Over the edge

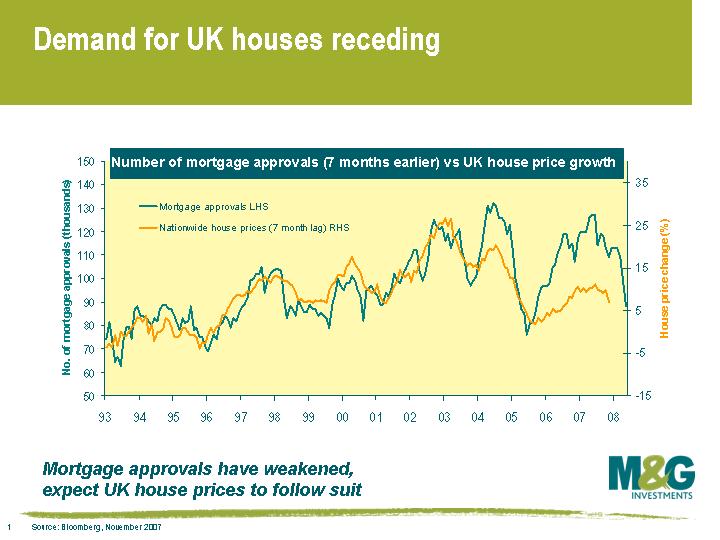

In this comment early last month, I posed the question as to whether the UK housing market was on the brink. Well, today’s data leads me to the conclusion that it has gone over the edge and we are entering a bear market for homeowners. This view is based on one of my favourite indicators of the future direction of the housing market – the level of mortgage approvals. Mortgage approvals are akin to blank cheques for homebuyers. As the attached chart shows, just 88,000 mortgages were approved in October, which was 7,000 less than expected and the smallest number since February 2005.

In this comment early last month, I posed the question as to whether the UK housing market was on the brink. Well, today’s data leads me to the conclusion that it has gone over the edge and we are entering a bear market for homeowners. This view is based on one of my favourite indicators of the future direction of the housing market – the level of mortgage approvals. Mortgage approvals are akin to blank cheques for homebuyers. As the attached chart shows, just 88,000 mortgages were approved in October, which was 7,000 less than expected and the smallest number since February 2005.

This points to prices falling (and indeed data released by Nationwide today indicate that house prices fell by 0.8% in October) as demand slackens. Approvals fall if fewer people ask for a mortgage, or less firms are willing to grant them. On the first point, the consumer is already stretched, and is also now well aware that prices may slide further, so sentiment has eased and buyers are hesitant. And on the other side of the equation, lenders fear a similar slowdown and face a credit crunch, so are tightening lending criteria, raising mortgage rates, or pulling out of the business altogether.

Looking forward, I think interest rates will have to come down as the economy slows. But how far we fall is not yet known.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox