EM debt funds hit by record daily outflow – is this a tremor, or is this ‘The Big One’?

On Friday last week, EM debt funds saw a daily outflow of $1.27bn, which equalled the record set during the dark days of September 2011, a time when the Eurozone periphery and the ECB were particularly active bungee jumping down a precipice. Outflows were even bigger on Monday this week, as EM debt funds were hit by $1.44bn in outflows. The fact that Monday saw a daily record wasn’t much of a surprise; markets were violent, even by recent standards, with some Turkish bank bonds down 10% intraday at one point. Outflows were a slightly less bad $1.07bn on Tuesday this week (the most recent data available), but that’s still $3.78bn of EM debt fund outflows in just three days.

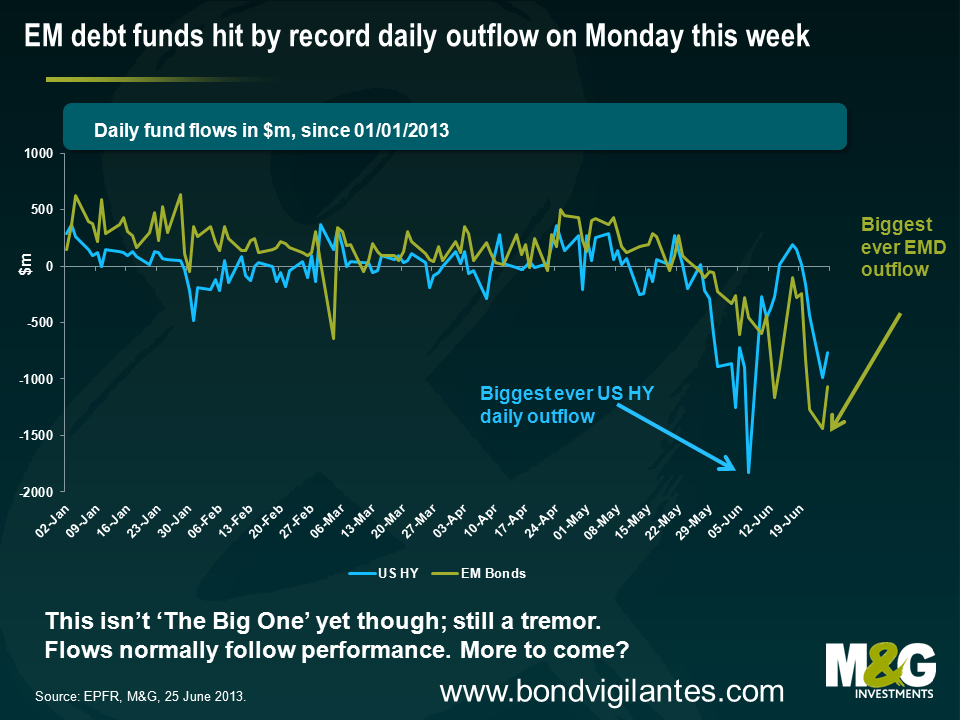

The chart below plots the year to date daily flows in US high yield and EM debt, courtesy of EPFR. Note that this data is for mutual funds only and doesn’t include flows from insurance companies, central banks etc, so while it gives you an idea of how grim the picture looks, it’s perhaps only 10% of the whole picture. Note also that the EM debt asset class is significantly bigger than it was just two years ago thanks to a huge amount of debt issuance, meaning that although Monday saw a record outflow in absolute terms, it actually ranked number four relative to the size of the market.

Do the outflows matter? EM debt bulls might argue no – fund flows tend to lag market performance and flows have historically had little if any predictive power in forecasting future returns. The collective human instinct is always to buy at the top and sell at the bottom, and the losses in EM assets in the last seven weeks told you the outflows were coming. Bulls might also argue it is comforting that EM debt outflows haven’t actually been bigger. EM debt has seen the biggest drawdown since Q4 2008 – in the last 7 weeks the JP Morgan GBI-EM Index, a commonly used EM local currency sovereign debt index, has plummeted 13%, and the JP Morgan EMBI Global diversified index, a widely used EM sovereign external debt benchmark, has fallen over 10%. Real money investors aren’t yet capitulating, which suggests that the huge inflows of the last few years are relatively sticky.

EM debt bears might look at it another way – in the context of the enormous inflows into EM debt in the last four years in particular, outflows haven’t actually been that huge, and yet returns have been abysmal. One of the unintended consequences of much tighter bank regulation and balance sheet deleveraging is that market markers have reduced ability to warehouse risk, so relatively small changes in EM debt fund flow dynamics are causing far greater swings in market prices. If outflows continue at this pace or worsen, then the effect on EM debt will likely be cataclysmic.

Are these outflows just a tremor, or are we witnessing ‘The Big One’? To begin to attempt to answer that, it’s necessary to figure out what has caused such a violent sell off. About a year ago I tried to explain that the reasons most people seem to buy EM debt – strong growth, good demographics, low government debt levels, an ‘under-owned asset class’ – are broadly irrelevant. Thailand and Malaysia had great demographics in the mid 1990s, but that didn’t prevent the Asian financial crisis. Ireland and Spain had very little government indebtedness prior to 2008, but that didn’t help much either. EM debt returns are instead largely a function of US Treasury yields, the US dollar, and global risk appetite, where the mix varies depending upon whether you’re looking at EM local currency debt, or EM external sovereign or corporate debt (see Emerging market debt is cool but you may be surprised what you find if you strip away the marketing myths for more).

The recent EM debt sell off appears to justify this view of the primary drivers of EM debt returns. Market commentators’ explanation for the recent leg down in EM debt is Bernanke’s tapering talk, and this is clearly a factor. Treasury yields have jumped, the US dollar has soared, and EM currencies have mostly slumped. This is something that we had anticipated and were positioned for as explained in January, see Why we love the US Dollar and worry about EM currencies.

If you assume this EM debt sell off has all been about Fed speak, then I’d actually be much more comfortable about EM debt valuations now. EM bond yields have risen significantly faster than US Treasury yields, while EM currencies have generally fallen sharply, so EM debt valuations are obviously relatively more attractive now versus two months ago. At the time of writing back in January, 10 year US Treasury yields were 1.8% and we believed they looked ripe for a correction. Now, however, yields are above 2.5%, and yet the solid but unspectacular trajectory of the US economy hasn’t really changed that much. Meanwhile US inflation expectations have in fact fallen considerably – for example the US 5 year 5 year forward breakeven inflation rate has slumped from 3% to 2.4%. Jim discussed the US economy following a research trip in a blog earlier this month, see While the market gets excited about unemployment falling to 6.5%, the Fed’s attention is turning to falling inflation.

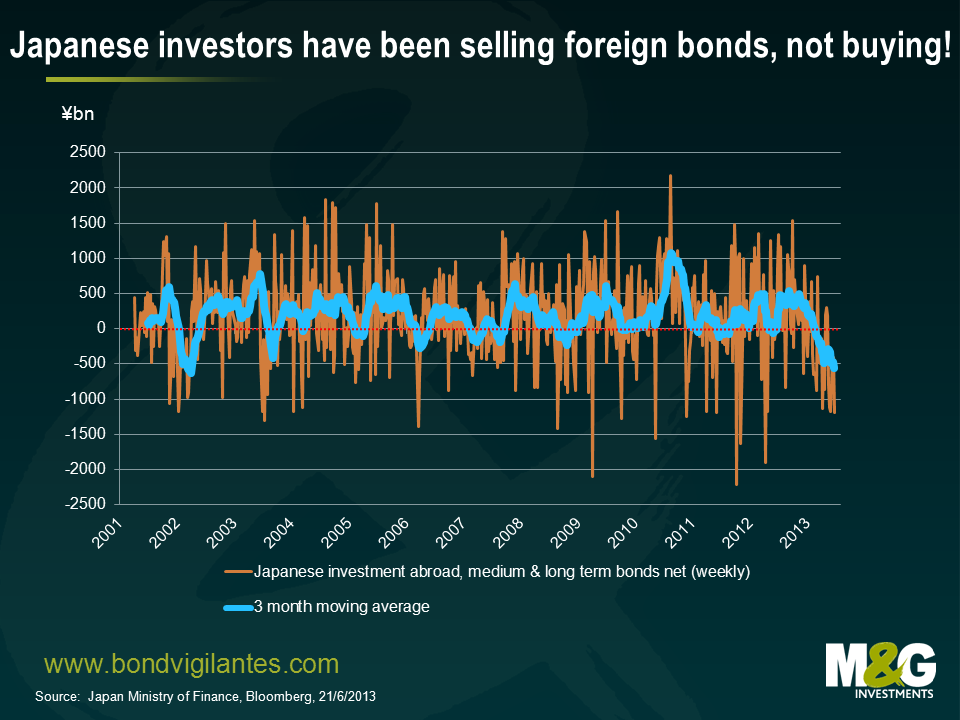

However, the recent EM debt move is unlikely to be all about Fed speak. EM debt has been a stand out underperformer in the great carry sell off of the last two months, and dynamics in Japan and China are surely also important. I believe that the behaviour of domestic Japanese investors is playing a greatly under-appreciated role. In the early days and months of the much hyped but so far little-achieving ‘Abenomics’, every man, his dog, and his dog’s unborn puppies seemed to have gone long USD, short JPY, long risky assets and particularly long EM debt. Some did it in a very leveraged way, and these trades have been a disaster since the beginning of May. As mentioned in a blog a month ago, Japanese investors have in fact done the precise opposite of what every market participant seemed to think they would do. Below is an updated chart from a blog last month (see Japanese investors are not buying foreign bonds, they’re selling). Japanese selling of foreign bonds has accelerated further recently, with the announcement overnight that there were ¥1.2 trillion of sales alone during the week to June 21st. Taking a rolling three month average, Japanese investors are selling foreign bonds at a near record pace.

It is the China dynamic that I find particularly worrying. Commentators have focused on the drying up of Chinese inter-bank liquidity as demonstrated by spiking SHIBOR rates, although I think fears are overblown. There is much speculation as to why SHIBOR has soared, the only additional observation I have is that spikes in SHIBOR are nothing new – I wrote a brief comment about a previous episode in January 2011, see funny goings on in Chinese banking sector. There was a near replica of the current SHIBOR spike exactly two years ago, and while the SHIBOR moves this time around are particularly big, it’s hard to see why this time it’s different and the PBOC won’t supply liquidity.

A much bigger longer term China worry is that market participants still believe that China can grow at 7%+ ad infinitum, but I can’t see any scenario under which this is actually possible. China’s wages have doubled since 2007 and its currency has appreciated 25% against the euro and 35% against the US dollar (based on spot return) since China dropped its peg in 2005. Competitiveness has therefore significantly weakened. Intentionally or unintentionally, the Chinese authorities have tried to hit an unsustainable growth target by generating one of the biggest credit bubbles that the world has ever seen. If you add that an enormous demographic time bomb is starting to go off in China (eg see article from The Economist here), China’s long term sustainable growth must be considerably lower than consensus expectations. Some believe the Renminbi’s destiny is to become a currency to rival the US dollar. I think it’s more likely that opening up the capital account will encourage big capital outflows as domestic investors seek superior investment returns abroad (as an aside, Diaz-Alejandro’s paper Goodbye Financial Repression, Hello Financial Crash offers some background on Latin America’s experience with financial liberalisation in the 1970s and 1980s).

My central thesis remains, therefore, that China will experience a significant slowdown in the coming months and years and this will have profound effects for global financial markets and EM debt in particular. If you like clichés, China is in effect ‘turning Japanese’, but unlike Japan, it has grown old before it has grown rich. Rather than regurgitate the arguments, see blog from March (If china’s economy rebalances and growth slows, as it surely must, then who’s screwed?). I continue to believe that EM and developed countries with a heavy reliance on exporting commodities to China are vulnerable, countries that are increasingly reliant on portfolio inflows from developed countries to fund their current account deficits are vulnerable, and those countries that tick both boxes (eg Australia, South Africa, Indonesia, Chile, Brazil) are acutely vulnerable.

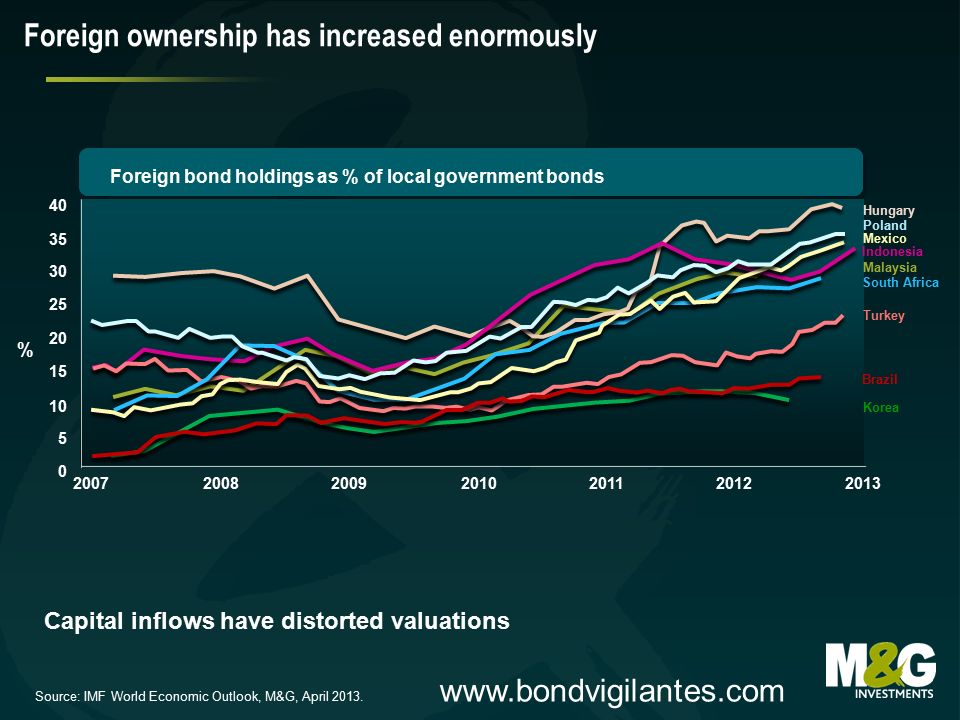

In sum, EM debt now offers relatively better value than a few months ago, and it therefore makes sense to be less bearish on an asset class that we have long argued has been in a bubble. That doesn’t mean I’m bullish. The arguments put forward in September 2011 (see The new big short – EM debt, not so safe) are more valid now than ever. Foreign ownership of many EM countries’ bond markets has climbed higher (see chart below), and the EM debt outflows of the past few weeks are a pimple on an elephant’s derriere in relation to the decade-long inflows. These inflows were initially driven by US investors fleeing the steadily depreciating US dollar, and more recently driven by European investors looking to park money outside the Eurozone. Following the recent sell off, the vast majority of investors who have piled into EM debt in the last three years are underwater, and it will be interesting to see how they react.

The recent EM debt sell off probably isn’t yet ‘The Big One’, it is more a tremor. ‘The Big One’ will probably need either US growth and inflation surprising considerably to the upside or China surprising to the downside. If that happens then EM debt could really rumble, and these eventualities still don’t seem to be remotely priced in. It will take a much bigger sell off in EM debt, and specifically much higher real bond yields, before I’d turn outright bullish on EM debt and EM currencies. Developed markets and specifically US dollar assets appear more likely to appreciate, and it’s ominous that previous periods of US dollar strength (1978-1985, 1995-2002) have been coupled with EM crises.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox