The demise of ‘supersub’ bank bonds

The original ‘supersub’ was the ginger scouser David Fairclough, famed for coming off the bench to rescue the mighty Liverpool FC. The financial markets themselves have returned to the 1970s with chants of stagflation and bank failures emanating from city players. Everyone is fully aware of sub prime, but as I explained in the FT today, corporate bond investors’ main concern should be about sub debt.

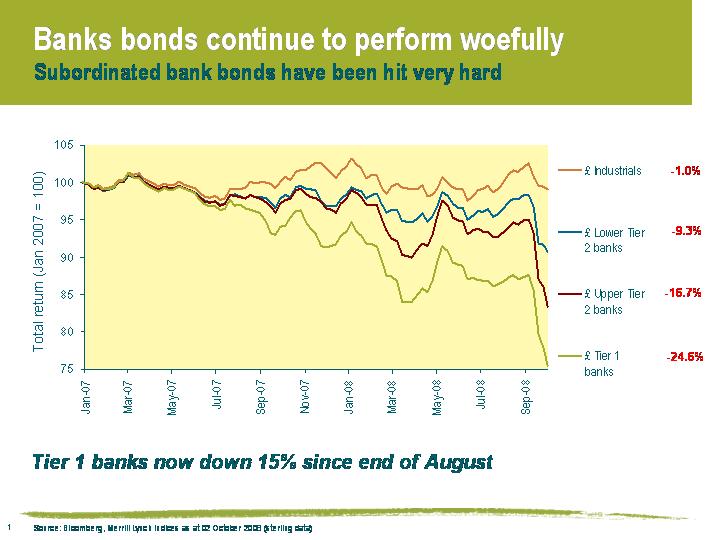

Ben argued at the end of August that Tier 1 bank bonds would feel more pain. ‘Pain’ was putting it mildly. As at yesterday, sterling Tier 1 bank bonds have returned -14.4% since the end of August, while euro Tier 1 banks have done even worse, returning -14.8%. We continue to believe that Tier 1 bank bonds are poor value, even at these levels. Given the huge illiquidity in subordinated bank bonds, any forced sellers of this debt (and there are many) are in serious trouble.

Finally, this article published in the New York Times in September 1999 is worth a look. “In moving, even tentatively, into this new [subprime] area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980’s.

The seeds of this crisis were sown a long, long time ago.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox