Central banks’ poor forecasting records and why the Fed may hike rates before late 2014

Central banking has evolved substantially in recent decades. Part of this evolution has involved a move towards greater transparency around a central bank’s forecasts and operations. The reason for this shift is because it is believed by many economists that by having a central bank communicate its objectives and forecasts, economic agents like consumers and businesses will make better informed decisions and allocate resources more efficiently. Theoretically, the real economy should improve.

The problem is, economic forecasting is a difficult game to be in. Many private sector economists have had a torrid time over the past five years in attempting to assess the state of the real economies of the US, Europe and the UK. If you think that central bankers have had it any easier, then you would be wrong. Time and time again, central bankers have been proven wrong with their economic forecasts.

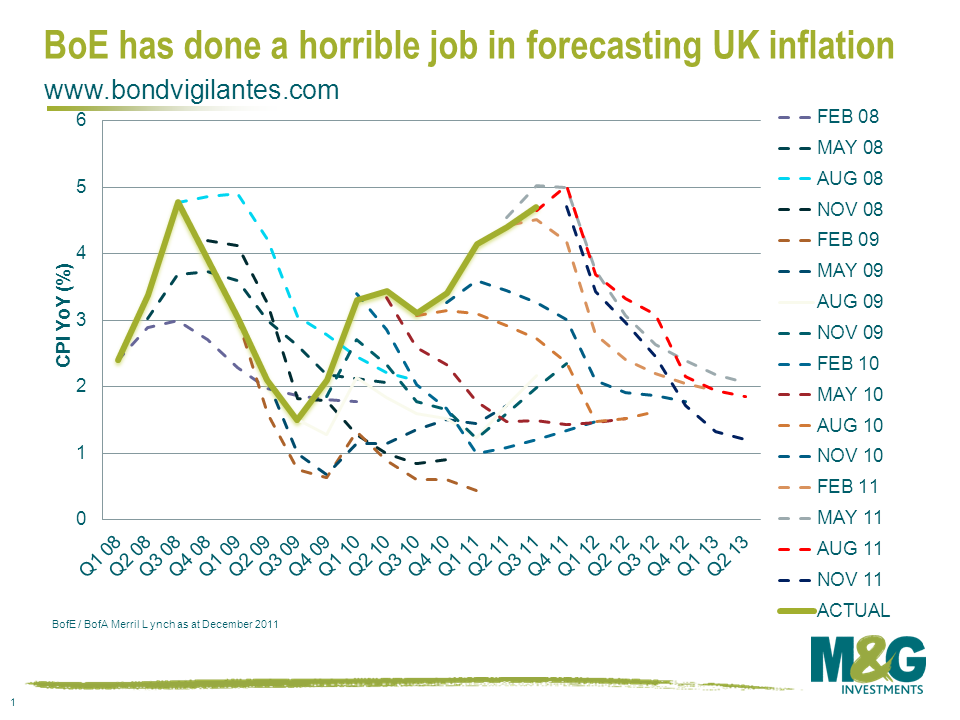

For example, the following chart (courtesy of John Wraith at Bank of America Merrill Lynch) highlights the dismal inflation forecasting record of the Bank of England. It shows actual inflation versus the BoE’s forecasts from the quarterly inflation report. Time and time again over the past couple of years the BoE has forecast lower inflation, and time and time again it has been wrong. This is worrying if you are an inflation targeting central bank.

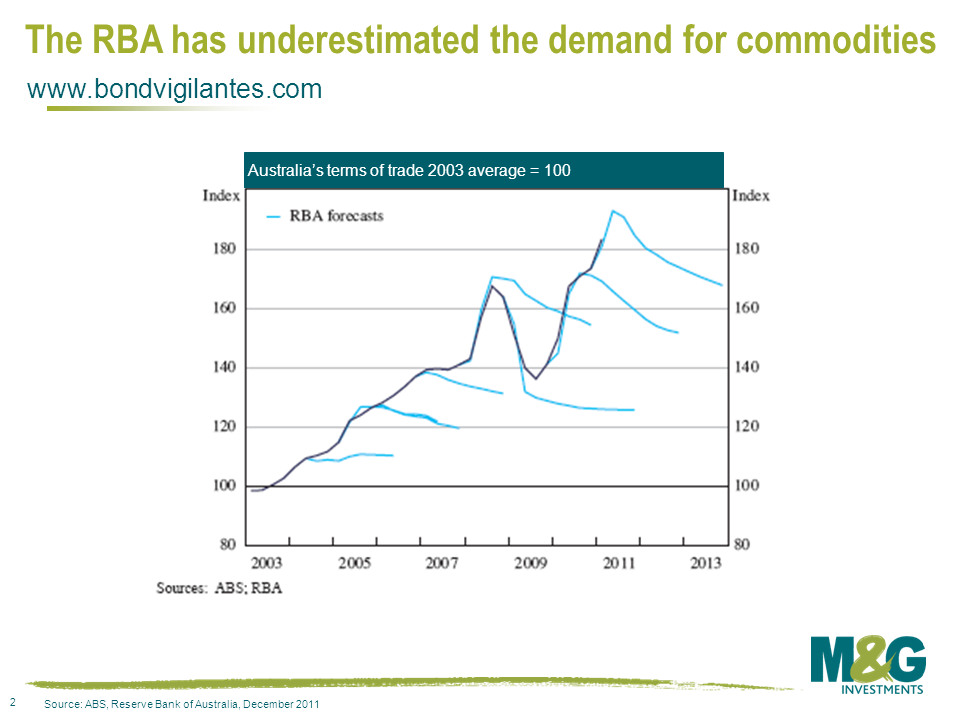

This poor record of forecasting is not limited to the Bank of England. The chart below shows the record of the Reserve Bank of Australia in forecasting Australia’s terms of trade. As you can see, the RBA’s forecast of a fall in the terms of trade has repeatedly been proven wrong, largely caused by the boom in China and its appetite for Australian commodities. The RBA should be right on top of developments in resources markets – and it probably is – but this has not helped the RBA in determining the future course of Australia’s terms of trade.

The charts above highlight how two central banks, the BoE and RBA, can be totally inaccurate in forecasting major economic variables. Of course, there are many more examples of central banks providing inaccurate forecasts including this amusing lowlights package of Ben Bernanke.

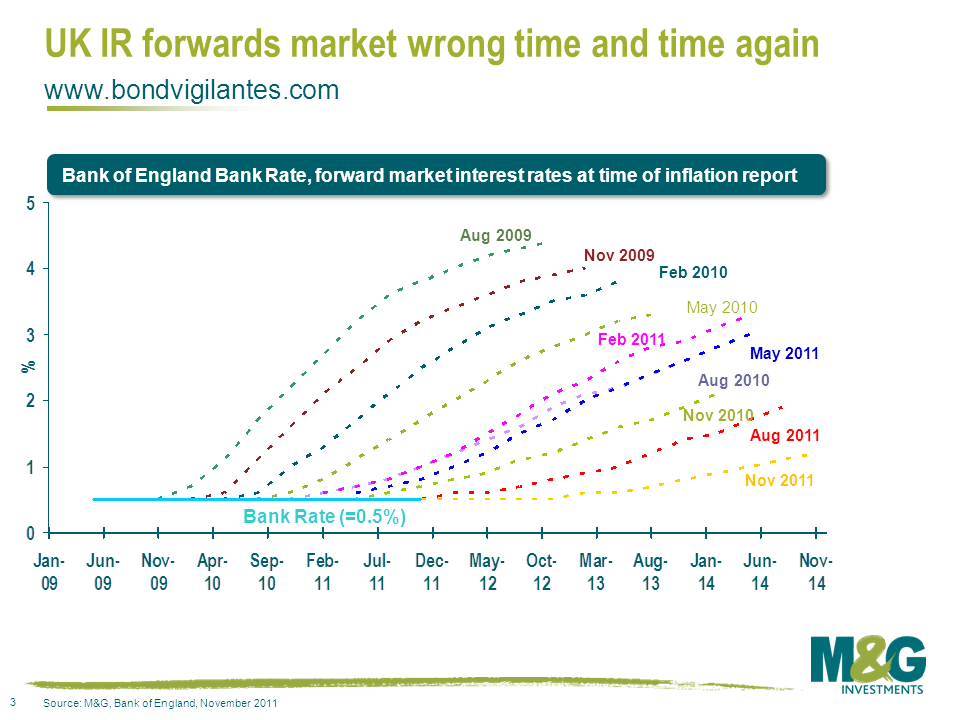

Of course, markets have shown that this poor forecasting record is not limited to public institutions. The forward market for interest rates has repeatedly priced in interest rate hikes and has continually been disappointed by the Bank of England’s lack of action (in fact, the BoE has done the opposite to hiking rates and pumped the economy with further QE).

Let’s turn now to the US Federal Reserve. In January 2012, the Federal Open Market Committee (FOMC) took the extraordinary position of indicating that interest rates will be at exceptionally low levels until late 2014. The markets have read this as an assurance that interest rates are on hold until that time. But I am not so sure.

From the January monetary policy release – “In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014”.

I have underlined the most important part of this statement. The FOMC’s forecast that interest rates will remain low or on hold until late 2014 is based on the FOMC’s forecasts of US economic conditions, in particular resource utilisation and inflation over the medium run. And as we have seen above, these forecasts are frequently plain wrong.

We won’t be surprised to see the Fed hike rates before late 2014. And that is because central banks are terrible forecasters of economic variables, just like the rest of us. If we start to see a real improvement in the fortunes of the US economy (and there is already evidence of this occurring) and inflation expectations start to rise, then the Fed will face a substantial dilemma. Will Bernanke and company hike rates in order to maintain inflation fighting credibility, or will they maintain ultra-low interest rates in order to support the real economy? Should they fail to act in an environment of higher inflation outcomes, we will have the clearest indicator yet that the financial crisis has caused central banks to have a re-think about the goals of monetary policy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox