servicing a mortgage. We can then use average income to derive a guide to how cheap housing is. This chart shows how affordable housing is on a debt servicing basis.

We are debt investors, so we are used to analysing whether companies’ earnings are sufficient to service their debt. With regard to housing, similar methodologies can be employed to determine the health of the housing market and the consumer. The simplest method is to plot the average house price versus average interest rate charged so that we can derive the cost of servicing a mortgage. We can then use average income to derive a guide to how cheap housing is. This chart shows how affordable housing is on a debt servicing basis.

While this is a good guide, the banks’ ability and willingness to lend has been greatly diminished, and availability of financing for new purchases is restricted. Mortgage approvals for new purchases therefore remain moribund. This new reality is not great news for house prices, housing activity, and the economy.

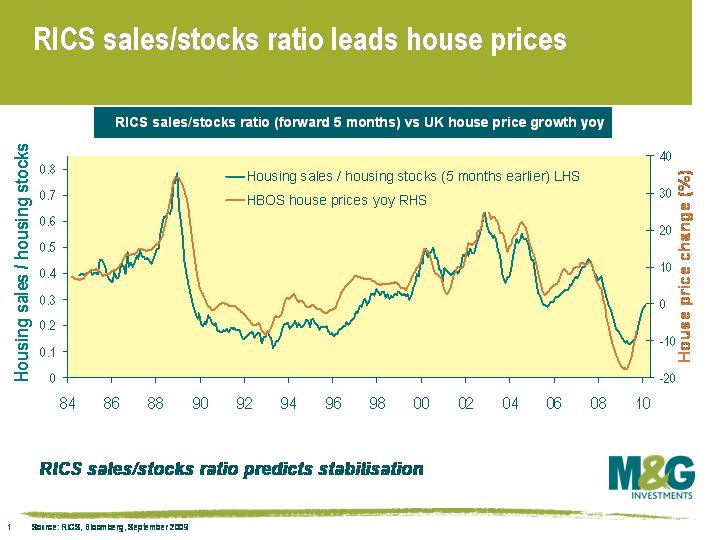

However, if an asset price is cheap versus the cost of financing, then the market can still stabilise in the absence of the leveraged buyer. Firstly, cash buyers or the less stretched borrowers will enter the market. Secondly, individuals who own a property will logically decide not to sell as their housing is historically cheap to finance. Data on the first is hard to source and is mainly anecdotal (eg euro based individuals buying cheap sterling property). The second is easier to follow – the RICS sales to stock ratio is a measure of demand versus supply, and suggests a more bullish outcome for the housing market than the mortgage approvals numbers.

However, if an asset price is cheap versus the cost of financing, then the market can still stabilise in the absence of the leveraged buyer. Firstly, cash buyers or the less stretched borrowers will enter the market. Secondly, individuals who own a property will logically decide not to sell as their housing is historically cheap to finance. Data on the first is hard to source and is mainly anecdotal (eg euro based individuals buying cheap sterling property). The second is easier to follow – the RICS sales to stock ratio is a measure of demand versus supply, and suggests a more bullish outcome for the housing market than the mortgage approvals numbers.

The consensus view seems to be that demand/supply ratios have lost their relevance because the volume of transactions is low. We differ – to make a market you have to focus on supply and demand, and this lack of supply is fundamental and reflects the cheapness of housing on a serviceability basis. The UK housing market has traditionally been driven by first time buyers, as reflected by the historically close correlation between mortgage approvals and house prices. This buying power is now limited, but supply is equally limited. New less levered buyers will step into the breach, and existing owners of property will hold on and attempt to service their historically cheap debt. Of course, higher interest rates could rapidly change the supply dynamic, but the authorities are acutely aware of this, and with inflation subdued, rate hikes still look a long way off.

Monetary policy is thankfully working in the UK. Low rates are directly supporting the housing market, and in turn supporting the economy. Now that the housing market is showing strong signs of bottoming, one can become more relaxed that the economy can recover. Deflation is not as likely as earlier this year, and financials look healthier.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox