After yet more strong housing market data, how much longer can we go without a rate hike?

My last housing market note at the end of March discussed how strong mortgage approvals are an excellent predictor of future house price movements. If mortgage approvals are strong, then many people are taking out mortgages. If people are taking out mortgages, then they are looking to buy a house, and if demand for housing increases, house prices do too.

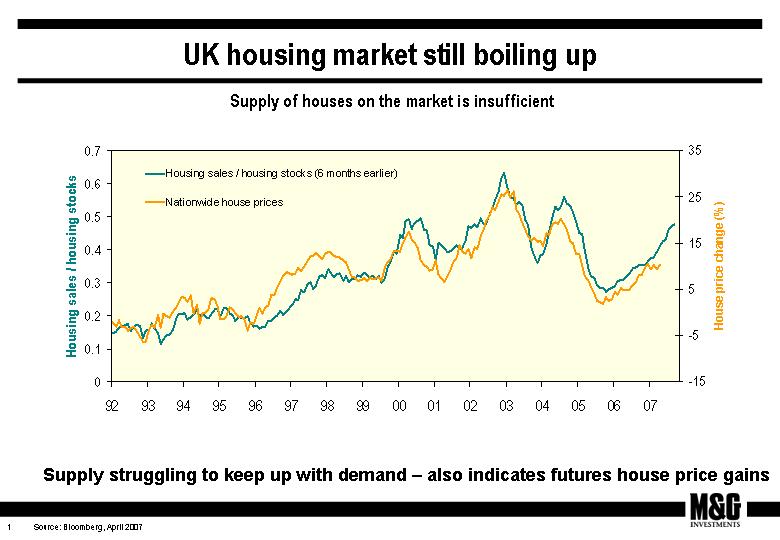

Mortgage approvals data is a good proxy for the demand for housing, but what about the supply of houses on the market? The RICS sales to stocks ratio shows the number of house sales relative to the number of houses advertised by estate agents, and is therefore a good indicator of housing market supply. Data released last week show that the sales to stock ratio has increased to 0.48, a level which has historically led to strong double digit house price growth (click on graph to view). London homeowners saw their properties rise by an average of £76,000 over the past year, 3 times the median London salary – and similar boosts to income have been seen across the UK. Therefore I am less worried than Jim about the erosion of consumers’ incomes from higher taxes and fuel costs. These rising home prices will continue to keep consumption strong.

Mortgage approvals data is a good proxy for the demand for housing, but what about the supply of houses on the market? The RICS sales to stocks ratio shows the number of house sales relative to the number of houses advertised by estate agents, and is therefore a good indicator of housing market supply. Data released last week show that the sales to stock ratio has increased to 0.48, a level which has historically led to strong double digit house price growth (click on graph to view). London homeowners saw their properties rise by an average of £76,000 over the past year, 3 times the median London salary – and similar boosts to income have been seen across the UK. Therefore I am less worried than Jim about the erosion of consumers’ incomes from higher taxes and fuel costs. These rising home prices will continue to keep consumption strong.

With both demand and supply measures indicating a strong housing market over the next six months, the pressure is firmly on the MPC to hike rates. The UK bond market has sold off over the past month on strong economic data, and the benchmark 10 year gilt yield has risen to 5.10%, the highest since July 2004. The bond market is now pricing in a 0.25% rate hike next month with about a 70% chance of another 0.25% rate hike by September. If the next rate rise fails to stem the housing market (and hence the economy), then I expect significantly more rate hikes than the market is currently pricing in.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox