The Great Credit Crash

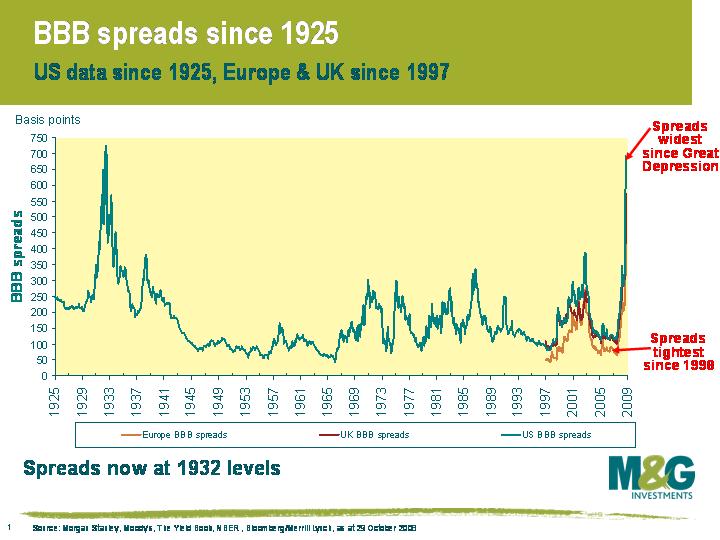

Since May 2007, we’ve seen the Great Credit Crash, with the fastest and sharpest sell off in credit that the modern world has ever seen. In the US, in May 2007, the average BBB corporate bond yielded just 120bps (ie 1.2%) over a government bond. The figure was 699bps as at the end of yesterday. BBB rated bonds now yield 10% on average in the US and UK, and almost 9% in Europe. This chart is a good illustration of the severity of the bear market. US BBB spreads have gone from being the tightest in a decade to the widest since July 1932. In fact, spreads were only wider than they are now in May-July 1932, when the excess yield was 720bps.

Now clearly the BBB index constituents have changed a bit over the past 76 years, with fewer railroad companies and more PC manufacturers, but what was considered BBB then can be roughly assumed to possess the same credit characteristics as a BBB now. This chart is therefore saying that the credit risk premium is as high now as in the depths of depression in 1932 . Put another way, a 7% excess yield means that an investor can afford for 7% of a portfolio of 10 year BBB rated bonds to default every year for 10 years, with a recovery rate of zero pence in the pound, just to break even with the return from a ‘risk free’ government bond. The investment grade corporate bond market is pricing in a horrific economic scenario.

Now clearly the BBB index constituents have changed a bit over the past 76 years, with fewer railroad companies and more PC manufacturers, but what was considered BBB then can be roughly assumed to possess the same credit characteristics as a BBB now. This chart is therefore saying that the credit risk premium is as high now as in the depths of depression in 1932 . Put another way, a 7% excess yield means that an investor can afford for 7% of a portfolio of 10 year BBB rated bonds to default every year for 10 years, with a recovery rate of zero pence in the pound, just to break even with the return from a ‘risk free’ government bond. The investment grade corporate bond market is pricing in a horrific economic scenario.

As readers of this blog will be well aware, we’ve been very gloomy on the global economy for a couple of years. Judging by where corporate bond yields were until this year, our gloomy economic outlook was not remotely believed by the market. This was particularly true in the high yield (junk) bond market.

But to believe that BBB rated bonds are unattractive now, you have to believe that things are going to be worse than in the 1930s. I believe the global economic outlook is very grim, with the developed world heading for a prolonged, nasty recession, however policy makers have learnt lessons from the 1930s and the many recessions since. Banks are being supported, fiscal stimulus is going to be undertaken and interest rates are being slashed.

For a number of years now, we have thought that the credit risk premium for owning corporate bonds was insufficient, and we positioned our portfolios very defensively in terms of credit risk. We favoured ‘AAA’ and ‘AA’ rated bonds over ‘A’ and ‘BBB’ rated bonds in investment grade bond funds, and focused our high yield portfolios away from unrewarding risky assets. Now that credit risk premia are extraordinarily high and policy actions are credit positive, we think BBB rated bonds are attractive and it is appropriate to be long of credit risk in investment grade funds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox