The European monetary zone getting back on course ?

In my last blog I focused on the transition mechanism of financial policy in the UK, with government actions targeting the housing market, thus having the effect of loosening monetary policy. This encouraged us to look once again at the situation in Europe. Is the ECB any nearer making the monetary transmission system actually work?

Back in May 2011 we wrote about how the monetary system in the eurozone was not working effectively because different nations faced different interest rates in the private and public sector. One central bank rate was not being transmitted across the whole eurozone.

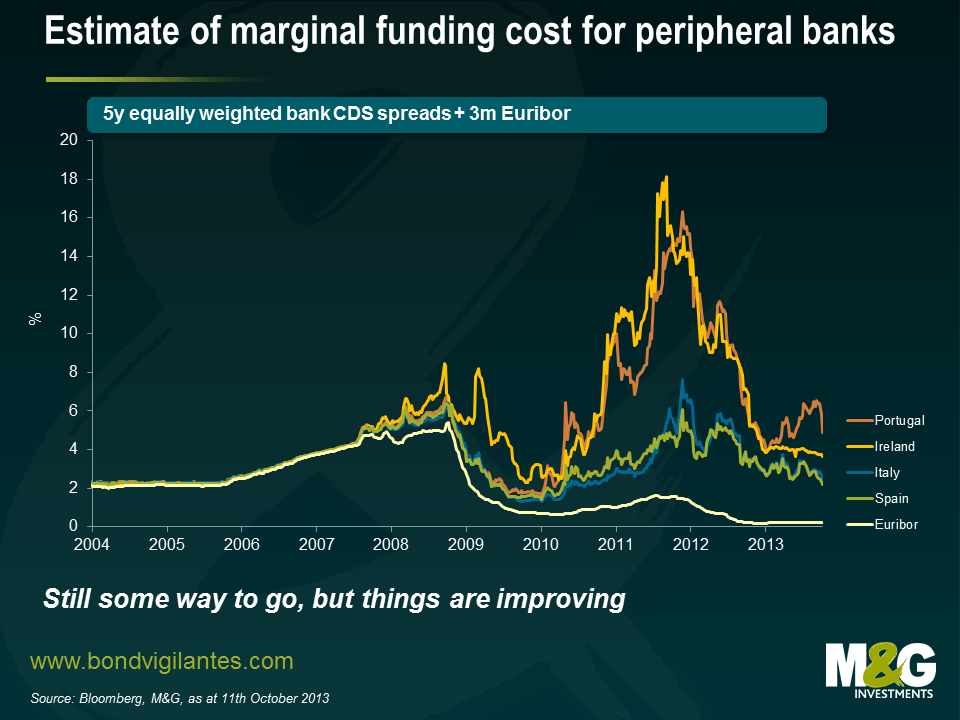

By using official money market rates as depicted by Euribor and adding bank CDS spreads as a proxy for the real cost of borrowing, we illustrated the difficulty the ECB was having in transmitting a single policy through a fractured financial system. We have brought the chart up to date below, and as you can see, the situation is no longer as extreme.

Thankfully, some semblance of order is being returned. The drag on growth from the massive fiscal adjustment that most of Europe has been through over the past few years could be petering out. Hopefully, less restrictive policy will point to future economic growth across the region. Although some progress has been made and funding costs have come down, access to credit remains restricted for many in the real world (see for example Ana’s blog from August). But if the ECB and the authorities can continue to heal the banking system then a virtuous circle of confidence could return to the eurozone, once again making loose monetary policy set by the ECB flow into the real world in the periphery.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox