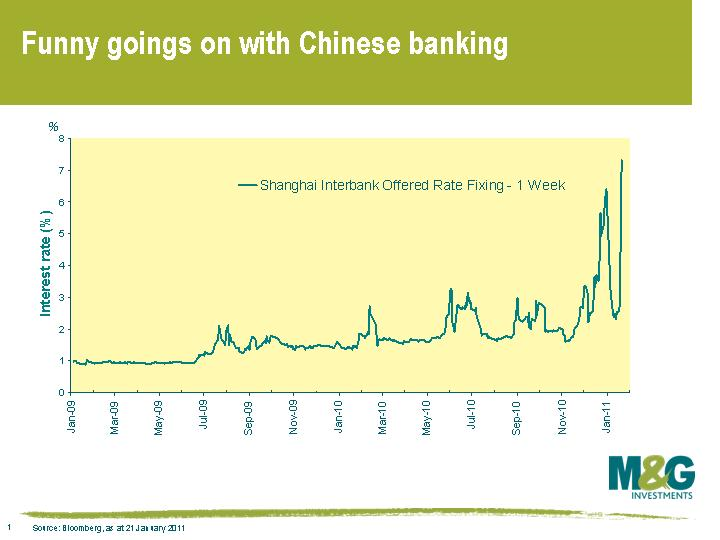

Funny goings on in the Chinese banking sector

The interbank lending rates (Shibor) in China have gone ballistic in the last three days, with the 1 week Shanghai Interbank rate soaring from 2.6% on Monday to 7.3% today. The worrying move has been put down to a combination of Chinese New Year (there is traditionally a bit of a movement around Chinese New Year but not this much) and the most recent increase in Chinese bank Reserve Requirement Ratio (the fourth in three months) catching banks by surprise. Rumours of a rate hike didn’t help either. Following the increase in the Reserve Requirement Ratio, Chinese banks slowed or completely stopped interbank lending, which left some banks desperate for cash to pay the reserves. Domestic news reported that two banks failed to raise enough cash to pay the new reserve requirement ratio so the People’s Bank of China made an unusual reverse repo to these banks (ie took collateral from the banks to make a cash loan).

It looks like the spike is being driven by technical factors and should return to more normal levels post Chinese New Year in the second week of February, but unusual bank liquidity events are definitely worth keeping an eye on.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox