Fixed interest markets performance review year to date – some interesting results

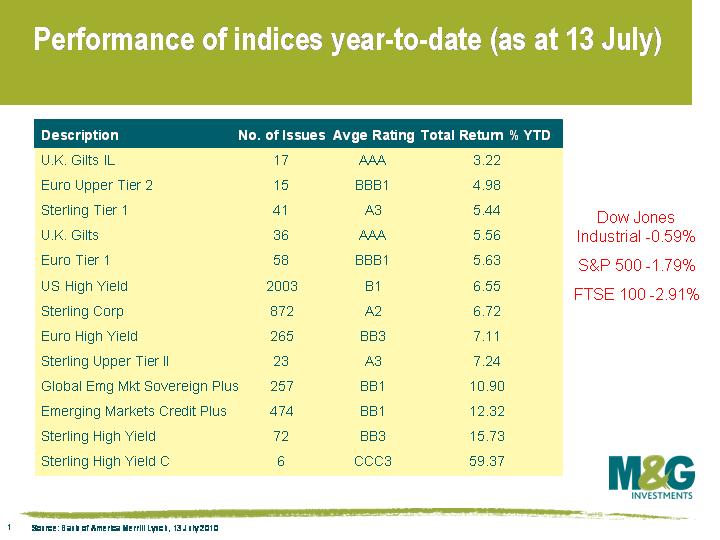

We have now passed the halfway mark of 2010 and we thought it would be interesting to put together some figures to show how various bond indices have performed year-to-date (as at July 13). BofA Merrill Lynch provide an excellent download service via Bloomberg which has allowed us to extract the data in the following table. Interestingly, in this perceived world of risk on/risk off, performance YTD in fixed interest markets has not necessarily reflected the amount of credit risk an investor is willing to take.

Within bond markets, AAA rated index-linked gilts have provided a total return of just over 3%. UK gilts have given investors a solid 5.5% return, outperforming some of the higher risk indices like sterling tier 1 and Euro upper tier 2 debt. The financial indices suffered as risk aversion increased due to concerns about the banks exposure to peripheral sovereign debt. The star performers YTD are the corporate indices, particularly high yield, which in Europe and the UK has returned 7.11% and 15.73% respectively. The Sterling High Yield C index (which is actually CCC & below) has returned a massive 59.37% YTD – though this reflects the fact that the index consists of only 6 issues so big moves in a constituent of that index can swing the returns. Emerging market sovereign debt and emerging market credit have provided investors with double-digit returns, a reflection of the solid macroeconomic conditions that many emerging market nations are currently enjoying. Note that all returns are measured in local currency terms.

We have also included some of the major equity indices in the table, confirming the choice that Paul the Octopus made last Friday.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox