US jobless rate is to climb sharply

Unemployment in the US has remained remarkably low in the face of the recent economic slowdown, partly because unemployment has traditionally been a lagging indicator. Labour market rigidity means it’s not possible to immediately make workers redundant when there’s a slump in demand (even in the hire & fire US economy).

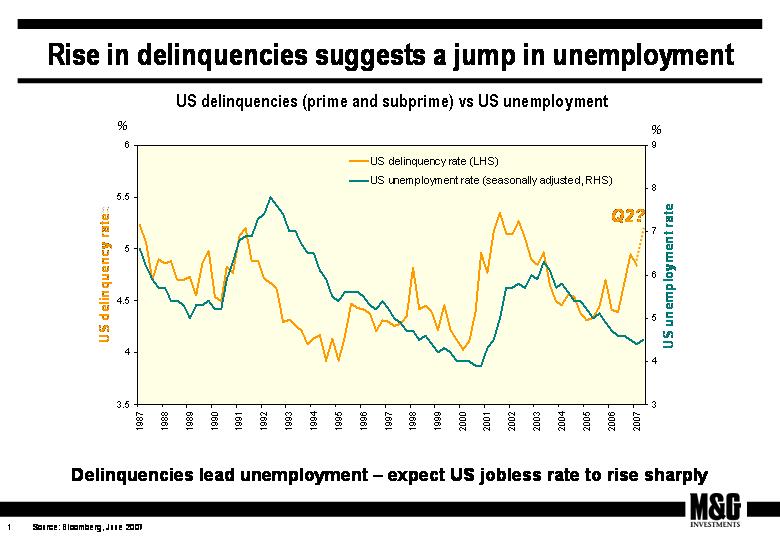

But the unemployment rate looks finally set to turn. US initial jobless claims moved higher for the third consecutive week last week, and this chart suggests that a jump in the unemployment rate is imminent. There is a close correlation between the US delinquency rate and the US unemployment rate, where delinquencies tend to lead unemployment by about two years. Most worryingly, the delinquency data here is only for Q1 this year – Q2 figures aren’t due to be released for a few weeks yet, and will surely be significantly higher.

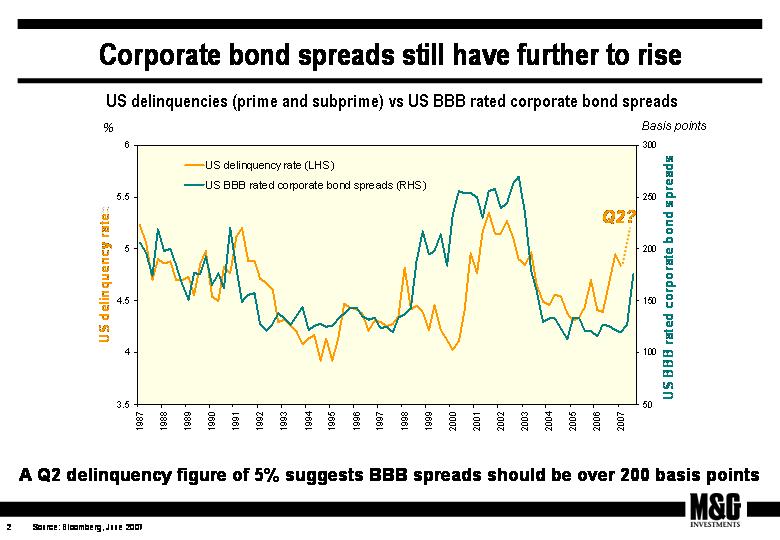

In fact you can plot the delinquency rate against a number of other variables, and all make fairly grim reading. This chart shows the correlation between delinquencies and corporate bond spreads. The corporate bond sell off that’s taken place over the past couple of months should have been of no surprise given the recent spike in delinquencies, and if you assume that the Q2 delinquency figure will be in the region of 5%, then the spread on the average US BBB rated should be over 200 basis points, not the 177 basis points at Friday’s close.

Last week saw some dire statistics released on US housing starts, permits and completions. US builder sentiment is close to all-time lows, and the housing market debacle is far from reaching the bottom.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox