Asian economic slowdown and the EMD bubble

Last month I commented on the long term headwinds facing Asia and tried to cut through the sales cheese. The last few weeks have seen more evidence of a slowdown in Asia, and seemingly more people buying into the EMD story as valuations in a number of countries have hit extremely expensive levels. Taking one example, in the middle of last week the $2.25bn issue of Peru 7.35% 2025s reached a yield spread of 109 basis points over US Treasuries. Liquidity on the bond is not fantastic, with a bid-offer spread of 1% on screens, implying that over a one year time horizon the yield spread is an illiquidity premium, with almost zero credit risk priced in. Spreads are reaching levels of the super liquid days prior to 2008. Bubbletastic.

Some charts below.

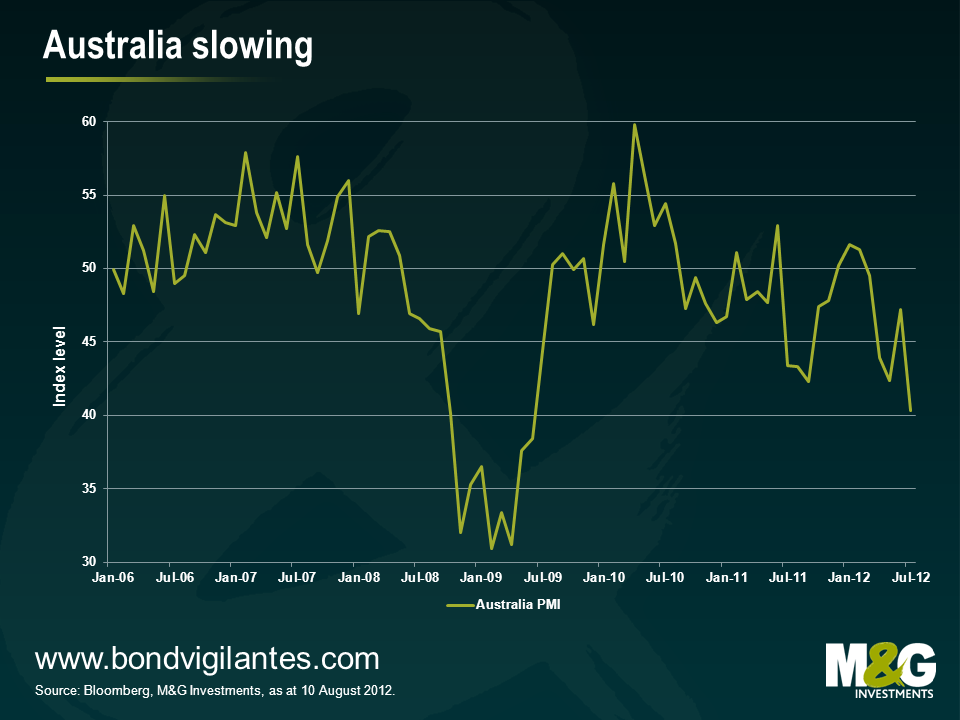

Australia’s economy appears to be struggling, with the Australian Dollar pushed higher by speculative inflows.

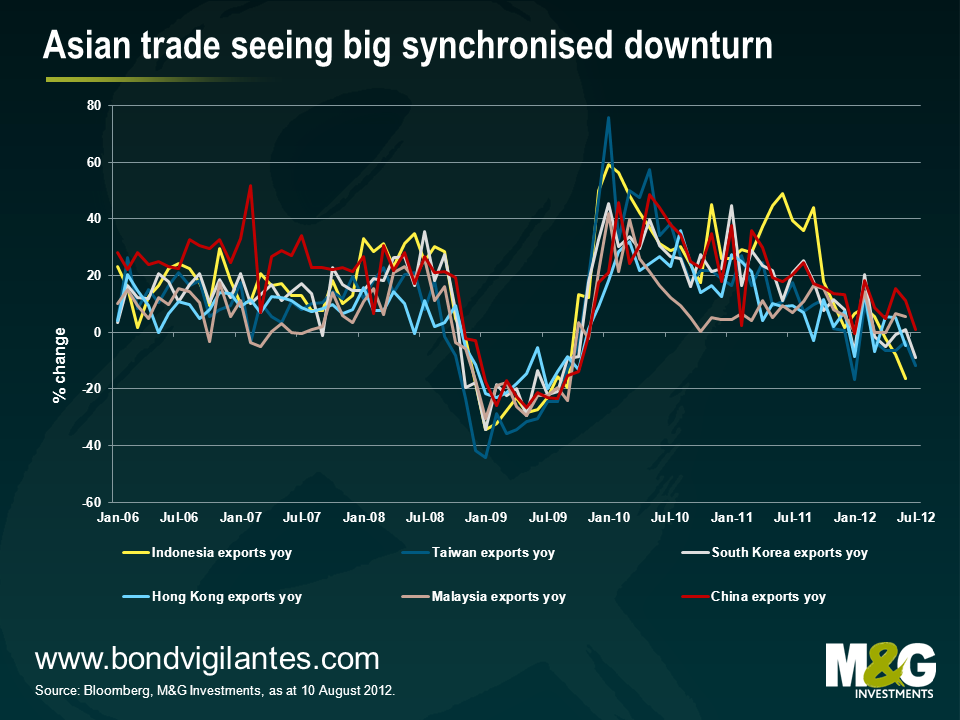

Many of the countries reliant on exporting to China are seeing flat or negative export growth year on year.

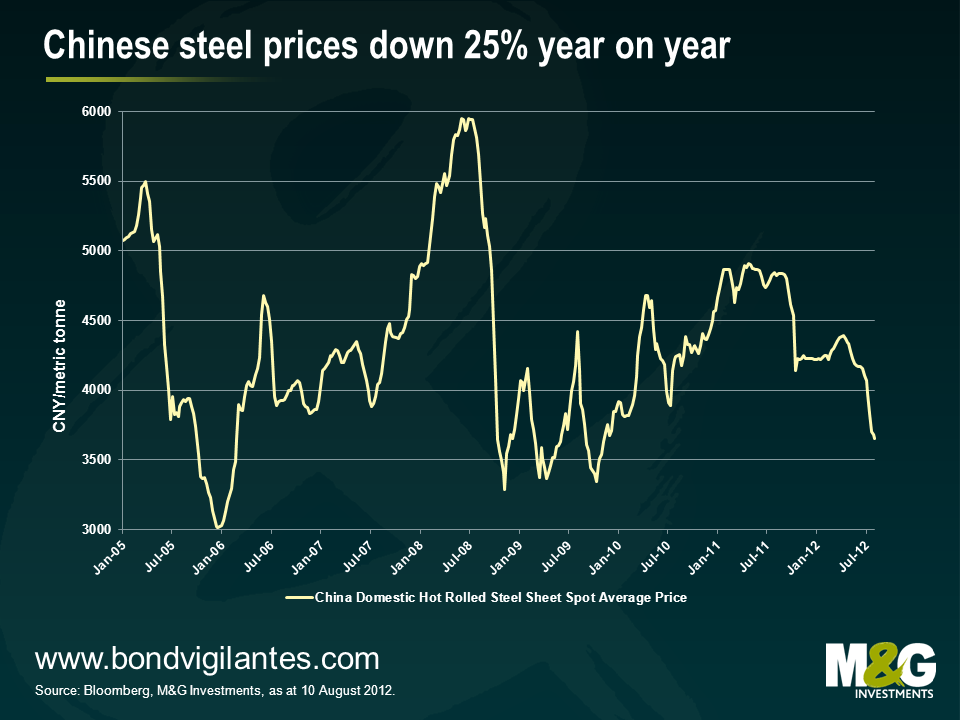

As discussed last month, Chinese growth has been highly dependent upon excessive investment growth. This has been driven by construction, which has been reliant on steel. So it’s interesting that steel prices have fallen 25% in the last year in China.

And finally the current bubbletastic spread levels on emerging market debt.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox