UK mortgage approvals weaken – but outlook for UK housing market is still rosy

Last week it was announced that the number of new UK mortgage approvals fell to 113k, resulting in much media speculation that the UK housing market is in danger of collapsing. I strongly disagree with this view and expect the UK housing market to remain buoyant over at least the next half year.

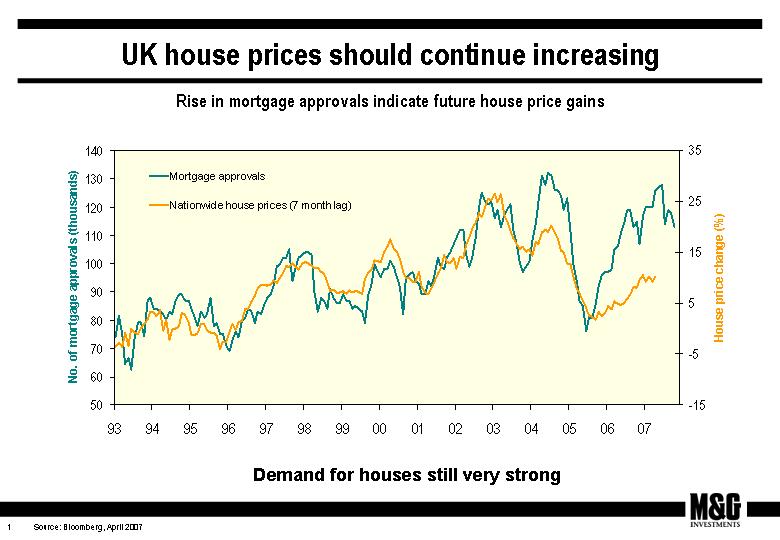

The image above shows the close correlation between mortgage approvals and UK house price growth. There is a lag of seven months between mortgage approvals and the rate of house price changes, so I’ve moved the mortgage approvals data forward by seven months so you can predict where house prices will be in seven months time. While mortgage approvals have fallen slightly, a level of 113k has historically corresponded to annual house price growth of over 15% seven months later.

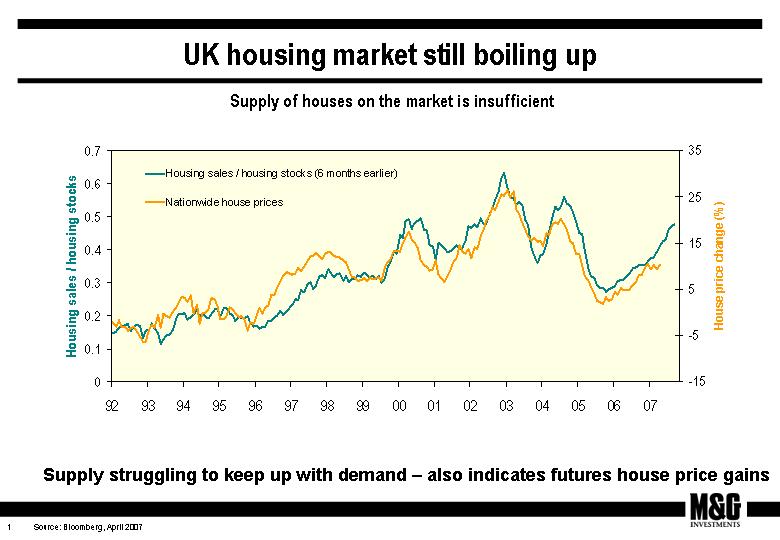

Our bullish view on the UK housing market is enforced by this image, which shows the RICS sales/stock ratio against UK house price changes. The sales/stock ratio is measured over a rolling three months and shows the number of estate agent sales divided by the number of unsold houses that estate agents have on their books. The sales/stock ratio is a measure of both demand and supply (mortgage approvals is only a demand measure), and the ratio is an even better predictor of UK house prices. Crucially, the sales/stock ratio is still rising and the current level suggests that annual UK house price growth will move from around 10% now to at least 15% in six months.

Looking forward, the key question is whether the slight fall in mortgage approvals is the beginning of a downward trend as in 2005 (when a sustained drop in mortgage approvals data very accurately predicted the sharp slowdown in the housing market and prompted the Bank of England to cut rates), or whether the recent fall in mortgage approvals is just a blip along the same lines as the beginning of 2006 (when mortgage approvals dropped from 119k to 107k but then rebounded). Based on historical correlations, mortgage approvals data below about 100k and sales/stocks of about 0.35 indicate that the housing market is slowing, but at the moment there is no evidence of this happening.

Indeed, UK house price growth is, if anything, accelerating. The London property market is extremely hot – figures from the Department of Communities and Local Government show that London prices rose 16.7% in the year to the end of February. Traditionally, London is at the epicentre of the UK housing market, and price gains (or losses) in London gradually ripple outwards. The only way to slow the housing market is hike rates.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox