Writedowns, Cuts & Losses

Now that many ‘experts’ have revised their expectations for total bank writedowns significantly upwards, many in excess of one trillion dollars, I thought it may be useful to take a look at those losses that have so far been realised, and how this compares to the amount of capital raised. It’s also interesting to note the correlation with the number of financial market employees that have found themselves out of work as a consequence of these losses.

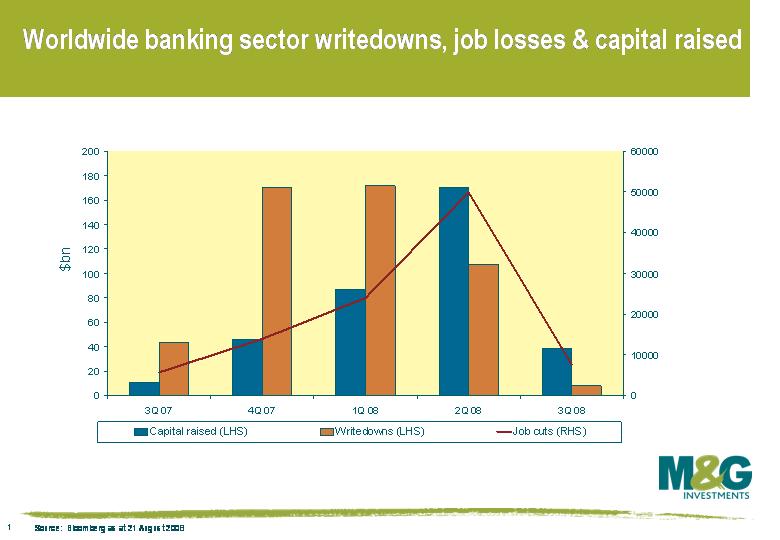

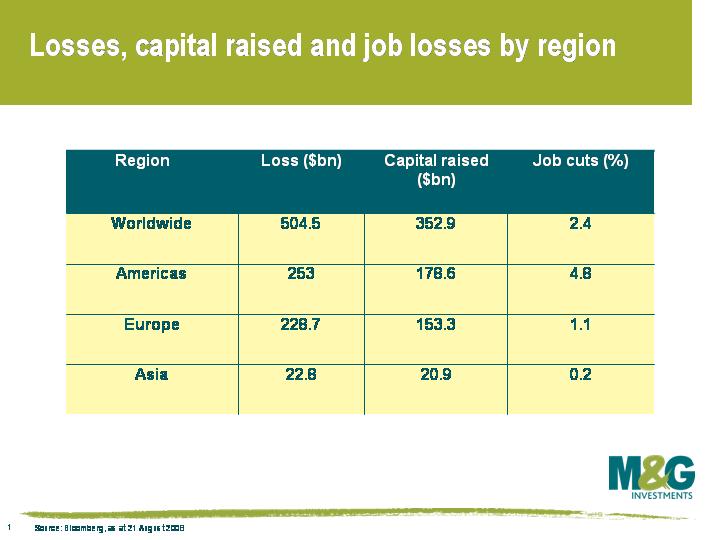

So far globally, banks have taken approximately half a trillion dollars in writedowns since the summer of 2007 (see table and chart below) and despite their efforts, have only managed to raise about 70% of the capital to replace these losses. At the same time approximately 100,000 workers have lost their jobs as banks have moved to slash costs. As capital becomes ever more scarce, writedowns continue to rise, and the effects of a slowing global economy are realised, the challenge of raising capital to keep pace with losses may well become increasingly acute.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox