Turning Japanese I think we’re turning Japanese I really think so

Yesterday it was announced that UK CPI inflation for the month of October was minus 0.2%. The annualised rate of inflation dropped from +5.2% to +4.5%, the biggest year on year drop in UK CPI since April 1992. Inflation expectations have plummeted. The 5 year breakeven inflation rate, i.e. the rate of inflation priced in by the UK index-linked bond market, is now -0.1%. In other words, the UK bond market is saying that RPI inflation (which is the inflation measure that the linker market prices off) is going to average -0.1% per year for the next five years. UK RPI inflation has historically been about 1% higher than UK CPI inflation over the past two decades, although this is likely to change over the next couple of years as the housing cost portion of RPI (which isn’t in CPI) falls. Anyway, you get the picture – deflation is now a very serious risk. And that’s fantastic for good quality bonds, because you’re locking into a fixed rate of interest which could soon be extremely attractive.

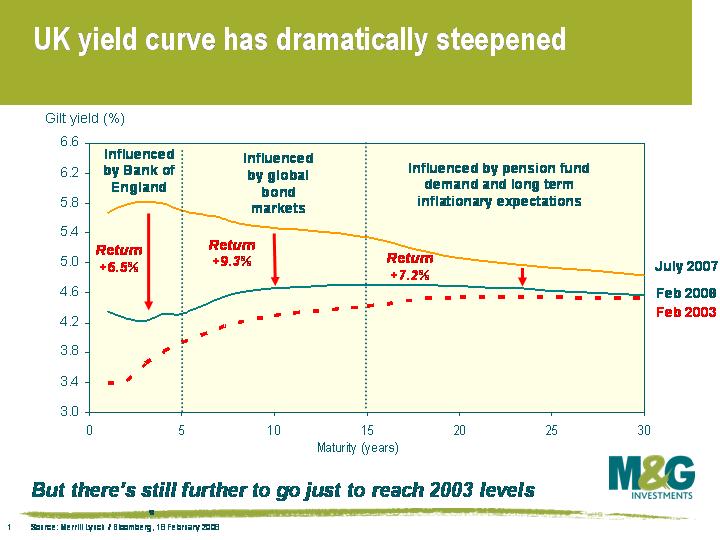

Gilts have already enjoyed a strong rally, but how much further has it got to go? I thought it would be worth updating a comment I posted in February (see here). In February, the gilt market had already rallied hard from the previous summer due to the dramatic lowering of interest rate expectations. I argued that there was still further to go just to get to where the yield curve was in 2003 (bear in mind that the UK economy of 2003 was in a much better shape than the UK economy of November 2008). This chart shows where the UK yield curve was in February 2003 and February 2008 relative to where the UK yield curve is today. The front end of the gilt market has sailed through the lows set in 2003, and 5 year gilt yields have today hit another record low (the sixth day in a row that’s been the case, in fact).

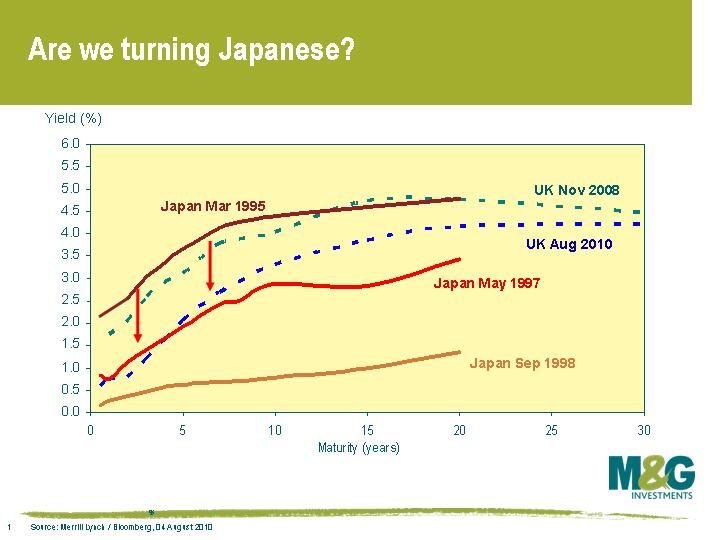

It’s time to alter our sights since we’re now through the UK’s 2003 levels – what kind of returns could we be looking at if we go into the ‘Japan’ scenario? Well this chart shows what happened to Japanese government bonds (JGBs) from March 1995 to September 1998, and it’s pretty spectacular. As you can see, the Japanese yield curve of March 1995 looked very similar to the UK yield curve today. JGBs had already had a boom in the first half of the decade, but this continued in earnest from March 1995.

So if the UK (or indeed the whole world) goes into the ‘Japan scenario’, you can expect some terrific returns from good quality bonds. What’s the likelihood of that happening? There are strong arguments that it won’t get that bad. Lessons have been learnt – banks are being saved, and with a few notable exceptions, they’re coming clean with what’s hidden away on their balance sheets. Monetary stimulus and fiscal stimulus were slower to be implemented in Japan. Our economy is (probably) more responsive to monetary stimulus. Japan’s fiscal stimulus wasn’t very effective. Japan’s real estate and stock market bubbles were arguably worse than we’ve experienced. On a trade weighted basis, the Yen was no weaker in 1998 than it was in 1992.

However, there are some arguments that it could even be worse too. Japan struggled through the 1990s at a time when the rest of the world was booming, but the whole world is in trouble this time around. And the Japanese have always had a very high savings rate which enabled the standard of living to remain high through the troubles, while the same certainly can’t be said for the western world today, where many consumers are already technically insolvent. If we do get a bout of deflation, which increases the real value of debt, the effect on the UK consumer will be far greater than the effect on the Japanese consumer.

On balance, while recession is unlikely to last for as long as in Japan, and deflation is unlikely to become so entrenched, every day seems to be bringing us closer to a Japan scenario (for example, while I was typing this sentence it was announced that US CPI fell by a record 1% in October, the biggest monthly drop since records began in 1947). If you believe that there is a sizeable risk of at least a ‘semi’ Japan scenario, which we do, then gilts, other sovereign bonds, and good quality corporate bonds could rally much, much further.

PS If you haven’t heard the song for a while, click here!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox