Deflation before the (tariffs) storm

US inflation continues to be lower than feared. In March, inflation actually transitioned into deflation, as prices declined by -0.1% month-over-month. This decline was partly driven by the reduction in energy prices. However, even outside of the energy sector, prices generally decelerated. Core inflation, which excludes volatile components such as energy and food, was significantly lower than anticipated, suggesting a broader-based deceleration in inflation. Currently, the headline CPI stands at 2.4% year-over-year, while core inflation is recorded at 2.8%.

Arguably, the most encouraging news from yesterday’s report came from the so-called super core inflation, which declined significantly in March. This is the inflation component the Fed is most worried about, as it includes categories predominantly influenced by wages, thereby posing a potential risk for a price-wage spiral.

Source: Bloomberg, BLS, 31 March 2025. Ticker: CSXHSPCY Index

Under normal circumstances, such a favourable inflation print would likely provide substantial relief to both the Fed and market participants. However, its positive implications were largely overlooked due to the prevailing volatility and uncertainty surrounding tariffs at present.

As I mentioned in previous posts, I believe these concerns may be somewhat overstated. Sure, tariffs will undeniably increase the prices of certain goods and exert some upward pressure on overall inflation, however we should not focus solely on one specific aspect of the inflation narrative. Instead, we should adopt a broader perspective to better understand overall inflation dynamics.

Below are three things worth bearing in mind when evaluating the potential impact of tariffs on inflation:

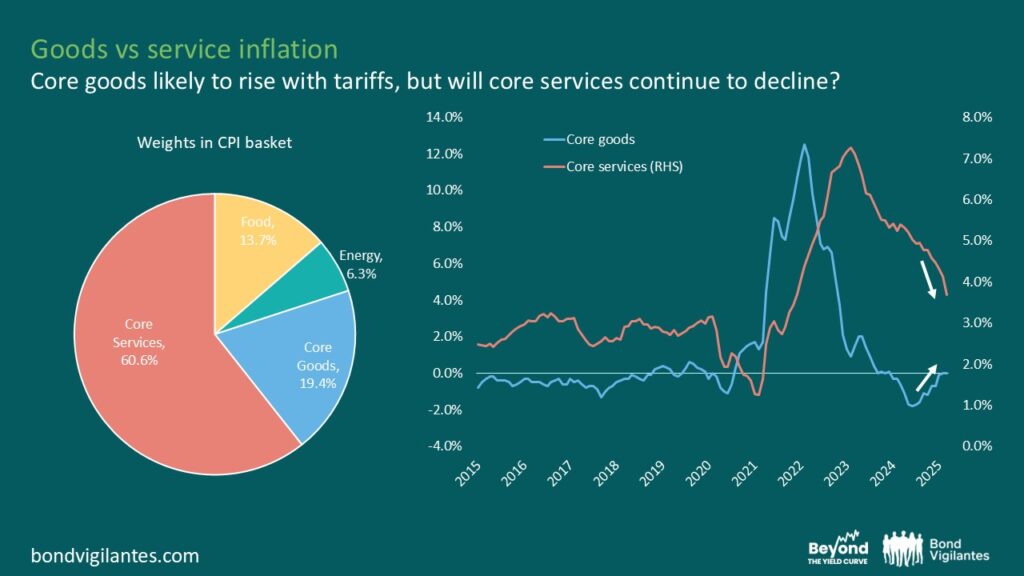

1. Goods inflation constitutes less than 20% of US inflation: The US economy has evolved significantly over the years, transitioning from a goods-based economy to a service-driven economy. Consequently, spending patterns have shifted, with consumers spending considerably more on services than on goods. This transformation is reflected in the CPI calculation, where the goods component accounts for less than 20% (see left chart below). Although tariffs will directly impact goods prices, their effect on services, the largest portion of the inflation basket, is more complex. Crucially, as previously highlighted on this channel, if tariffs are implemented in an environment of relatively low money supply, consumers will be forced to reduce their consumption, potentially causing price declines in other areas. The right-hand side chart below shows core goods versus core services inflation. In the coming months, we can anticipate an acceleration in core goods inflation driven by tariffs, but it is essential to monitor services inflation as it constitutes the largest segment of the inflation basket and may continue to decline.

Source: Bloomberg, BLS, 28 February 2025. Tickers LHS chart: CPIVFOOD Index, CPIVENER Index, CPIVCLFE Index, CPIVSLES Index. Tickers RHS chart: CPUPCYOY Index, CPUPSXEN Index (annualised)

2. Oil prices can offset much of the tariff impact: While much attention has recently been directed towards tariffs, the decline in oil prices has not gained the traction it deserves. The price of oil has breached a key support level and is now approximately 30% lower than it was one year ago. If oil prices remain low or decrease further, they could compensate for most of the price increases resulting from tariffs. This is a critical factor to monitor closely.

Source: Bloomberg, 11 April 2025. Ticker: CO1 Comdty

3. Elasticity of demand determines the inflationary impact of tariffs: Tariffs function as a tax shared between consumers and producers. If producers absorb the cost, it will not be inflationary, merely leading to a reduction in their profit margins. However, if companies pass the cost onto consumers, it will be inflationary. Whether the consumer or producer bears the cost largely depends on the elasticity of the demand curve. If demand for a product is highly elastic, meaning consumers can easily switch to alternatives, producers will bear most of the cost. Conversely, if demand is highly inelastic (for essential goods, for example), consumers will bear the cost as prices rise. Hence, it is important not to assume that an increase in tariffs will lead to a proportionate increase in prices. It is far more nuanced.

In summary, while the recent inflation report was encouraging, market attention remains fixated on the looming impact of tariffs. Over the next few months, we will gain a clearer understanding of the tariffs’ influence on inflation. Although tariffs will undoubtedly exert some upward pressure on inflation, particularly in the short term, it is essential to remain focused on the overall picture and place the impact of tariffs into proper perspective.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.