Watch out below

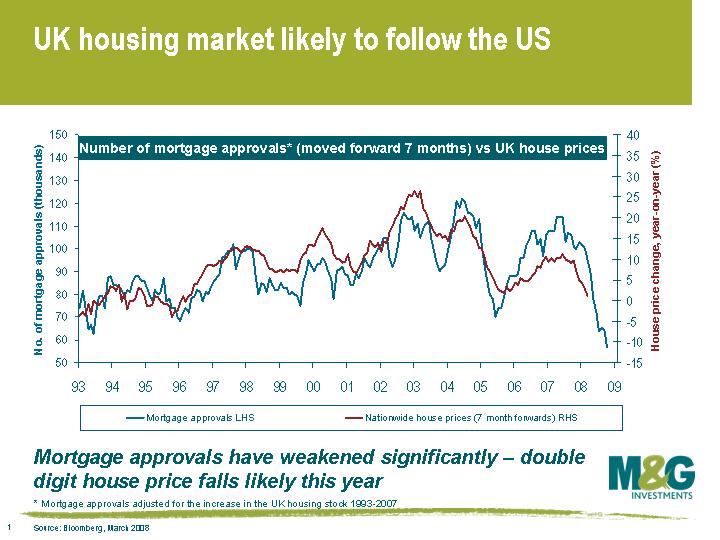

We try to look beyond the headlines, and look at real numbers. As we have previously pointed out, it is not just the headline amount that matters but the ratio of new mortgage approvals relative to the available size of the UK housing stock. So comparing mortgage approvals last month to mortgage approvals in the early 1990s is wrong, because the UK’s housing stock has risen by about 0.8% per year. The headline unadjusted number is a record low, but adjusting for the growth in the housing stock makes this number even worse. The outlook for the housing market (and hence the economy) is therefore bleaker than headline figures suggest.

We try to look beyond the headlines, and look at real numbers. As we have previously pointed out, it is not just the headline amount that matters but the ratio of new mortgage approvals relative to the available size of the UK housing stock. So comparing mortgage approvals last month to mortgage approvals in the early 1990s is wrong, because the UK’s housing stock has risen by about 0.8% per year. The headline unadjusted number is a record low, but adjusting for the growth in the housing stock makes this number even worse. The outlook for the housing market (and hence the economy) is therefore bleaker than headline figures suggest.

The big question is are these approvals a momentary spike down, or are they going to get worse? The anecdotal evidence sadly points to ongoing falls in this number. This is due to the mortgage lenders’ decision to change their lending and business plans in the face of the credit crunch. Northern Rock typifies the change – this time last year they had the largest new market share, but they are now shrinking their total mortgage lending. The ongoing credit withdrawal is continuing. Nationwide yesterday announced that they won’t lend to a new buyers on their base mortgage rate without a deposit of at least 25%, and they’ve also decided to stop lending more than £500,000 per property. This will further hit buyer demand.

The foundation of the UK residential property market is the first time buyer and the availability of credit. If these impetuses disappear, then the credit drought could cause damage to the UK property market that will take years to repair.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox