Stress in the Eurozone – Day of action, years of reaction

Today in Europe we have a day of action. The day of action means in reality a day of inaction, as the active protesting on the streets is outweighed by the inactive sectors such as transportation hit by the strike. Why are workers and, increasingly importantly, non workers undertaking such protests?

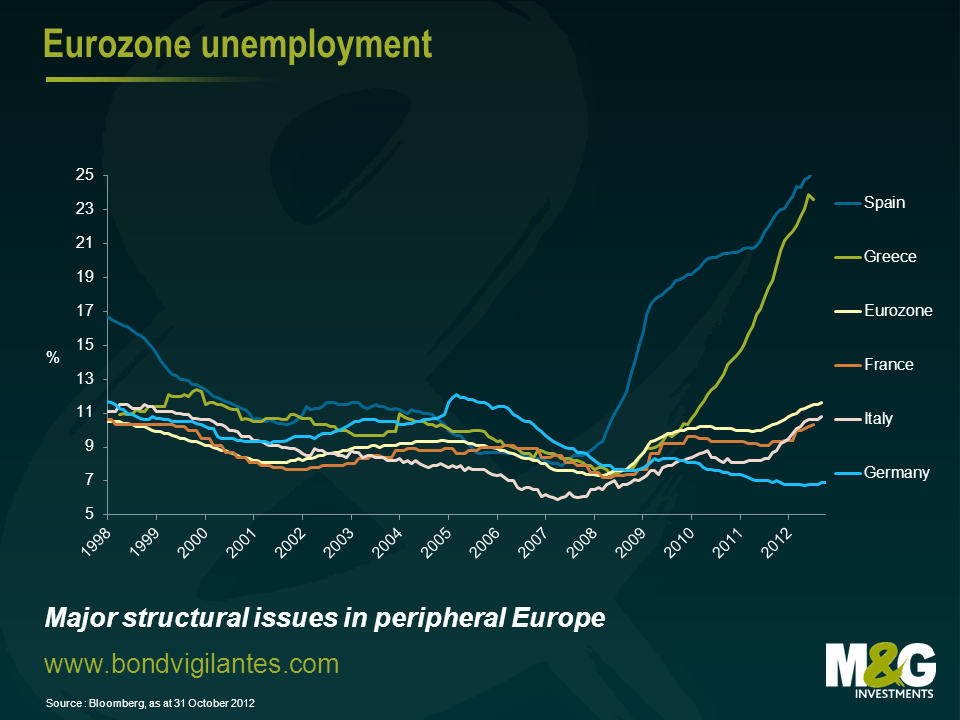

Firstly let’s look at the evidence. Below is a chart of unemployment in the Eurozone split by country. The chart shows who is protesting and why. The higher the unemployment the more concern there is in that nation’s population over the current economic situation. Germany is not protesting; southern Europe is.

It can be seen from the chart that at various times over the last 10 years the sick and healthy economies of Europe have alternated, the strong core and the weak periphery were the weak core and the booming periphery in the middle of the last decade. Industry, labour skills, and structural shifts do not occur that quickly so what is causing this volatility in national economic outcomes?

We have commented before on the travails of the single currency concept. This is an economic construct, which has been constructed for the good of Europe. Let’s look at how this current economic policy affects the Eurozone, and how the divergence in economic outcomes can be solved using economic theory.

The first economic lesson I learned from my excellent economics teacher, was the concept of the invisible hand (quite ironic as he had the biggest hands I’ve ever seen!). The introduction of a single currency causes the invisible hand as expressed via exchange rates to be metaphorically tied behind your back. Given the single currency is the root of the dislocation, disbanding it is an obvious solution. However the other ramifications of doing this are potentially large, and it is not an option European leaders are prepared to take. This is not because it is an ineffective policy option, but they are wedded to the political concept as well as the economic concept that comes with a single currency. The weak economies are therefore stuck with too high an exchange rate and the strong economies are left with too low an exchange rate. The economics of the invisible hand in foreign exchange markets is not allowed to work and therefore economic divergence not convergence becomes a more likely event.

Being educated in Britain, the next main economic lessons we learned were around the work of John Maynard Keynes. The principle point drummed into us being that governments should run counter cyclical budget deficits. Unfortunately in Europe the response that the weaker economies are being forced to take is more fiscal discipline through budget deficit reductions. The strong have room to undertake fiscal stimulus, the weak are being told to run pro cyclical fiscal policy. So from this economic perspective the weak will get weaker and the strong stronger…..

The third basic lesson of economics was monetary policy. Lower interest rates stimulate consumption and growth. If you’re the German state, a German company, or a German individual the transmission mechanism of borrowing substantial amounts of money at low rates is available and is working. Sadly if you’re the state, a company, or an individual in the weaker economies the cost of borrowing is high and the physical quantity you can borrow is limited. The transmission mechanism is not working equally across Europe. The strong will get stronger the weak will get weaker.

The single currency is an economic construct that has come about through a political process. If that economic construct does not cause many economic ripples then politically it is relatively easy to take the political decisions to make the concept work. However if the economic construct becomes very destabilising as it appears to be doing then the political skills and policy options have to increase in size to offset its destabilising effects. The political day of action of launching a single currency was simple, the actions required to make it work long term are not.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox