The chart annoying every Aussie consumer

In 2012, the Reserve Bank of Australia cut its cash rate five times and by a total of 1.25%. That is a big move in interest rates for an economy growing at 3.1%, an unemployment rate of 5.4% and inflation sitting bang-on target at 2.0%. The RBA cash rate is now equal to the 50-year low seen during the 2009 recession. So what has got the RBA so nervous?

One word: consumption. Around 54% of Australian GDP is household consumption. But the household saving rate, at 10.6%, is more than double the average of the past decade. Aussies are deleveraging. Consumption, for so long the driver of growth in the boom years, has stumbled.

And unfortunately for the RBA, the latest GDP statistics showed limited sign of investment outside the mining sector. Certainly the appreciation of the Australian Dollar – once known as the “Aussie Battler” or “Pacific Peso” – has not helped things. On a trade-weighted basis, the Australian Dollar has risen by 45% since January 2009, leading to calls from industry for the RBA to intervene in currency markets. The strong dollar is a huge headwind for the Australian manufacturing sector in an increasingly globalised world. The RBA is hoping that a reduction in interest rates will a) spur household consumption and b) have some impact on the strength of the currency.

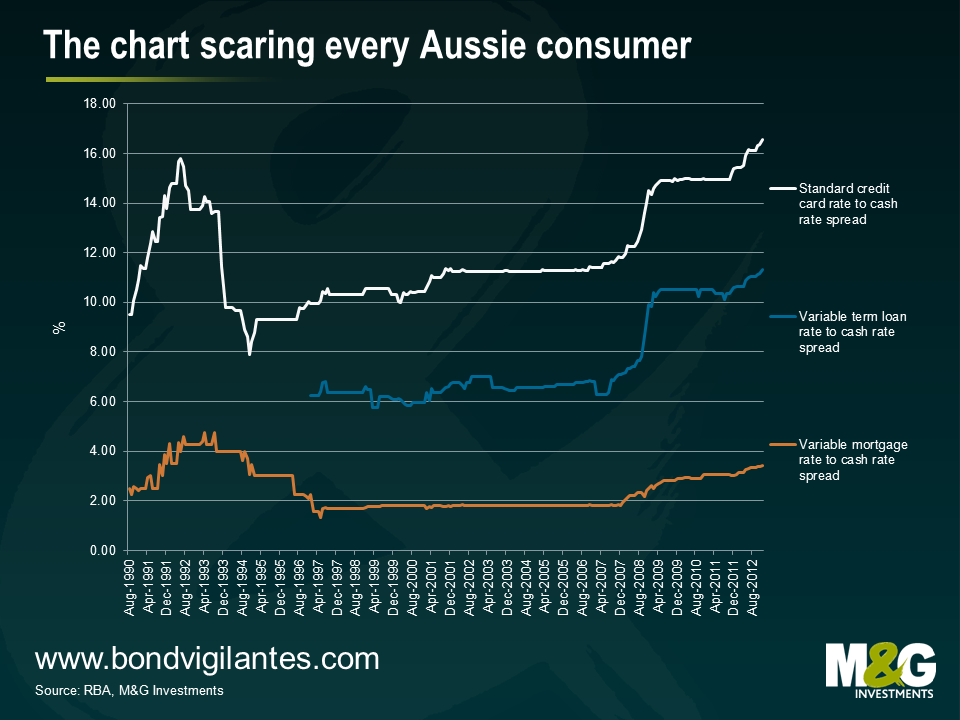

On the currency front, the RBA rate cuts have had minimal impact. The trade weighted index rose over the course of 2012 by 1.7%. Ouch. On the consumption front, unfortunately for the RBA and the heavily indebted Aussie consumer, the banks haven’t been playing ball. The chart below highlights the spread differential between variable mortgages, variable term loans, and the standard credit card rate over the RBA’s cash rate.

Despite a record low cash rate of only 3.0%, the spread between the rate charged on personal loans and credit cards is at a record highs. Banks aren’t passing on the full cuts in the official rate. In the variable home loan space, the spread has been steadily rising since October 2007. It is particularly important to have a look at the variable mortgage rate as around 80% of home loans in Australia are variable rate mortgages. Overall, the chart shows that the transmission mechanism of monetary policy in Australia is becoming increasingly muted, presenting greater challenges for the RBA.

Central banking isn’t the easiest job in the world at the best of times. Due to high rates of indebtedness and home ownership, the RBA has previously found that moving interest rates could quickly stimulate the economy if needed. The last thing that central bankers need is a further handicap on their ability to deliver their inflation targets. But that is exactly what is going on in Australia right now and the RBA should be concerned.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox