What’s driving the US Dollar?

The behaviour of the US Dollar over the past few days has left investors a bit stumped, and the FT have been asking the same question in today’s Short View column. Friday of last week saw the biggest rally in the US Dollar since January as an unexpected drop in the unemployment rate led to speculation that the Federal Reserve will lift interest rates by the middle of next year. Yesterday the dollar continued to gain against the euro, which has been attributed to Bernanke’s comments that the US economy faces “significant headwinds” and inflation could move lower. Surely weak growth and subdued inflation suggests no pressure to raise US rates, so the thing that apparently drove the US dollar yesterday was the opposite of what influenced the US dollar on Friday.

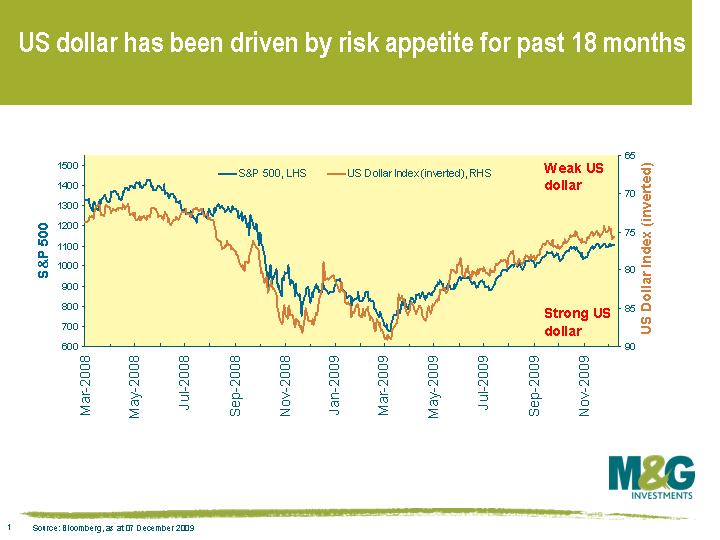

People try to attribute all sorts of things to the performance of the US dollar, but the reality is that for the last 18 months, or until last Friday anyway, the performance of the US dollar has been almost entirely due to whether the world’s investors were in a mood for risk taking or risk aversion on any given day. This can be seen in the attached chart, which plots the S&P 500 versus the US Dollar Index, where the Dollar Index measures the US dollar against a basket of six major currencies. The two indices have tracked each other particularly closely over the past six months, with a correlation of -0.94.

The close negative correlation between the US dollar and risky assets can be explained by the currency carry trade. The carry trade rapidly unwound post Bear Stearns ‘s rescue in March 2008, resulting in lower yielding, lower risk currencies such as the US Dollar and Japanese Yen outperforming. This year, the carry trade is back, as risk seeking investors have taken advantage of low US interest rates to borrow in US dollars at a cost of next to nothing, and have used the proceeds to invest in higher yielding currencies such as the Australian Dollar or Brazilian Real.

Last Friday, US non-farm payroll data caused the correlation to wobble. While the payrolls figure was still negative, data came in much stronger than expected as US employers cut the fewest jobs last month since the recession began. The US unemployment rate unexpectedly fell from 10.2% to 10.0%. European equity markets jumped 1.5% on the news and government bonds sold off reasonably sharply. You’d normally expect to see the US dollar weaken in this environment of risk appetite, however the US dollar actually rallied more than 1% against the Aussie Dollar and Norwegian Krone, and rallied 1.5% against the euro and more than 2% against the Japanese Yen.

As Jim explained in a recent teleconference, the Federal Reserve has not traditionally started hiking rates until unemployment has been falling for a while. Strong unemployment figures therefore increase the risk that the Fed will start hiking rates next year. If the Federal Reserve does start to hike rates, it has the potential to dramatically alter the way the US Dollar behaves. For proof of this, you need look no further than what happened between March 2004 (when the markets began pricing in a series of Fed rate hikes) and the end of 2005 (when the ECB started hiking rates too) – in an environment of rising risk appetite, the US dollar appreciated almost 12% versus the Yen, 7% against sterling, and 4% against the euro and the Australian Dollar, all this despite the US dollar’s status as a ‘safe haven’.

Now it’s quite easy to read too much into last Friday’s strong unemployment number, ie one data point does not a trend make, although one data point is more likely to be the start of a trend than no data point at all. Bernanke’s comments yesterday suggest it’s probably still too early to get excited about rate hikes happening any sooner than the second half of 2010. But the case for a steadily weakening US dollar is now a little less compelling.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox